Market Failure and Externalities

Define Externality

Externalities refer to the costs or benefits to a third party arising from the production and consumption of goods and services for which no appropriate compensation is paid. Third party comprises of individuals, organizations that are affected indirectly as a result of an economic activity.

Externalities usually arise when property rights for resources or asset are not defined. As long as property rights are well defined, trade between agents would result in efficient allocation of the externality.

Externalities is an example of market failure.

MARKET FAILURE: Market failure refers to a situation in which the allocation of goods and services is not efficient. It is a situation when there is a violation of 1st theorem of welfare economics which states that a competitive market equilibrium will always produce efficient results.

There are two types of externalities:

A) Consumption externality: this type of externality occurs when consumption of a good causes a negative or positive externality to a third party.

B) Production externality: production externality occurs when production possibilities of one firm are influenced by the choices of another firm or consumer.

Difference Between Marginal Private Cost and Marginal Social Cost

Externalities may be negative or positive.

Negative Externality

Negative externality refers to the costs suffered by a third party as a result of an economic activity for which no appropriate compensation is paid to the affected. A negative externality is also referred to as external cost. In case of a negative production externality, marginal cost to society exceeds the marginal cost to the firm i.e. marginal social cost (MSC) is greater than marginal private cost (MPC). This lead markets to produce a large quantity than what is socially desirable.

Socially efficient point is where MSC (Marginal social cost) = MSB (Marginal social benefit)

Examples of negative externalities include: Air pollution by manufacturing firm negatively affects the whole society; noise pollution during ongoing production in a factory affects nearby residents; overfishing by fishermen in oceans leading to the depletion of stock of fish; a neighbor playing loud music at 2 ‘o’ clock in the morning will cause displeasure to others.

Positive Externality

Positive externality refers to the benefits that are enjoyed by a third person as a result of an economic activity. The individuals who enjoy the benefits of any economic activity without paying for it are known as free riders.

When there is positive externality, then marginal social benefit (MSB) exceeds marginal private benefit (MPB). As a result, markets produce smaller quantities than is socially desirable.

For example, in education, the skill and knowledge acquired by a person can benefit the society as a whole. A neighbor’s garden with beautiful flowers may give pleasure to the passersby.

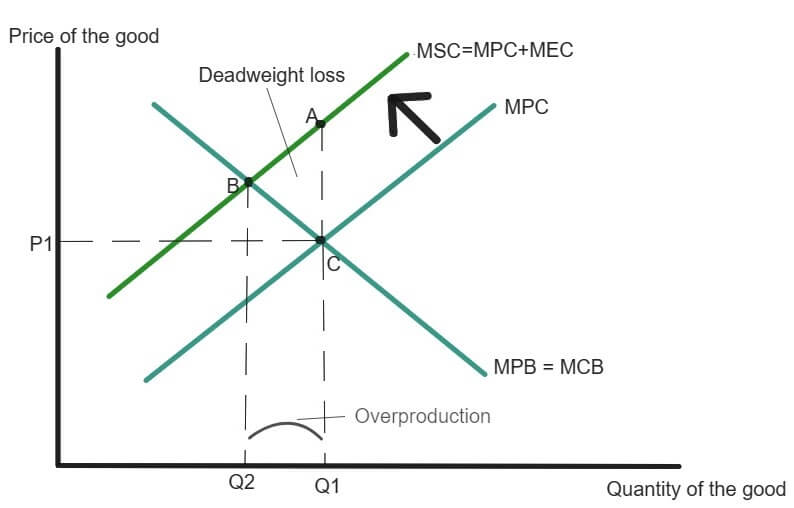

Negative Production Externality

Negative production externality is an externality caused by a firm’s production process which leads to reduction in the well-being of an unrelated third party.

MARGINAL PRIVATE COST (MPC): this refers to the per unit cost to the producer i.e. cost incurred for producing an additional unit of a good or service.

MARGINAL EXTERNAL COST (MEC): refers to the additional costs associated with the production of an additional unit of a good that are incurred by a party other producer or the buyer of that good. Example: a firm produces a good whose production causes pollution and affects another firm’s production process negatively by causing a $40 worth of damage. Here MEC is $40.

MARGINAL SOCIAL COST (MSC): refers to the additional cost incurred by the society on account of production of an additional unit of a good or service.

