Accounting Assignment Help With By-Product Costing

7.4 By-product costing

Practically speaking by-products are not costed. They are of insignificant value as compared to the main product(s). Value of by-products is deducted from the joint cost to arrive at the cost of main products.

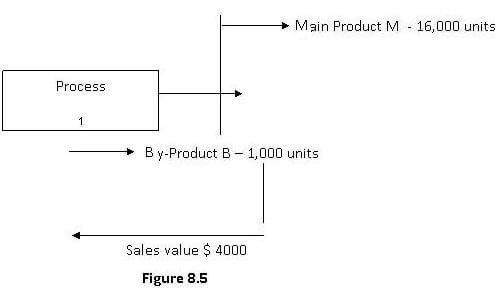

Let us see the product costing structure

Input 20,000

Units

Total cost $ 100,000

Less: By product value $ 4,000

Cost of main product $96,000

Cost per unit of main product is $ 6.

Sometimes by-products are also processed further. In that situation Reverse cost method is followed for by-product costing. This method suggests deducting separate cost, selling and distribution cost and reasonable profit to arrive at the cost of by-product at the time of split off point.

Continuing with the example given above, let us suppose B is sold for 16,000, separation processing cost is $ 8,000 and per unit packaging cost is $ 3. A profit of 10% is expected on cost. Applying reverse cost method, cost of by-product may be arrived at as follows.

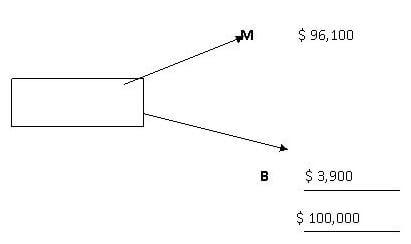

Sales $ 16,000

Separate process cost $ 8,000

Selling cost $ 3,000

$ 11,000

Profit $ 1,100 $ 12,100

Cost of by-product B at $ 3,900

Split off point

So, the joint cost is apportioned between M and B as follows.

Email Based Assignment Help in By-Product Costing

Following are some of the topics in Process Cost Analysis in which we provide help:

- Process Cost Analysis

- Process as cost centre

- s href="process-cost-analysis-without-incomplete-units" title="Process cost analysis without incomplete units">Process cost analysis without incomplete units

- Abnormal loss

- Process cost analysis with incomplete units

Accounting Assignment Help | Accounting Homework help | Help with Accounting | Management Accounting | Cost Accounting | Online Tutoring | Financial Accounting | Email Based Accounting Homework Help