Strategic Management Barclay Bank Sample Assignment

INTRODUCTION

Strategic Management is the process of using the capabilities and capacities of an organization to achieve the business objectives of the company (Robson, 2015). The report helps to apply the different tools and the frameworks related to the business strategy to develop an effective plan for organizations. The different tools and the framework that is used in the report are PESTLE analysis, SWOT analysis, VRIN Model, Value chain model and the Porter five force model with regard to the Barclays Bank.

Barclay Bank is one of the oldest banking and the financial service company in the UK, the company owns an experience of the more than three hundred years in the banking service (BV, 2017). The business of the company is operational in fifty-five countries, through direct and the indirect operations. The company reported an annual revenue of the more than twenty-one billion pounds in the year 2017 and the company aims to achieve business growth with the use of technology and customer service (BV, 2017). The main products of the company are personal banking services, corporate banking, wealth management and the investment banking service (BV, 2017).

PESTLE ANALYSIS

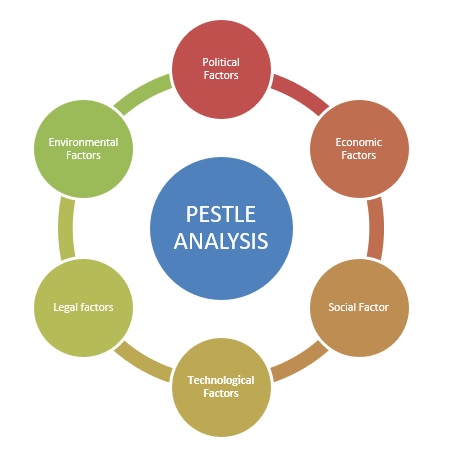

The pestle analysis is a framework that is used for the analysis of the external environment of the company. The external environment holds a significant position with regard to the business performance and the development of the business strategy in accordance with the external environment helps to optimize the efforts taken by different business functions (Freeman, 2010).

The Pestle analysis considers the examination of the political, economic, social, technological, legal and the environmental factors that affect the business of Barclays Bank in the UK (Freeman, 2010). The pestle analysis of Barclay’s bank is as follows:

Figure 1: Pestle analysis

Source: Freeman, 2010

Political Factors

The main political factors that have an influence on the business of the Barclay is Brexit and the impact of the new banking and the financial policy that will be developed after Brexit (Dhingra et al. 2016). Due to the Brexit, the business of the Barclay in other European countries will be affected negativity, in addition to this, the operational cost of Barclay will also rise in other parts of Europe. Barclay will also face difficulty in management of the human resource as the most of the recruitment in the bank consist professional form other European Countries. The changes in the banking and financial sector policies will affect the investment and personal banking business of Barclay.

Economic Factors

The analysis of the economic factors that affect the business of the Barclay can be divided into two parts, one the short term factors and the second the long terms factor. The instability in the market after Brexit and the falling prices of the pound have a negative impact on the business of the Barclay in short-term (Kolios and Read 2013). Analyst suggests that this short-term effect will get recovered, as it can be observed that post-Brexit Barclay bank have reported a profit in quarter two of 2018 after the fall of 32% in share price after Brexit (Barclay Bank, 2018).

The long-term factors such as the inflation rate and the slow growth rate in the GDP of UK also affect the economic development of the Barclay. In addition to this stagnated UK Banking and Financial service also creates a negative impact

Social Factor

The external social factors that have an influence on the business of the Barclay is the change in the demographics of the UK and the changing consumer demand with regard to the banking and financial service(Florin, 2014).

According to the demographic study of the UK, the number of age-old population is increasing, more than 18% of the population is age-old (Florin, 2014). Due to this Barclay bank must introduce new service that is related to this age group and the investment and saving capacity of age-old is likely to be higher which will benefit Barclay in terms of higher deposits (Florin, 2014). In addition to this, the Barclay Bank also has an edge in terms of the changing consumer demand with regard to new advance technological services in banking as the company is a global leader in terms of the innovation and development in the banking sector.

Technological Factors

The technology factors that affect the business environment are the availability of new products and services and use of technology for doing business. Barclays is known to be the business leaders in terms of the technology related to the banking and financial service, the company is able to provide all the modern facility such as the use of the biometrics, mobile application and the internet technology to all the customer (Florin, 2014). The company has also invested in research related use of the cryptocurrency in trading and banking services.

