Monopoly Assignment Help

What Is a Monopoly?

A monopoly is a specific firm or a person who is the sole seller of a particular commodity (which does not have any close substitutes) in its market.

Why Do Monopolies Arise?

A monopoly exists when no other find it profitable or possible to enter the market. This means that BARRIERS TO ENTRY are the basis of all the monopoly power. Some of the factors leading to barriers to entry for new entrants are as follows:

- (a) COST ADVANTAGES: The technology of a firm may be such that the production of a good by that firm may exhibit decreasing marginal and average costs over a wide range of output levels (reaping the benefits of the economies of scale). The decreasing marginal cost with an increase in the volume of production and large initial cost required to set up the business serves as an advantage to the firm over its possible competitors. Decreasing costs enables the firm to reduce its prices to such an extent (lower than the operating cost of its competitors) that it would make it difficult for other firms to enter the market.

- (b) GOVERNMENT ACTIONS: Many times, monopolies emerge due to legal barriers imposed rather than due to economic conditions. The government may assign intellectual property rights, including patents and copyrights, giving a firm exclusive control over production and sale of certain goods for a specific period of time.

Sometimes, the government may award exclusive rights to a particular firm to serve a market. Such rights are awarded in the cases of public utility services, post offices, communication services etc. - (c) Sole access to a key resource: A firm may buy up unique resources in order to prevent the entry of a new firm. A key resource required to produce a particular well may be solely owned by a firm.

- (d) Technological ascendancy: A firm may be able to acquire and integrate the best possible technology in order to produce its goods while new entrants may not have the expertise required to operate that technology or may not be able to afford it.

Monopoly Assignment Help By Online Tutoring and Guided Sessions at AssignmentHelp.Net

f 5

Read More about Barriers to Entry in a Monopoly Market Structure

Market Power

Market power refers to the ability of a firm to raise the market price of a good or service over the marginal cost. Perfectly competitive firms charge prices equal to the marginal cost (P=MC). The firms in perfect competition cannot charge a higher price than their marginal costs. Thus, a perfectly competitive firm does not enjoy any market power.

On the other hand, Monopoly is a common example of market power. A monopoly has the ability to charge a price greater than the marginal cost of production as it is the sole seller of a good in its market.

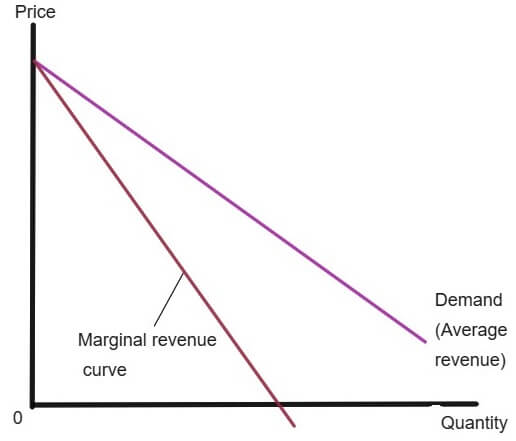

Demand Curve and the Marginal Revenue Curve for A Monopolistic Firm

MARGINAL REVENUE refers to the amount of revenue that the firm receives for every additional unit of output.

AVERAGE REVENUE refers to the amount of revenue received per unit of output sold.

| QUANTITY (Q) (UNITS) | PRICE ($) | TOTAL REVENUE (P×Q) | AVERAGE REVENUE (AR=TR/Q) | MARGINAL REVENUE (MR=Δ(TR)/ΔQ) |

|---|---|---|---|---|

| 0 | 11 | 0 | 0 | - |

| 1 | 10 | 10 | 10 | 10 |

| 2 | 9 | 18 | 9 | 8 |

| 3 | 8 | 24 | 8 | 6 |

| 4 | 7 | 28 | 7 | 4 |

| 5 | 6 | 30 | 6 | 2 |

| 6 | 5 | 30 | 5 | 0 |

| 7 | 4 | 28 | 4 | -2 |

| 8 | 3 | 24 | 3 | -4 |

As is clear from the above illustration, the marginal revenue is always less than the price of the good. This is due to the fact that the monopoly firm faces a downward sloping demand curve. So, in order to sell more units, the firm has to reduce its prices for all the customers.

The increase in a number of units of good sold by the monopolist has two types of effect on the total revenue (P×Q):

- OUTPUT EFFECT: As more output is sold, Q is higher. Thus, total revenue is higher.

- PRICE EFFECT: As more output can be sold by reducing the price level for all the units sold, P falls. Thus, total revenue falls.

