PSTAT 171 Term Structure of Interest Rates Homework

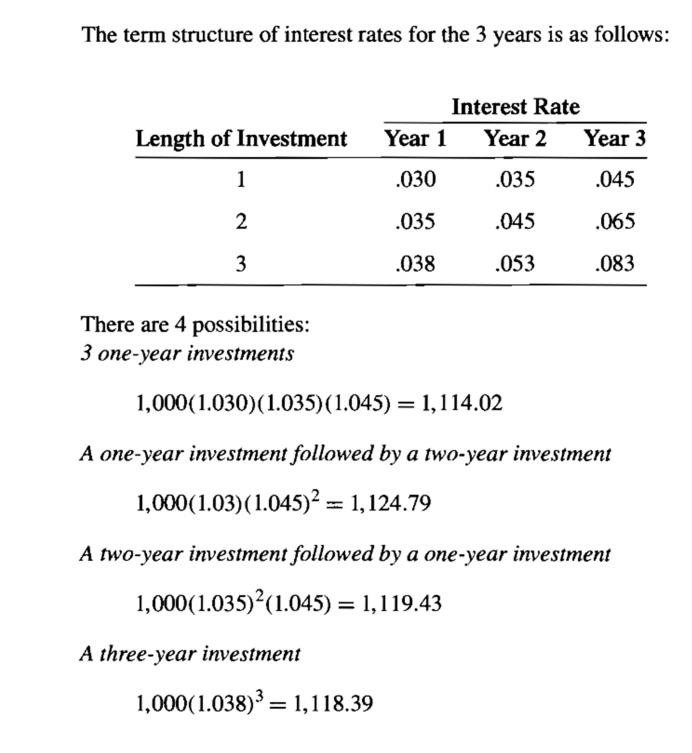

Given the following yield curve, answer the next 2 questions:

Year Spot Rate

1 5.0%

2 4.5%

3 4.0%

4 4.0%

5 4.0%

1. A three year 1000 Par bond with annual interest payments has a coupon rate of 4%. Use the yield curve above to find the price P and the yield to maturity.

Solution

PV = 40/(1.05) + 40/(1.045)2+ 1040/(1.04)3 = 999.28

2. Find the one-year forward rate.

Solution

i 1,2 = s2 2/s1 = 1.0452/1.05 = 1.04

i 1,2 = 0.04.

3. Yield rates to maturity of zero coupon bonds are currently 8.5% for a one- year, 9.5% for two year and 10.5% for a three-year maturity. Calculate the forward rate for year two implied by these current bond yields.

Solution

We want to calculate 1,2 i

= 10.5%

= (1+s2)2/(1+s1)1-1

2

4. A yield curve is defined by the following equation:

ki = 0.09+0.002 k−0.001 k 2 where ikis the effective rate of return for a zero coupon bond of maturity k years.

Find the one-year effective forward rate for year 5 that is implied by this yield curve.

Solution

Note that the question asks in terms of a spot rate of “ik.” We use the terminology skfor the spot rate.

The forward rate (as our notes define) for year 5 is i4,5, which we know is equal to (1+s5)5/(1+s4)4-1.

s4 = 0.082 and s5= 0.075.

Then i4,5 = 1.0755/1.0824-1 = 4.74%

5. You are given the following term structure of spot rates:

Year Spot Rate

1. 5.00%

2. 5.75%

3. 6.25%

4. 6.50%

A three year annuity-immediate will be issued a year from now with annual payments of 5,000. Using the forward rates, calculate the present value of this annuity a year from now.

3

Solution

We can start with a time-line:

|_____________|_____________|______________|________________|

| 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| X | 5,000 | 5,000 | 5,000 |

We want to value the income stream at time X.

We need to calculate a new set of spot rates for the years one-year hence.

(The spot rates that we are given apply today). We will denote them as jn.

Then:

(1+j1) = 1.05752/1.05 = 1.065

(1+j2)2= (1+i1,2)(1+i2,3) = (1.065)(1.0625)3/1.05752= 1.14229

(1+j3)3= (1+i1,2)(1+i2,3) (1+i3,4) = (1.065)(1.14229)(1.065)4/1.06253= 1.2251

PV = 5000 | + | 5000 | + | 5000 | = 13,152.50 |

|---|---|---|---|---|---|

| 1.065 | 1.14229 | 1.2251 |

6. You are given the following n-year forward rates:

Year Forward Rate

1 3.0%

2 4.4%

3 4.8%

4 5.6%

4

a. Find s4.

b. A four-year 1000 par bond is issued with 5% annual coupons. Find the price of the bond using the spot rates calculated in a.

c. What is the yield to maturity of this bond?