Legal factors

The legal regulation is very strict with regard to the banking and financial service. Barclays needs to invest large amount money in audit and risk management of its operation at the international level (Freeman, 2010). In addition to this, the legislation such as the Modern Slavery and the data protection also affect the business of the bank. Barclay holds a positive reputation in terms of following the legal factors(Freeman, 2010).

Environmental Factors

The environmental factors such as carbon emission and the use of the resources for business operations affect the business of the Barclay. The shift in consumer behavior towards the "Green Consumerism" affects the decision making of leaders (Kolios and Read, 2013). Barclay has launched various products such as Green Loans to the initiate the investment in using renewable energy and addresses the green consumerism (Kolios and Read, 2013).

PORTER FIVE FORCE ANALYSIS

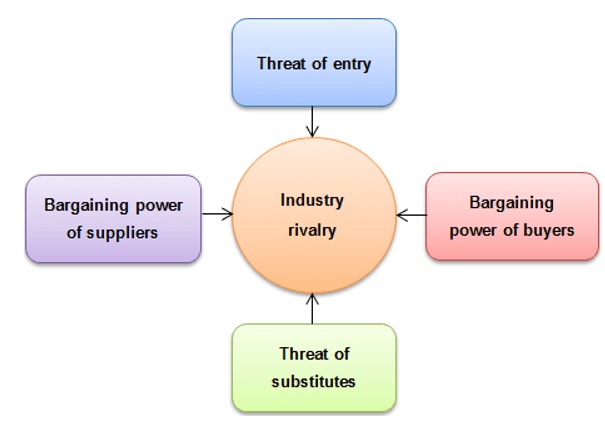

This framework helps to understand the competitive position of the company in a business environment (Hill et al. 2014). The framework is based upon analysis of five aspects that are competitiveness, the threat of new entry, the threat of the substitution and the bargaining power of the consumer and the bargaining power of the suppliers.

Figure 2: Porter five force analysis

Source: Jurevicius, 2013

The porter five force analysis of the Barclays Bank is as follows:

Industry Competition

The impact of the industry competition is very high in the banking and financial service sector. The reason behind this is that the major market companies such as the HSBC, Standard Charted and Lloyds have tough competition with the Barclay in terms of the market share and capitalization (Clerides et al. 2015). The second reason is the industry stagnation and limited scope for growth in the home market of UK.

The threat of the New Entry

The threat of the new entry can be rated to the below as the cost of the investment and the complex process of the licensing and the requirement of the talented human resources for management is challenging for the new companies to develop (Clerides et al. 2015). In addition to this, the limited scope of the growth in this sector also limits the new companies to invest in this sector.

The threat of the Substitution

The new technological solution is not available that can substitute the conventional banking business that is done by Barclays. The new types of the banking business that is branchless and completed depended on mobile application is also a form of the conventional banking that is done on mobile is adapted by Barclay and other major companies in the sector, so the risk of the substitution can be rated as very low (Hryckiewicz and Kozlowski, 2018).

Bargaining power of Suppliers

The different requirements of the Barclay are the banking machines, ATM cards, Information technology solution and the printed marketing material. It can be identified that the size of the requirement of this product for Barclay is very high, so Barclay has a superior position in terms of the negotiation and dealing (Hryckiewicz and Kozlowski, 2018). Due to this reason, the Bargaining power of supplier for the Barclay can be related to the low.

Bargaining power of the Consumers

The consumers of the Barclay are the customers that have a personal banking requirement, the business that requires corporate banking and the wealth management and investment management customer (Clerides et al. 2015). It can be identified that the requirement of the bargaining power of consumers is very high due to the availability of the wider range of the choices and the regular discounts and offers that are given to the consumers.

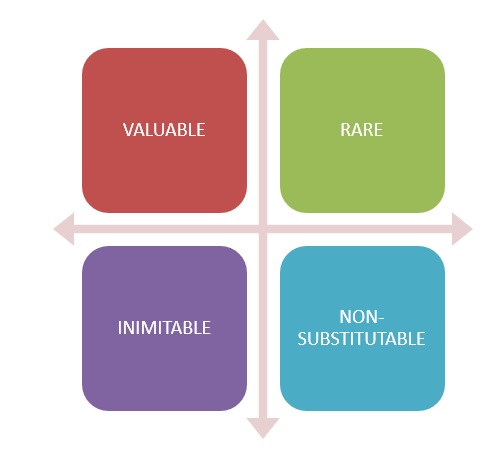

VRIN MODEL

VRIN model will help to the valuable resources of the Barclay, rare resources of the Barclay and imitable and the non-substitutable resources of the Barclay (Freeman, 2010). The model is useful to examine the competitive advantage the bank has in terms of its competencies.

