Standard Costing Variance Analysis Assignment Help

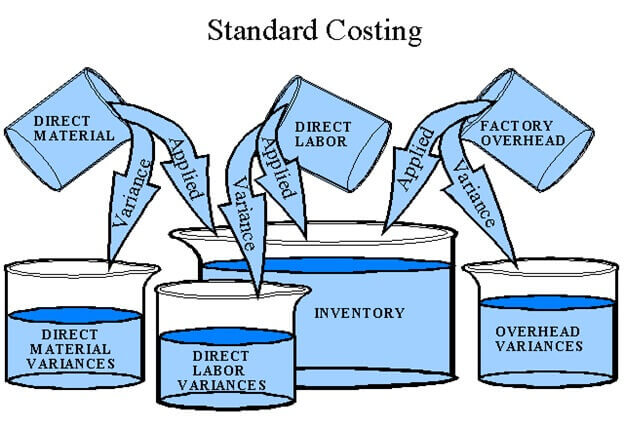

Standard Costing is a costing method which is mainly concerned with the analysis of the actual figures with the standard figures. Every manufacturer estimates some amount of inputs, labor, Overheads that will be used to produce products. These inputs are allocated to the site on an estimation basis with taking in regard the standard output and the standard input required for such output. Thus the Standard Costs are allocated to the site and not the Actual Costs. But in real, the Actual Costs differ from the Standard Costs. These differences between the costs is known as Variances.

These Variances are studied in the Standard Costing. The Standard Costing is an important managerial tool to configure business. It is highly effective in managing the trends in the business. As soon as the Management gets notified about the differences, the sooner the steps to mitigate it can be taken.

Standard Costing Assignment Help By Online Tutoring and Guided Sessions from AssignmentHelp.Net

There can be two situations in Standard Costing:

1. When the Standard Cost exceeds the Actual Cost: It is a situation when the standard cost is more than the actual cost i.e. the management estimated the costs to be more and they were less in actual. This is a situation where business is in benefit and can earn more than what was planned. It is a favorable situation for the business.

2. When the Actual Cost exceeds the Standard Cost: It is a situation when the actual cost exceeds the standard cost i.e. the management estimated the costs to be less than what actually got spent. This is a situation where business needs to be careful and needs to take remedial steps to mitigate the problem. It is an unfavorable situation for the business.

Thus Standard Costing is a very useful concept which helps the management to take timely actions about the situations and try them to bring them to a par level.

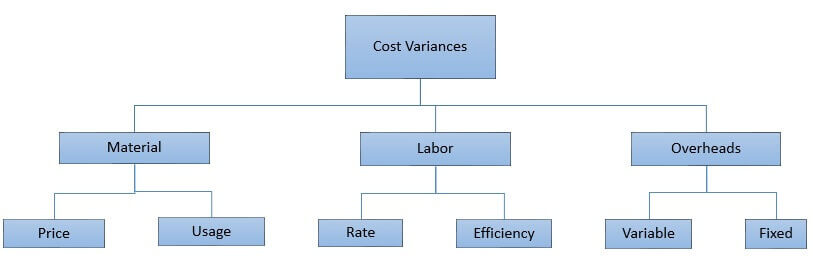

The Standard Cost of the product is always a sum total of all the components of cost. These components are:

- (a) Material

- (b) Labor

- (c) Overheads

- (i) Variable Overheads

- (ii) Fixed Overheads

The above stated are the costs which should be analyzed to find the reasons for the variances in the costs. The variances in the components are the reasons for the variance in the total cost.

The Variance is not studied only for Cost factors. It can be studied for Sales as well to ascertain the differences between the planned sale and the actual sale. This variance will help to know the reasons and laggings in fostering the sales.

Wish to know more about how Standard Costing works? Log on to assignmenthelp.net now.

The formulae used for studying the different variances are listed below.

DIRECT MATERIALS VARIANCES:

(i) Materials purchase price variance Formula

Materials purchase price variance = (Actual quantity purchased × Actual price) – (Actual quantity purchased × Standard price)

(ii) Materials price usage variance formula

Materials price usage variance = (Actual quantity used × Actual price) – (Actual quantity used × Standard price)

(iii) Materials quantity / usage variance formula

Materials price usage variance = (Actual quantity used × Standard price) – (Standard quantity allowed × Standard price)

(iv) Materials mix variance formula

(Actual quantities at individual standard materials costs) – (Actual quantities at weighted average of standard materials costs)

(v) Materials yield variance formula

(Actual quantities at weighted average of standard materials costs) – (Actual output quantity at standard materials cost)

DIRECT LABOR VARIANCES:

(i) Direct labor rate / price variance formula

(Actual hours worked × Actual rate) – (Actual hours worked × Standard rate)