When the monopoly increases the production of its good by 1 unit, then it must reduce the price for all the units it sells. This reduction of price reduces the revenue on the units it was already selling. Thus, MR is less than the Price (or average revenue).

The demand curve shows how the quantity of the good produced affects the price of the good.

The marginal revenue curve shows how the firm’s revenue changes when the quantity produced increases by 1 unit.

Because the price charged for all the units sold must fall if the monopoly increases the production, marginal revenue is always less than the price of the good.

Relationship between Elasticity and Marginal Revenue

Price elasticity of demand refers the responsiveness of quantity demanded of a good or a service to changes in price level, ceteris paribus.

- - The demand for a good is said to be elastic when Ed>1. In this case, demand is highly responsive to a change in price.

- - The demand for a good is said to be inelastic (less than perfectly inelastic) when Ed<1. In this case, demand is less responsive to a change in price.

Price elasticity of demand plays a crucial role in the calculations of Marginal revenue of the monopoly firm which faces a downward sloping demand curve.

When demand is elastic (less than perfectly elastic), then Marginal revenue is positive i.e. MR>0. This is because in the case of elastic demand, if the monopoly firm reduces the price of its good a little bit, in order to produce more quantity of output, then the demand will rise considerably, this will increase total revenue (TR=P×Q) and hence Marginal revenue (TR/Q) will be positive.

When demand is inelastic (less than perfectly inelastic), then Marginal revenue is negative i.e. MR<0. This is because in the case of inelastic demand, if the monopoly firm reduces the price of its good in order to produce more quantity of output, then the demand will rise, but not as much as the decrease in price. This will increase total revenue (TR=P×Q) and hence Marginal revenue (TR/Q) will be negative.

Profit Maximization by a Monopolist

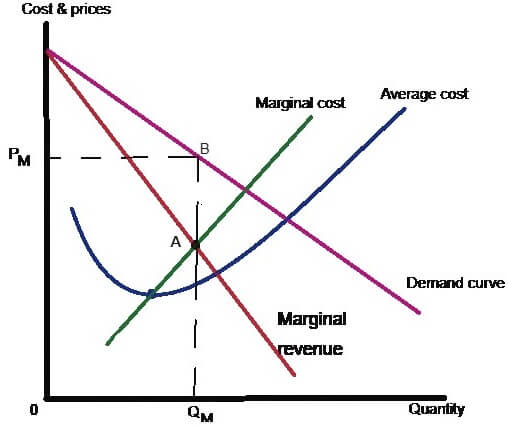

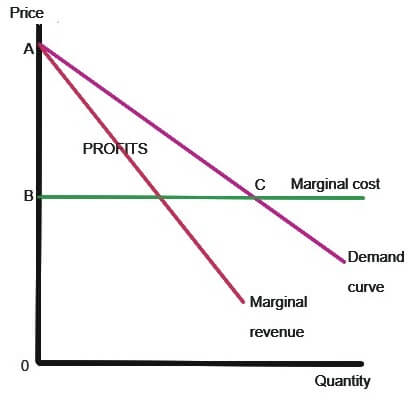

Profit maximizing quantity of output produced by the monopolist is decided by the intersection of the marginal revenue curve and Marginal cost curve i.e. at the point where. Thus, the profit maximizing level of output for the firm is QM. At this level of output, MR=MC and profits are maximized.

As the monopoly decides to produce QM units, the downward sloping demand curve indicates that the demanders of the monopoly firm’s good will be willing to pay a price, PM for the good. In other words, price PM will induce the consumers to purchase the monopoly good, given QM quantity is being produced.

Clearly, a monopolist produces output level such that marginal review is equal to the marginal cost, MR=MC and the profit maximizing price P is greater than the marginal revenue, P>MR.

That is, P>MR=MC

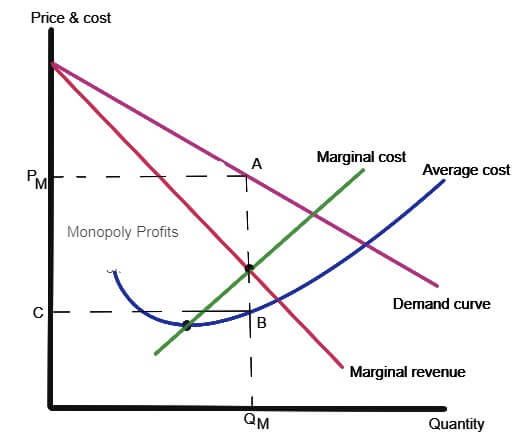

Calculating Monopoly Profit

{`

Profit = Total revenue (TR) – Total cost (TC)

Dividing and multiplying Right Hand Side terms by Q

Profit = (TR/Q – TC/Q) ×Q

Profit = (AR – AC) ×Q

TQ/Q is Average revenue and it equals Price (P), and TC/Q is the Average cost (AC). Therefore,

Profit = (P-AC) ×Q

This equation can be used to calculate the monopoly profits.

