Accounting Assignment Help With Overhead Variances

4.7.3 Overhead Variances

After having studied the variance analysis consisting of material and labour variances. Let us proceed to analysis of variances relating to overheads. Now the overheads variance analysis is different from variance analysis relating to materials and labour. Here the overheads and inputs are already determined. These pre determined overheads and inputs are called the standard. The overhead is considered in terms of predetermined rate and is applied to the input. There can be different bases for the absorption of overheads e.g., labour hours, machine tools, output (in units), etc.

Overhead variances may be classified into fixed and variable overhead variances and fixed overhead variance can be further analysed according to the courses. In case of variable overheads, it is assured that variable overheads vary directly with production so that any change in expenditure can affect costs. Some authors say that a variance may arise through inefficiency, but as these costs are usually very small per unit of output, it is to be ignored and any variance in variable overhead is attributed to expenditure variance. Considering the fixed overheads cost, the difficulty arises in determining standard overhead rates. This is so because this is dependent on the volume or level of activity. Any change in volume or level of activity causes a change in the overhead rate. Therefore the fixing the volume or level of activity is a crucial aspect in determining standard overhead rate. Now if the management decides to change the normal volume or level of activity, without a corresponding change in the fixed amount of overheads, then a change occurs in the overhead rate. Here it may be noted that in the case of material or labour variances, the volume decision does not in any way influence the fixation of standard rate. So to resolve this problem, normally the Budget is used in place of the standard.

Another important thing to be noted in case of overhead analysis is that different writers use different modes of computation of overhead variance and also different terminologies. E.g. spending variance is same as expenditure variance and volume variance is same as capacity variance.

After having discussed the preliminary aspect of overhead variance, now we go about the analysis of the overhead cost variances.

Classification of Overhead Variance

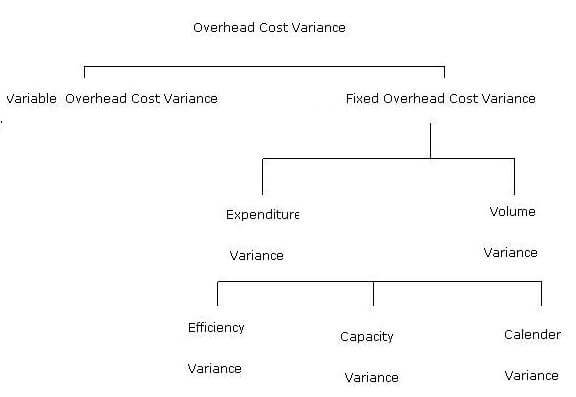

The term overhead includes indirect material, indirect labour and indirect expenses. It may relate to factory, office and selling and distribution centres. Overhead variance can be classified as sown in the following diagram:

Overhead cost variance is the difference between standard cost of overhead absorbed in the output achieved and the actual overhead cost. Simply, it is the difference between total standard overheads absorbed and total actual overheads incurred. Therefore, the formula for overhead cost variance is as follows:

Overhead Cost Variance = Total Standard Overheads – Total Actual Overheads

(OHCV)

The overhead cost variance may be divided into variable overhead cost variance and fixed overhead cost variance. Fixed cost variance may be further divided as fixed expenditure variance and fixed volume variance. Fixed volume variance may again be sub-divided into efficiency variance, capacity variance and calendar variance. Let us study, how these variances are calculated.

1. Variable Overhead Cost Variance (V.OH.C.V): This variance is the difference between the standard variable overhead and the actual variable overhead. The formula is:

Variable Overhead Cost Variance

= Standard Variable overhead for actual output – Actual Variable Overhead

Where,

Standard Variable Overhead

= Standard hours allowed for actual output X Standard Variable Overhead Rate

Standard Variable Overheads

Standard Variable Overhead Rate = ----------

Standard Output

It is stated earlier that there are two basic variances, price and volume. If volume does not affect the cost per unit the only variance to be calculated is price variance known as the variable overhead variance. But when assumed that variable overheads do not move directly with output, the variable overhead variances are to be calculated on similar lines as to fixed overhead variances which you will study later. In this unit, we are assuming that variable overheads do change directly with the output and infact it is the practice that many firms follow and by a number of writers on the subject.

Variable overhead cost variances arise due to the following reasons:

1) Advance payment of overheads

2) Outstanding overheads during the current period

3) Payment of past outstanding overheads during the current period

Email Based Assignment Help in Overhead Variances

Following are some of the topics in Standard Costing in which we provide help:

Accounting Assignment Help | Accounting Homework help | Help with Accounting | Management Accounting | Cost Accounting | Online Tutoring | Financial Accounting | Email Based Accounting Homework Help