Figure 3: VRIN model

Source: Freeman, 2010

The Valuable resources are the resources that the Barclay that is of greater value than the actual or market cost and of the resource (Freeman, 2010). The valuable resources of the Barclay are financial and the human resource of the company. These resources are of greater potential to the company as compared to the market value. The rare resource of the company is its offices in the prime business areas of the UK, as the company is more than three hundred years old, this office offers high value to the market presence of the Barclay and rare to be available to other companies (Piercy, 2012). The Imitable resources of the company are its brand image and its experience in the banking and the financial sector. The non-substitute resources of the Barclay are its capacity to sustain the economic ups and the down of market and grow as banking service providers.

Table 1: VRIN Model

|

RESOURCE |

VALUABLE |

RARE |

INIMITABLE |

NON-SUBSTITUTABLE |

|

Physical Resource |

Yes |

Yes |

Yes |

No |

|

Financial Resource |

Yes |

Yes |

Yes |

No |

|

Technology Resource |

Yes |

No |

No |

No |

|

Organizational Resource |

Yes |

Yes |

Yes |

Yes |

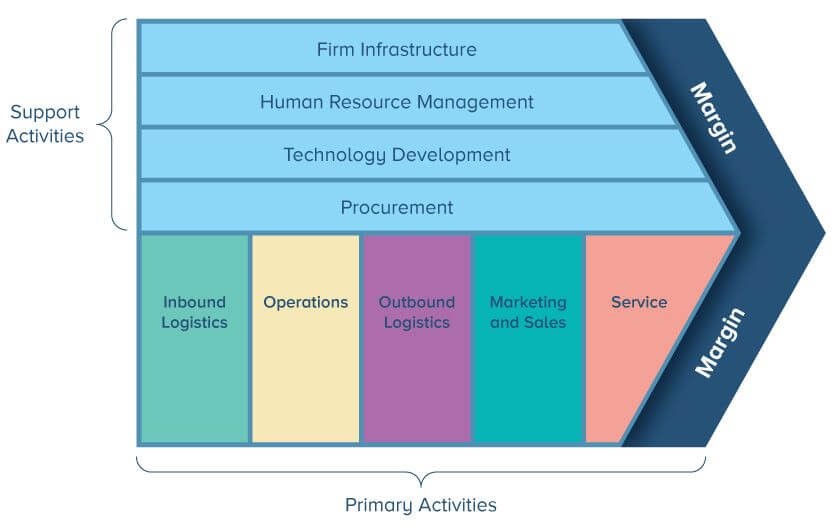

VALUE CHAIN MODEL

Value Chain model is the method that is used to the conduct the internal analysis of the company, the different process of the company is divided into the support activates and primary activities (Wheelen and Hunger, 2011). In the analysis of the support activates the procurement, technology, human resource management and the infrastructure of Barclay will be analyzed and the in the analysis of the primary activity inbound and the outbound logistics, operations, marketing, and service will be analyzed with regard to the Barclay (Wheelen and Hunger, 2011).

Figure 4: Value Chain model

Source: Wheelen and Hunger, 2011

Support activity analysis

The procurement in the Barclay bank has well established, the management of the bank use high-quality machines and the infrastructure of the all the bank branches and the offices are well designed. The experience of the more than three hundred years of the banking is considered to take the decision with regard to the purchase and design of the interiors. The technology of the banking services that are used in the Barclay is advance and the bank has a dedicated function that aims to provide high technology to the customer. It was the first bank to launch ATM and the conducted research on the use of the Blockchain in the trading and the banking services (Barclay Bank, 2018). With regard to the analysis of the human resource management of the company the Barclay has more than 79,000 employees and the experienced staff for personal banking, corporate banking and the wealth management service (Barclay Bank, 2018). The company also have effective knowledge management and the training and development program called “E-gain”.

Primary activities

The process of the inbound logistics the Barclay is the based upon use of the financial management software called “Finacle”, in addition to this, the Barclay also use the various other software that is integrated with data analysis and the artificial intelligence(Barclay Bank, 2018). The outbound logistics is delivered to the customers of Barclay via the online net banking service, its branches, and the ATM machines. The company has a wide range of the network of this service that makes its strategic position strong. Barclay also has a global presence in the more than fifty countries that makes the outbound logistics for international and corporate customers stronger. The operations of the Barclays are largely dependent on its network of the branches and its software service. The average time of the operation in personal banking service is 12 minute in London (Barclay Bank, 2018). The marketing and sales strategy is the Barclay is a target based campaign, the company identify the target audience for its wide range of the products and services and launch a different marketing campaign with regard to its, the effective marketing strategies of the company have helped for market development and the market penetration in its global operations.