(ii) Direct labor efficiency / usage / quantity formula

(Actual hours worked × Standard rate) – (Standard hours allowed × Standard rate)

(iii) Direct labor yield variance formula

(Standard hours allowed for expected output × Standard labor rate) – (Standard hours allowed for actual output × Standard labor rate)

FACTORY OVERHEAD VARIANCES:

(i) Factory overhead controllable variance formula:

(Actual factory overhead) – (Budgeted allowance based on standard hours allowed*)

(ii) Factory overhead volume variance

(Budgeted allowance based on standard hours allowed*) – (Factory overhead applied or charged to production**)

(iii) Factory overhead spending variance

(Actual factory overhead) – (Budgeted allowance based on actual hours worked***)

(iv) Factory overhead idle capacity variance formula

(Budgeted allowance based on actual hours worked***) – (Actual hours worked × Standard overhead rate)

(v) Factory overhead efficiency variance formula

(Actual hours worked × Standard overhead rate) – (Standard hours allowed for expected output × Standard overhead rate)

(vi) Variable overhead efficiency variance formula

(Actual hours worked × Standard variable overhead rate) – (Standard hours allowed × Standard variable overhead rate)

(vii) Variable overhead efficiency variance formula

(Actual hours worked × Fixed overhead rate) – (Standard hours allowed × Fixed overhead rate)

(viii) Factory overhead yield variance formula

(Standard hours allowed for expected output × Standard overhead rate) – (Standard hours allowed for actual output × Standard overhead rate)

Notes:

*Fixed overhead budgeted + Standard hours allowed × Standard variable overhead rate

**Standard hours allowed for actual production × Standard overhead rate

***Fixed overhead budgeted + Actual hours worked × Standard variable overhead rate

Some of the Sales Variances are:

- Total Sales Variance = Actual Sales - Budgeted Sales

- Sales Price Variance = Actual Sales - Standard Sales (for Actual Qty.) = Actual Qty. (Actual Price - Budgeted Price)

- Sales Volume Variance = Standard Sales - Budgeted Sales = Budgeted Price (Actual Qty. - Budgeted Qty.)

- Sales Mix Variance = Actual Qty. (Budgeted Price per - Budgeted Price per) Unit of Actual Mix unit of budgeted mix

- Sales Quantity Variance = Budgeted Price per unit (Actual Qty. - Budgeted Qty.) of Budgeted Mix

Advantages of Standard Costing:

1. Standard Costs serve as the yardstick so as to compare the actual cost. The comparison makes it possible to ascertain whether the business is working efficiently or not. It helps the management to know about the situation and improvise it accordingly. This helps in cost control and also assists the management to formulate policies so as to reduce the cost as much as possible.

2. As the management is able to draw the differences between the actual costs and the planned costs, it enables the management to figure out the laggings in the business and point out the people responsible for such lagging. This helps in increasing the responsibility of the employees towards their work.

3. Standard Costing makes the people in the firm price conscious so that they may be reduce the cost wherever possible.

4. Standard costing helps largely in planning, organising, controlling and laying out the aims to be achieved by the business. This lays the standards to be achieved.

5. Standard costing is a thinking process and it needs constant efforts to plan things. The pre determined rates and standards help in planning and budgeting process.

Disadvantages of Standard Costing:

Standard Costing is no doubt an important aspect of costing. But it has some shortcomings too. Some of these are:

1. The setting of objectives of Standard Costing is not an easy task. It requires a lot of knowledge. Moreover it is just an estimate which can prove to be wrong as well. Thus the Standards may fail.

2. The Standard Costing is not an appropriate measure for the small firms. The small firms cannot afford to hire exoerts so as to formulate the standards for them.

3. The Standard Costing cannot work in the institutions where the cost is to be recovered from the customers i.e. customer based jobs.

4. The Standard Cost is hard to apply because the departments in an industry are inter-dependent on each other which makes it hard to ascertain the right standards.

For more info regarding the Standard Costing visit assignmenthelp.net. The standard costing’s practical applicability may be complicated and tactical. But we are here to help you out with your queries. You can take online classes form our teachers who are best and professional in their respective fields. They will take your doubts and help you in the better understanding of the topics. You will have a better grasp at the topics. We respect the idea that you can’t loose on marks and need to score well. The teachers will help you get good grades. You can also talk to our customer care executives in case you have any query regrding the procedure. We are available here 24*7 at your service. You can chat with our executives too and get your queries solved.

We also provide Assignment Help. You can get schoold and college assignments done. All you need to do is just upload the assignment with a deadline and we will deliver the assignment before the deadline. There are many service providers in the market but what distinct us from others is our dedicated efforts and quality work.You will get the best services here and our quality assignments will help you score well.

So what are you waiting for? Visit assignmenthelp.net now and have a look at some of our other assignments as well.