MSC = MPC + MEC

A negative production externality as shown in the diagram below, leads to marginal social cost which is more than the marginal private cost, and a socially optimal quantity of output (Q2) that is below the competitive market equilibrium output (Q1) (private optimal output). Thus, we say that there is overproduction of Q1-Q2. There is a deadweight loss as shown by area ABC.

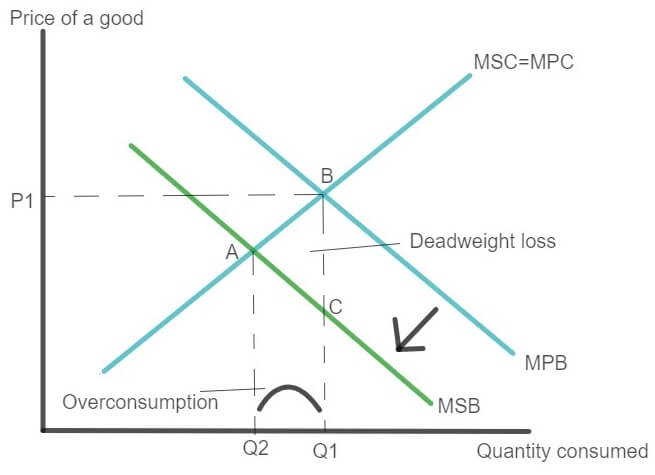

Negative Consumption Externality

Negative consumption externality is an externality caused by a consumer’s consumption of a good or service, which leads to reduction in the well-being of an unrelated third party. Example: a person smoking a cigarette negatively affects all those nonsmokers around him.

MARGINAL PRIVATE BENEFIT (MPB): This refers to the per unit benefit to the consumer i.e. benefit earned from consuming an additional unit of a good or service.

MARGINAL EXTERNAL COST (MEC): refers to the additional costs associated with the consumption of an additional unit of the good that are incurred by an unrelated third party.

MARGINAL SOCIAL BENEFIT (MSB): refers to the additional cost incurred by the society on account of production of an additional unit of a good or service.

MSB = MPB – MEC (in case of negative consumption externality)

A negative consumption externality as shown in the diagram below, leads to marginal social benefit which is below the marginal private benefit, and a socially optimal quantity of output (Q2) that is below the competitive market equilibrium output(Q1) (private optimal output). Thus, we say that there is overconsumption of Q1-Q2. There is a deadweight loss as shown by area ABC.

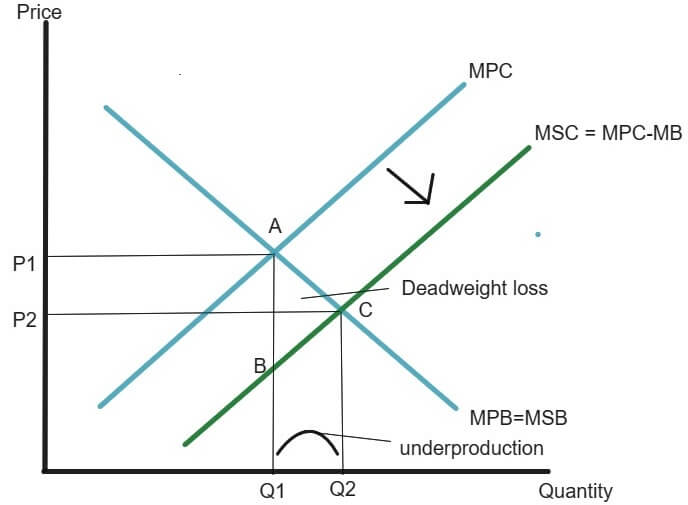

Positive Production Externality

Positive production externality is an externality caused by a firm’s production process which leads to increase in the well-being of an unrelated third party.

Example: Beehives of honey producers have a positive impact on pollination and agricultural output.

Positive Consumption Externality

Positive consumption externality is an externality caused by a consumer’s consumption of a good or service, which leads to increase in the well-being of an unrelated third party.

Example: Passersby enjoy seeing the beautiful flower garden.

Positive production externalities lead to under production of output

A positive production externality as shown in the diagram above, leads to marginal social cost which is below the marginal private cost, and a socially optimal quantity of output (Q2) that is greater than competitive market equilibrium output(Q1) (private optimal output). Thus, we say that there is underproduction of Q2-Q1. There is a deadweight loss as shown by area ABC.