`}

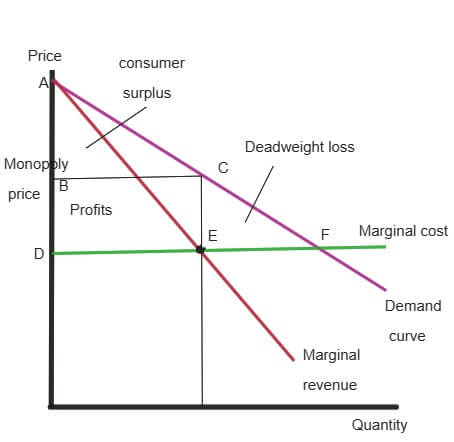

In the above figure, Monopoly profits are shown as a rectangular area PMABC. AB height is price minus Average cost (P-AC) which gives profit per unit sold.

Monopoly Shut Down Rule: Loss Minimization for Monopolist

Shut down of operations refers to a temporary suspension of production. Shutting down of the production process is a short run decision.

Consider again the profit equation derived in the previous section: Profit = (P-AC) ×Q

The Average cost (AC) comprises of two types of costs, Average variable cost (AVC) and Average fixed cost (AFC).

AVC: This refers to the firm’s variable cost (which varies with the level of output) divided by the quantity of output produced.

AFC: this refers to the firm’s Total fixed cost divided by the quantity of output produced. This type of cost decreases with increase in the level of output.

Thus, we say AC=AVC+AFC

- When P>AC at the quantity that equates MR and MC, then the firm is earning profit per unit of output it sells. Thus, the monopoly will continue to operate as the firm generates economic profit.

- When AC>P>AVC i.e. when price exceeds Average variable cost but is less than the Average total cost at the quantity that equates MR and MC, then the firm will operate as it will undertake loss minimization. The firm will incur smaller losses by producing some output than halting the production and thus producing nothing. As long as the price is greater than Average variable cost, the firm is able to cover at least its variable cost. If it produces nothing, it will still have to incur Fixed cost.

- When P< AVC at the quantity that equates MR and MC, then monopoly will shut down its operations i.e. it will choose not to operate in the short run. In this case, the entire demand curve is below Average variable cost curve.

Welfare Effects of Monopoly

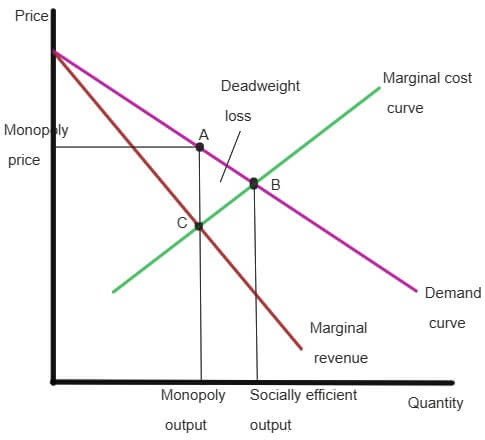

The deadweight loss in a monopoly: Deadweight loss or allocative efficiency is a loss of economic efficiency that can occur when equilibrium for a good or service is not achieved.

A perfectly competitive firm (or any organization which has no profit motive) will charge a price equal to its marginal cost (P=MC). This gives the consumers a precise indication about the cost of producing the good and they buy the efficient quantity. The quantity output produced corresponding to the perfectly competitive price is said to be the socially optimum (or efficient) level of output.

Unlike a perfectly competitive firm, the monopoly charges a price above the marginal cost in order to earn profits. As a result, consumers do not get a precise indication of the cost of producing the good. The monopoly chooses to produce and sell that quantity of output where MR and MC curve intersect. As the above figure shows, a monopoly produces less than the socially optimum quantity of output. Now as the demand curve faced by a monopolist is downwards sloping and the quantity produced is less than the socially efficient output level, the price that the monopoly charges are higher than what a competitive firm would charge.

Due to this high price, all those consumers who value the good more than the marginal cost of production but less than what the monopoly is charging will choose not to buy the monopoly good. Though particular consumers value the good more than its cost, they do not buy it due to high price. Thus, the result is an inefficient allocation of output as some mutually beneficial trade fails to take place.

This inefficiency created by a monopoly firm is represented by triangular area ABC (in the above figure). This allocative inefficiency is known as deadweight loss.

Price Discrimination

Price discrimination refers to a business practice of selling identical goods at different prices to different customers.

