Finance Assignment Help With Debt

Debt

Usually the cost of debt is equivalent to the company's interest expense (after tax effect) and is easily ascertainable from the footnotes to the company's financial statements (if the company has either audited or reviewed statements or compiled statements with footnote information). If the rate the company is paying is not a current market rate (e.g., long-term debt issued at a time when market rates were significantly different), then the analyst should estimate what a current market rate would be for that component of the company's capital structure.

Some companies have more than one class of debt, each with its own cost of debt capital. The relevant market “yield” is either the yield to maturity or the yield-to-call date.

Tax Effect Lowers Cost of Debt

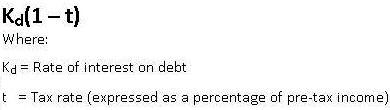

Because interest expense on debt is a tax-deductible expense to a company, the net cost of debt to the company is the interest paid less the tax savings resulting from the deductible interest payment. This cost of debt can be expressed by the formula:

Email Based Assignment Help in Debt

Following are some of the topics in Cost of Capital in which we provide help:

Corporate Finance Homework Help | Finance Assignment Help | Finance Assignment Help | Finance Homework Help | Finance Online Help | Finance Problems Help | Finance Tutor | Help With Finance Homework | Online Tutoring