COASE THEOREM

Coase theorem is named after the economist Ronald Coase. According to Coase theorem, when conflicting property rights occur and private parties can bargain over the allocation of resources at no cost, then markets will lead to an efficient outcome regardless of which party ultimately gets the property right, given that the transaction costs associated with bargaining is zero (or negligible). The initial distribution of property rights does not matter for market’s ability to reach efficient outcome. Coase theorem can be explained through a simple example:

Consider a factory operating not very far from a residential colony. During the day, the production process in the factory causes a lot of noise pollution (negative production externality), inflicting cost on the residents of the colony who are neither its customers nor the producers. There are no defined property rights in the area for the noise being created.

Now, it is efficient to allow the factory to function and carry on its production process if the value of the factory adds in the economy is greater than the cost inflicted on the residents of the colony. On the other hand, it will be efficient to close down the factory if the cost to the residents is much higher than the value added by the factory.

Now the conflicting interests of the factory owner and the residents of the colony may lead both of them in the court, who has to decide on the property right. The decision regarding the property rights will have no bearing in whether the factory continues to operate or not.

Suppose that the factory owner is willing to compensate (say, $1000) the residents of the colony more than what the residents would be willing to pay to shut the factory (say, $500). If the court decide that the residents of the colony have the right to quiet, then the factory owner would compensate the residents in order for the factory to continue its operations. There would be some price (say, $600) where both the parties would agree, that will allow the factory owner to continue his business and both parties would be better off.

On the other hand, if court decides that the factory owner can continue his operations at the expense of the cost to residents, then the factory will continue to operate. The residents won’t offer compensation to factory owner to shut the factory. (For the owner of the factory, the value of the factory continuing its operations {$1000} is more than what the residents would be willing to offer to shut the factory {$500}). This outcome is efficient, given the costs and the benefits.

Clearly, assignment of property rights by the court did not affect the ultimate outcome as soon as there was a possibility for bargain between the two parties. Thus, private economic agents can potentially solve the problem of externalities among themselves given the cost associated with bargaining is zero.

Missing Property Rights as the Source of Externalities

Markets are very efficient at producing private goods. The reason behind this is that producers and consumers have the right to ownership of the resources exchanged in an economic transaction involving a private good. When property rights are well defined, there will be no problem with production externalities. However, if property rights are not well defined, then the outcomes of economic activities will involve inefficiencies. Absence of well-defined property rights allow uncontrolled access of free riders leading to over exploitation of the common property. For example: overgrazing of land by cattle, famously known as the problem of tragedy of commons.

Lack of property rights often lead to negative externalities resulting into inefficient allocation of resources. A simple example from day to day life: public roads are not owned by any private entity. No one can charge anyone for using roads in peak hours or offer discounts to use roads in non-peak hours. This leads to overuse of roads in peak hours leading to heavy traffic jams and delays.

Thus, Lack of property rights causes over-use of resources such as depletion of resources such as over fishing, traffic congestion, forest depletion etc.

What are the Various Measures for Correcting Externalities?

1. Internalizing the externality: This refers to shifting or internalizing the burden, or costs, from a negative externality, such as pollution or traffic congestion, so that the producer takes into account the marginal social cost (MSC = MPC + external cost) while calculating his/her profits/losses.

When a party, say a factory causes a negative production externality say pollution, the firm does not take into account this external cost in the form of pollution while calculating its profits/losses. Now If, through some government actions or any private negotiations such as mergers, this external cost can be made to be reflected in the profits/losses calculations then we say that the externality has been internalized.

2. Coase theorem: when property rights are not defined clearly, but there is some possibility of costless bargaining between the party causing the negative externality and the affected party then such negotiations and bargains can result into socially optimal results in the market.

However, the optimal solution to an externality does not depend on the distribution of the property rights by law.

For example: if there is creation of a market of pollution through assignment of clear property rights where an individual owns a river and have a right to clean waters, then he can charge firms for causing pollution in his river by charging a price equal to marginal external cost caused by per unit of pollution (a negative production externality).