Price discrimination cannot occur in a perfectly competitive firm as it is assumed that there are no transaction or information costs. There is the perfect availability of information for both buyers and sellers. If any firm charges a higher price, then the consumers would buy the good from another firm. Thus, we can say that in order to charge a higher price, a firm must have the market power.

Effects of Perfect Price Discrimination on Economic Welfare

In the case of Perfect price discrimination, a monopolist knows exactly each consumer’s willingness to pay and thus is able to charge each customer a different price depending on his willingness to pay for the good.

The above figure shows a monopoly that charges same prices from all the customers i.e. there is no price discrimination in this case. Consumer surplus (difference in the amount that consumers are willing to pay and what they actually pay) is given by the area ABC, monopoly profits are given by area BCED and deadweight loss representing an inefficiency in allocation is given by the area CEF.

Consider the case when the monopoly firm undertakes perfect price discrimination.

Examples of Price Discrimination

Discussed below are some of the practical examples of how firms price discriminates between different customers:

AIRLINE TRAVEL TICKETS:

Airlines most often charge different prices for their tickets from different types of travelers (leisure travelers and business travelers). Prices also tend to vary depending on the season and the day of the week. A passenger on a business trip will have high willingness to pay while leisure traveler will have low willingness to pay.

During peak holiday season, the airlines charge relatively high prices for tickets as demand is high and inelastic.

DISCOUNT COUPONS:

Firms often prefer to offer discount coupons of say, $10 rather than cutting prices by $10. This is because offering discount coupons help customers to price discriminate. The use of these coupons helps the firm to understand the willingness of the customers. It is less likely for a rich customer keeping the coupon and using it as he has high willingness to pay. However, a low-income customer or the customer who is unemployed is more likely to use the discount coupon as they have low willingness to pay.

QUANTITY PURCHASED

In the case of electricity services, a monopoly firm may charge a different rate of tariffs from customers depending on their electricity consumption.

MOVIE TICKETS:

If a movie theater has some monopoly in its area, it may charge different prices for the movie tickets depending on the willingness to pay off the customer. Nowadays it is seen that movie theaters charge low prices for children and senior citizens. This is logical from the fact that children and senior citizens have low willingness to pay to watch a movie in a theatre.

BESPOKE PRICING

Many producers and sellers indulge in predictive modeling in order to know each of their customer behavior at the individual level. Suppose a seller, from his analysis of his customers, finds that there is a customer who has not made any purchase for a very long time. The seller, in this case, may offer the customer different discounts or good price for his products to get him back on a shopping spree in his store.

Natural Monopoly

What is a natural Monopoly?

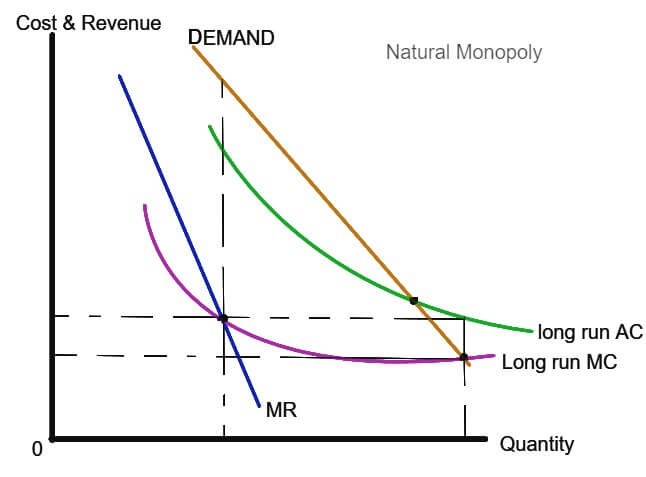

Natural monopoly (or a decreasing cost monopoly) occurs when a single firm can supply a good or service to an entire market at lower cost than could two or more firms. It is a firm that experiences economies of scale (the long run marginal cost and long run average cost of production declines as the volume of production increases) and is able to bear the relatively large initial fixed cost. As natural monopoly exhibits decreasing long run average cost (LRAC), the long run marginal cost (LRMC) curve is always below the LRAC.

Regulation of Natural Monopoly

The regulation of monopolies is done by the government to protect the interests of the consumers. Monopolies have the market power to set the price of a good higher (P>MC) than in the competitive markets (P=MC). Regulation of a monopoly by the government may be in order to prevent excess pricing so that a monopolist does not abuse its position in the market. Excess pricing results in allocative inefficiency and a decline in consumer welfare.