RESOURCE AND THE COMPETENCY ANALYSIS OF THE BARCLAY BANK

Resource analysis

The different resource that the Barclay has is the financial resource, human resource, assets and liabilities, and the technology resource. According to the annual report of the company, Barclay has assets £1,133bn globally, the valuation of the assets have the grown at 9.8% as compared to the last year (Barclay Bank, 2018). The total profit after expenses of the company is £3.2bn and cost to income ratio is 76 %.The number of employees that are working in the Barclay at the global level is the 79,900 and the company is operational in more than fifty countries directly and indirectly (Barclay Bank, 2018). Barclay has a stronger position in the technology sector and it offers all the advanced technology to the customers and the employee.

Based upon the resource analysis it can be analyzed that Barclay is having a significant amount of the asset and as the profit to income ratio is also 76% the company is a profit making company. In addition to this, the wide speared of operations and the stronger human resource provides strength to Barclay to the overcome external challenges (Hill et al. 2014).

Competency analysis

The competency analysis will help to examine the unique aspect of the Barclay that helps the company to overcome competition and also grow with consistency. It can be identified that there are four competencies of Barclay that are business skills, technology, product diversification, and the brand reputation. With the help of excellent business skills, Barclay has been able to expand the business globally and provide high-quality service to the customer (Hill et al. 2014). The company also have stronger technology skills that help to provide a technology-based solution to the customers and the use of high-end technology in the business operation. In addition to this Barclay also deal with wide range of the products and service, such as the personal baking, corporate banking, wealth management service and the investment banking service that help the company to improve the business volume and serve a wide range of customers (Piercy, 2012). In addition to this, the Barclay also has launched a new type of services such as Green loans for MNCs and corporate credit cards that improve its competency as a bank. Barclay vintage banking experience and its brand reputation in the UK is also a competency for the company (Barclay Bank, 2018).

Table 2: Strategic Position Map

|

HIGH COST , HIGH QUALITY Bank of Ireland Cooperative Bank |

LOW COST, HIGH QUALITY Barclay HSBC Bank Lloyds Bank |

|

HIGH COST, LOW QUALITY Metro Bank |

LOW COST, LOW QUALITY Ulster Bank NatWest Tide |

STRATEGIC CHOICES AND THE SOLUTION FOR BARCLAY

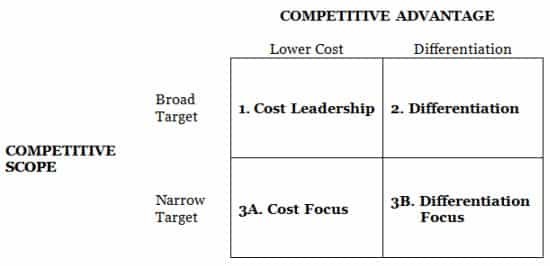

The framework of the “Porter’s Generic Strategies” can be used to identify the strategies that can be used by Barclay for business development. According to Porter’s Generic Strategies there are three approaches that can be used for business development, the approaches are Cost leadership strategy, differentiation strategy, and the focus strategy.

Figure 5: Porter’s Generic Strategies

Source: Spencer, 2014

Cost Leadership strategy

The cost leadership strategy aims to reduce the cost of the various products or service that offered by the business, with an aim of the market development (Doz, 2017). One of the main product of the Barclay is the personal baking services and then it can be studied that there are two types of the charges that are applied in the personal banking in the UK, one is the mouthy maintain fees and the other is the charges that are taken on electronic payment. For Barclay, the £6 pound is taken as Mount maintenance fees and the no charge is taken for the electronic payment. With regard to the cost leadership strategy, the company can charge as less as the £1 for one year for new customers and make the free for high-value customers. This strategy will help Barclay to be a discount bank in the UK and it will also help to over the competition as the charges that are taken by its main competition HSBC and the Lloyds Bank is £5 (Nandakumar et al. 2011). The method the company can use to overcome the cost by depending on high volume.

This strategy will help to the take advantages of its competence and the stronge resource, in addition to this, it will also help social and the economic aspects. Additionally, this can also be used in the other counties and the other division such as the loans and wealth management.