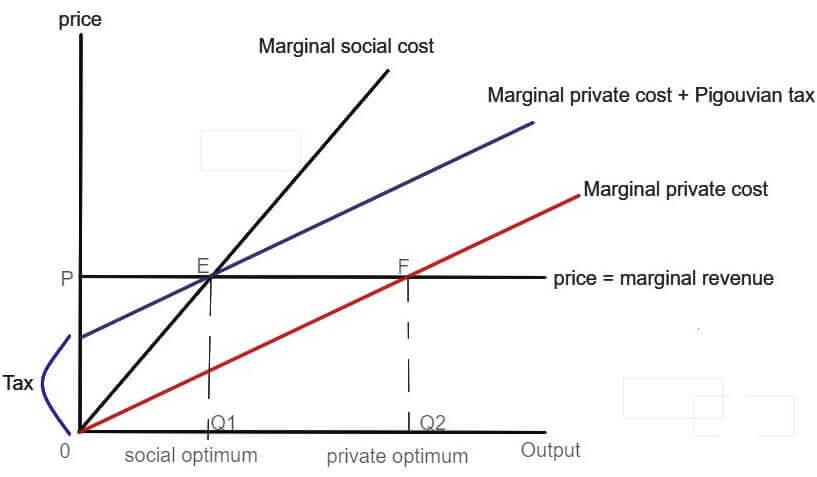

4. Pigouvian tax: It is a tax that is levied on any market activity that generates negative externalities. This tax is charged in order to correct the inefficient market outcomes caused due to the presence of a negative externality

When there is a negative externality, social cost of an economic activity is not covered by the private cost of the activity leading to inefficient market outcome. When the private cost is less than the social cost (the difference being the external cost of negative externality) then there is overproduction (or overconsumption) of the good.

The tax is charged equivalent to marginal external cost i.e. per unit of the negative externality (say, per unit of pollution caused by a factory). This per unit tax, known as Pigouvian tax increases the marginal private cost of the party that causes the externality, causing the MPC curve to shift upwards by the amount of tax. This leads to decrease in optimal quantity of output available for consumption to Q1 which is the socially optimal or socially desirable level of output.

Thus, per unit tax results in socially efficient allocation of resources.

5. Defining property rights: Private property rights are one of the preconditions for the existence of market economies. Well defined property rights lead to correct and efficient distribution of costs and benefits as long as there is visible impact of negative externalities on the efficient market outcomes.

Absence of clearly defined property rights or inadequate protection to the same is the main cause of market producing inefficient results (market failure). Negative externalities result from markets where property rights are not clearly defined or adequately protected.

Consider an example of negative production externality (pollution): A paper mill dumps pollutants into the river which affects a fishery located downstream. The pollutants increase the cost of production for the fishery while it reduces the cost of production of production of paper for the mill. Take 3 cases related to property rights:

a) When no property rights are defined: When there are no property rights regarding right to dump pollutants into the river or right to clean waters, then marginal social cost is greater than the marginal private cost and the mill do not record the external cost of pollution into his accounts. As a result, there is over production of paper, more than socially optimal level of output. As mentioned, the pollutants increase the cost of production for the fishery while it reduces the cost of production of production of paper for the mill. This will result in the overproduction of pollution than is desirable to the society. Thus, market outcome is inefficient.

b) When one of the party is assigned the property right: when property rights are well defined and there is a possibility of bargaining, then both parties, the paper mill and the fishery, can negotiate between themselves and resolve the externality privately (paper mill can pay compensation to the fishery for the pollution being caused if fishery has a right to clean river). This will result in efficient market outcome as property rights create a market for pollution where both the parties can trade and decide on the desirable level of pollution making both parties better off.

Microeconomics Homework Help Tutors

Microeconomics is a vast subject ranging from topics like Consumer Theory, Producer Theory, Cost Curves, Perfect Competition, Monopoly, Monopolistic Competition, Oligopoly and Game Theory to Market Failures and concepts like Externalities. Students study about concepts like positive and negative externalities, Coase theorem, applications of law and economics, liability rules, bargaining and Coase theorem etc. Whether it is a student of AP Microeconomics, principles of microeconomics, intermediate microeconomics theory for college level or advanced microeconomics graduate student, all of them have to study about externalities at varying levels of difficulty. At assignmenthelp we not only provide free study notes on externalities and market failures but also provide instant online economics homework help and microeconomics tutors to help with college essays, term papers in economics, research writers for microeconomics research essay topics as well as microeconomics help tutors for solving problem sets. Thus, without any delay, order online microeconomics homework help from assignmenthelp.net and get the best tutors for microeconomics.