It is believed that the prices charged by a monopolist must reflect the marginal cost of production. This will help reduce the deadweight loss and increase consumer welfare. However, if a natural monopolist charges a price equal to his long run marginal cost, then he will have to function at a loss.

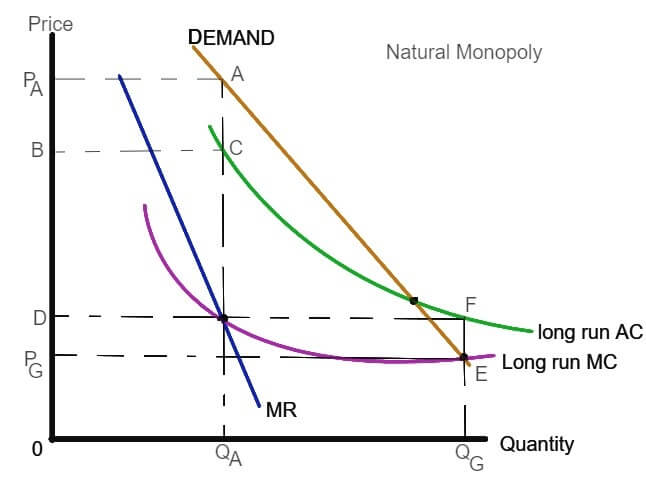

The above diagram shows the LRAC and LRMC curves of a natural monopoly. In absence of any regulation, the monopolist will charge price PA and produce output level (where MR=MC) of QA. profits will be given by rectangle PAABC.

When government tries to regulate the monopoly by asking it to enforce marginal cost pricing, then the monopolist will have to charge a price PG and at this price, QG will be produced. However, at the regulated price PG, the monopoly firm is incurring a loss of DFEPG. Thus, in marginal cost pricing, monopoly firm will have to operate indefinitely at a loss which is not possible.

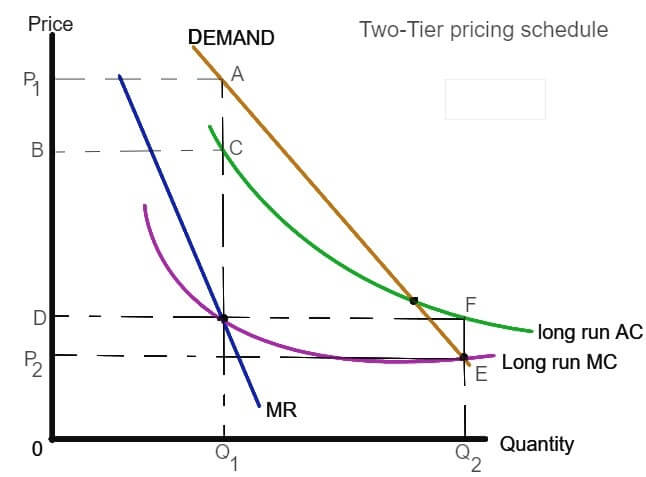

Implementing a Multi Price System (Two-Tier Pricing)

Instead of forcing the monopolist to follow marginal cost pricing, the regulating authority must try and implement multi price system. Under this system of pricing, the monopoly can charge some of its customers, high price for its commodity and charge a low price to its marginal customers. By following such a system, the customers who pay the high price are subsidizing the losses that the monopoly firm incurs by selling its commodity at a low price.

As shown in the figure above, the regulatory authority has set a price of P1 for some customers at which quantity Q1 is demanded. The profit from the sale of a good too high price customers will be P1ACB. The customers who are unwilling to buy the good at the price P1 are charged a lower price P2 (this price is decided by following marginal cost pricing). At P2, the quantity demanded is Q2. The loss incurred by charging a price of P2 will be given by the area DFEP2. Under this system, the profit from high price customers balances the losses incurred from low price customers.

Find Online Economics Tutors for More Homework Help with Monopoly

Looking for online tutors to help you solve your Economics homework assignment on monopoly? Or monopolistic competition, oligopoly, perfect competition, comparison of monopoly with perfect competition? Whatever it is that you need microeconomics help With CourseworkHelp tutors are available for your help 24x7 online. Ranging from Microeconomics Problem sets to microeconomics Assignment Help on any topic like opportunity cost, perfect competition, consumer surplus, demand and supply analysis, consumer theory, and indifference curves or market failure; our online microeconomics Assignment Help is the ultimate solution to your repeated request Do My Economics Homework. Any kind of Microeconomics, Macroeconomics, International Economics, Business Economics, Health Economics assignment topic, economics essay writing requirements, a term paper for economics, research paper for business statistics or econometrics; all these can be easily tackled by our online economics my Assignment Help experts. So log on to AssignmentHelp and order your Microeconomics Help Assignment now!