Finance Assignment Help With Option Pricing

Option pricing

We now look at the pricing and valuation of options. Options always have a positive value for the holder up until expiration.

The notation used throughout is:

S0, ST = price of underlying asset today, price of underlying asset at time T

X = exercise price

r = risk-free rate

T = time to expiration, expressed as number of days divided by 365

c0, cT = price of European call option today and at expiry

C0, CT = price of American call option today and at expiry

p0, pT = price of European put option today and at expiry

P0, PT = price of American put option today and at expiry

Looking first at the value at expiration, or the payoff, of a long call position we can see that if the underlying price is less than the exercise price, the option will lapse with zero value. If the underlying price is higher than the exercise price then the long call position has a value equal to (ST - X). The short position will have a value which is the negative of the value of the long position.

At expiration both European and American options have the same payoff; they are the same instruments at this point, so:

cT = Max [0, ST - X] and CT = Max [0, ST - X]

With a put option if the underlying price is higher than the exercise price, the option will lapse with zero value. If the underlying price is lower than the exercise price then the long put position has a value equal to (X - ST). At expiration:

pT = Max [0, X - ST] and PT = Max [0, X - ST]

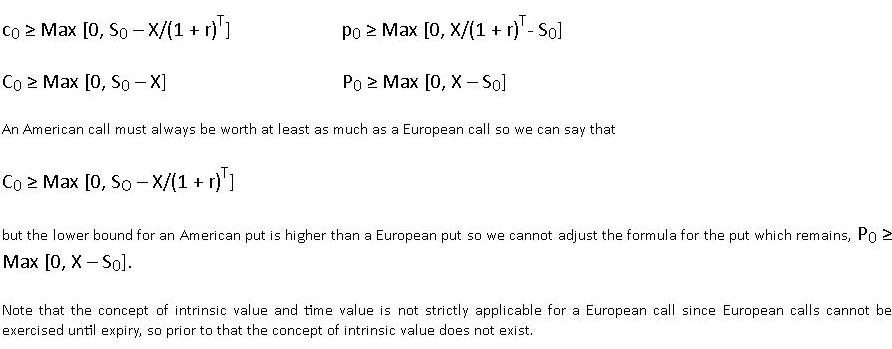

Lower bounds

Since an American option can be exercised at any time, the lower bound of its value is its intrinsic value; otherwise it could be exercised for an immediate gain. However for a European option the lower bound is a function of the present value of the exercise price, since we cannot exercise until the expiry date. So:

Exercise price

Let us consider the case where we have two call options with the same terms except for the exercise prices. The first is a European call with an exercise price X1 and the second a European call with an exercise price X2, which is larger than X1. We will refer to these as c0(X1) and c0(X2) respectively. If we look at a portfolio where we buy c0(X1) and sell c0(X2) we can calculate the value at expiration, for the three possible prices of the underlying ST as follows:

Value at expiration

| Value at expiration | |||

| S T≤ X1 | X1 < ST < X2 | ST ≥X2 | |

| c0(X1) - c0(X2) | 0 | ST - X1 | ST - X1 - (ST - X2) = X2 - X1 |

In all three cases the value is zero or positive, so we can conclude that the value of c0(X1) is higher than c0(X2).

A call option with a lower exercise price has a higher or equal value to one with a higher exercise price. This holds for both European and American calls.

Using the same methodology we can show that the value of a put with a higher exercise price has a higher or equal value to one with a lower exercise price.

Time to expiry

Now we look at two call options with the same terms except for the time to expiry. The first is a European call with a time to expiry T1 and the second a European call with a longer time to expiry T2. We will refer to these as c0(T1) and c0(T2) respectively.

When the first option expires it has a value of Max [0, ST1 - X] and at this point the call with a longer time to expiry will have a value of at least Max [0, ST - X/(1 + r)T2-T1]; this is worth at least as much as the shorter-term call. The same will be true for American call options.

We have shown that longer-term calls are worth at least as much as shorter-term calls. This is intuitively correct, as the longer you can hold the option the more chance there is of making money.

For European put options, the case is not so clear because if you exercise a put you receive money which can earn interest. However, usually a longer-term put will be worth more and all longer- term American put options are worth more than shorter-term ones (which can be exercised at any time so there is no penalty in waiting to expiration).

Email Based Assignment Help in Option Pricing

Following are some of the topics in Derivative Markets And Instruments in which we provide help:

Corporate Finance Homework Help | Finance Assignment Help | Finance Assignment Help | Finance Online Help | Finance Problems Help | Finance Tutor | Help With Finance Homework | Online tutoring