Differentiation strategy

The differentiation strategy suggests that products and service of the Barclay must be more appealing than the present competition. The differentiation strategy can be used by Barclay by providing “Completely Branch Less baking services” to the customers (Tanwar, 2013). This can be done by using the technology and business skill that Barclay have and it business skill. This strategy will help the company to reach a higher number of the customer and aligned with the external social and the technological factors.

This strategy can also be applied with regard to corporate banking and investment management services of the Barclay. To apply this company need to develop an advanced mobile application and internet banking service and also improve customer support. It can also be studied that only Starling bank in the UK, provides the branchless banking service to the customer, but with regard to the main competition of the Barclay that is the HSBC, Lloyds Bank and the Bank of Scotland does not offer branchless banking services (Hill et al. 2014).

Focus strategy

The focus strategy suggests focusing on the high-value customers of the industry by understanding their needs and providing special pricing to them. The main business with regard to the banking and financial service comes for the corporate banking sector of Barclay. The company can develop special products and the service forms the large MNCs and their employees (Hill et al. 2014). This will help the bank to gain high-value banking account of MNC and their Employees. In addition to this, the Barclay can also use its resource strength of branches in the globally, this will help Barclay to the gain higher volumes of the business and also MNCs will also get support with regard to the centralized banking service.

CRITICAL ANALYSIS OF THE STRATEGIES

Cost Leadership strategy

The main advantage of the cost leadership strategy for the Barclay will be that it will help to convert the high volume of the business opportunity in the UK and other countries due to the reasonable rate offering by the company. In addition to this, it will also help to the get a competitive edge over the banks such as Lloyds and the HSBC in terms of cost (Teece, 2010). The method will also help to make new customers which will provide Barclay with an opportunity of cross-selling.

The limitation of the cost leadership strategy is the cost of the services will be higher for Barclay as it will offer the same service at a reasonable rate, in addition to this the operational load on the employees will also increase due to the higher work (Teece, 2010). The other limitation of this approach is that the company will only be able to the earn profits only if the sale of the service is the at the break-even point

Differentiation strategy

The differentiation strategy will help Barclay to attract wide range of the customers as the product of “Completely Branch Less baking" can be used by all the age group of customer. It will also help Barclay to the do business in the areas where it does not have a branch which will help improve the market penetration (Stead and Stead, 2014). In addition to this, it will also be cost saving as the rental and maintenance cost of the branches could be eliminated completely.

The limitation of this strategy is that Completely Branch Less banking is prone to the issues such as hacking, due to which the system of the company need to be highly advanced. In addition to this, any kind of the technical error in this sector can stop or stagnate the baking process of the all the customers that are linked with it(Stead and Stead, 2014).

Focus strategy

The merit of the focus strategy is the that it will help them improve the business profits of Barclay with use of existing infrastructure of services. In addition to this with the growth and development of the business of the MNCs, their banking requirement will also grow that will help to ensure growth in the sector (Hill et al. 2014). The other advantage of the business is that it will help to use the brand image and the global presence of the brand in an effective manner.

The limitation of this strategy is the conversion of the MNCs as the customer is a challenging work for the marketing function of the Barclay, in addition to this the process of the decision making and the contracts is likely to take longer time, the other limitation of the process is the services also need to the customized as per the requirement of the MNCs that will take time (Clerides et al. 2015).

SWOT ANALYSIS

The SWOT analysis of the Barclay Bank will help to study the strengths, weakness, opportunities and identify the risk and the potential development opportunities (Thompson and Martin, 2010). The SWOT analysis of Barclay is the as follow:

|

STRENGTHS Barclay has a stronger brand image due to its experience In banking and its presence worldwide(BV, 2017) The company has a wide range of portfolio of the products Barclay is the leader use and development of the technology The company have strong assets that are distributed worldwide the excellent processes of the business management help the company to over the external challenges (BV, 2017) The environmental activities that run by the company are unique and help in customer acquisition (Wu and Shen, 2013) |

WEAKNESSES The banking and the financial service sector is facing a high level of competition all over the world, due to which the growth of Barclay is slow The company have faced legal charges in Qatar and USA, which have created a negative impact on the image of the company The cost of the global operation of the Barclay is very high, which the cases an impact on profit ration (Bennett and Kottasz, 2012) Due to Brexit and falling rate of the pound the company is likely to face challenges with regard to the development of the new policy and the procedure (Barclay Bank, 2018) |

|

OPPORTUNITIES Barclay has potential to expanse to the developing countries With the help to product diversification, the company can improve its business in the existing companies With the help of the use of technology and innovation the company develop its existing business (Piercy, 2012) The company high positional for growth in the with regard to the wealth management service |

THREATS Due to industry competition, the company have lost the majority of its share in the business in USA and UK(BV, 2017) The changes in policy with regard to the corporate and the baking sector will Crete a slowdown in the business for Barclay (Helms and Nixon 2010) |

CONCLUSION

Based upon the report it can be analyzed that different methods and tools of the strategic management provide knowledge and understanding to develop comprehensive strategies with regard to internal and the external condition of the organizations. The tools such as the Pestle analysis and the Portal five force analysis helped to identify the external business environment for Barclay and suggested that method that company must adapt to the overcome the negative aspects and external environments and how the external factor such can help Barclay for growth and development. The tools such as the VRIN model, SWOT analysis and the values chain helped to the study the internal aspect of Barclay in detail. Additionally the Ansoff Generic strategic provides the framework to develop the strategies that can be adapted by Barclay for the business development and their potential limitation with regard to the application and the success.

REFERENCES

- Barclay Bank, Annual Report, 2018 (Online available at https://home.barclays/investor-relations/reports-and-events/annual-reports/ last accessed on Nov 2018)

- Bennett, R., and Kottasz, R., 2012. Public attitudes towards the UK banking industry following the global financial crisis. International Journal of Bank Marketing, 30(2), pp.128-147.

- BV, B.S.N., 2017 Barclays Bank PLC.

- Clerides, S., Delis, M.D. and Kokas, S., 2015. A new data set on competition in national banking markets. Financial Markets, Institutions & Instruments, 24(2-3), pp.267-311.

- Dhingra, S., Ottaviano, G.I., Sampson, T. and Reenen, J.V., 2016. The consequences of Brexit for UK trade and living standards.

- Doz, Y.L., 2017. Strategic management in multinational companies. In International Business (pp. 229-248). Routledge.

- Florin, N., 2014. A Assignment of Banks' Competitiveness in the United Kingdom and Bangladesh Using PESTEL Model. Journal of Applied Management and Investments, 3(2), pp.74-82.

- Freeman, R.E., 2010. Strategic management: A stakeholder approach. Cambridge university press.

- Helms, M.M., and Nixon, J., 2010. Exploring SWOT analysis–where are we now? A review of academic research from the last decade. Journal of strategy and management, 3(3), pp.215-251.

- Hill, C.W., Jones, G.R. and Schilling, M.A., 2014. Strategic management: theory: an integrated approach. Cengage Learning.

- Hryckiewicz, A. and Kozlowski, L., 2018. A horserace or boost in market power? Banking sector competition after foreign bank exits. International Review of Economics & Finance.

- Jurevicius O., 2013 (Online available at https://www.strategicmanagementinsight.com/tools/porters-five-forces.html last accessed on Nov,2011)

- Kolios, A. and Read, G., 2013. A political, economic, social, technology, legal and environmental (PESTLE) approach for risk identification of the tidal industry in the United Kingdom. Energies, 6(10), pp.5023-5045.

- Nandakumar, M.K., Ghobadian, A. and O'Regan, N., 2011. Generic strategies and performance–evidence from manufacturing firms. International Journal of productivity and performance management, 60(3), pp.222-251.

- Piercy, N.F., 2012. Market-led strategic change. Routledge.

- Robson, W., 2015. Strategic management and information systems. Pearson Higher Ed.

- Spencer, T., 2014 (Online available at https://www.spencertom.com/2014/07/07/porters-generic-strategies/#.XA4Z7osza1s last accessed on Nov, 2018)

- Stead, J.G. and Stead, W.E., 2014. Sustainable strategic management. Routledge.

- Tanwar, R., 2013. Porter’s generic competitive strategies. Journal of business and management, 15(1), pp.11-17.

- Teece, D.J., 2010. Business models, business strategy and innovation. Long range planning, 43(2-3), pp.172-194.

- Thompson, J.L. and Martin, F., 2010. Strategic management: Awareness & change. Cengage Learning EMEA.

- Wheeler, T.L. and Hunger, J.D., 2011. Concepts in strategic management and business policy. Pearson Education India.

- Wu, M.W. and Shen, C.H., 2013. Corporate social responsibility in the banking industry: Motives and financial performance. Journal of Banking & Finance, 37(9), pp.3529-3547.