Solution

| a. | (1 | + | i 0,1 | )( 1 | + | i 1,2 | ) ( 1 | + | i 2,3 | ) ( 1 | + | i 3,4 | ) | = | (1+s ) 4 | 4 |

|---|

s4= [(1.03)(1.044)(1.048)(1.056)]1/4

4.44%

b. We first need to calculate a series of spot rates:

(1+s4)4= 1.19 => s4 = 4.44%

(1+s3)3= 1.127 => s3 = 4.06%

(1+s2)2= 1.075 => s2 = 3.68%

Then the value of the bond is 50/1.03 + 50/1.075 + 50/1.127 + 1050/1.19

PV = 1,021.77

c. Yield to maturity=> | 50a 4| +1000v 4 | = 1021.77 |

|---|

i= (179.82 + 841.94) at 4.395%

7. The yield to maturity on 5 year annual coupon bonds maturing at 1000 Par is as follows:

Term (years) | Yield |

|---|---|

1 | 6.0% |

2 | 6.5% |

3 | 7.0% |

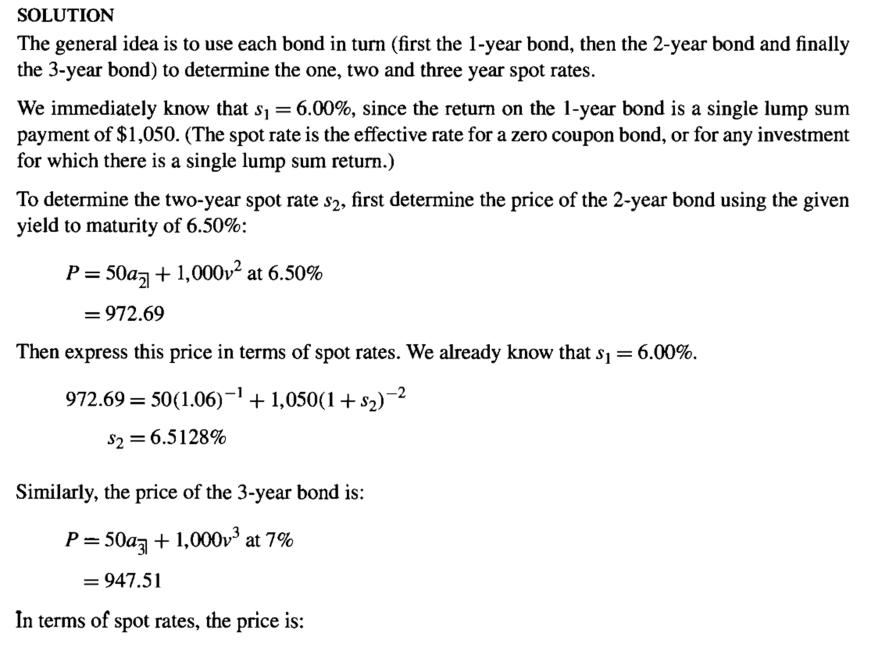

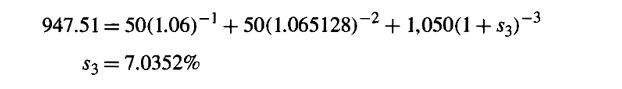

Calculate the 1, 2 and 3 year spot rates.

5

8. | The following are the current prices of $1,000 zero-coupon bonds: |

|---|

Term (years) | Price |

|---|---|

1 | $943.40 |

2 | X |

3 | 805.08 |

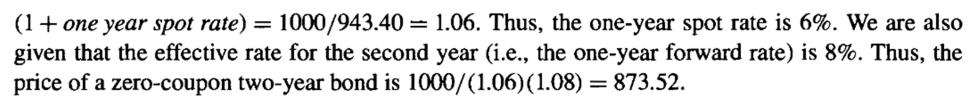

If the one-year forward rate for year 2 is 8% (i.e. the one year effective rate during year 2) determine X.

6

Solution

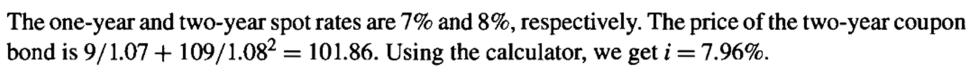

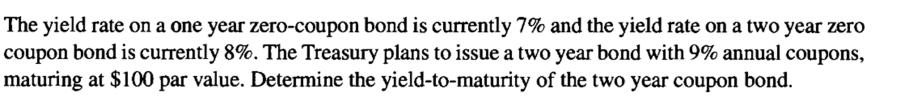

9. The yield rate on a one year zero-coupon bond is currently 7% and the yield rate on a 2-year zero coupon bond is currently 8%. The Treasury plans to issue a two year bond with a 9% annual coupon, maturing at $100 par value. Determine the yield to maturity of the two year coupon bond.

Solution

10. | You a given the following information about the Treasury market: |

|---|

Term (years) | Coupon | Yield-to-maturity (nominal annual rate converted semi-annually) | Price |

|---|---|---|---|

0.5 | 0% | 8.1% | $96.11 |

1 | 0% | 8.4% | $92.10 |

1.5 | 9% | 8.6% | $100.55 |

2 | 10% | 9.0% | $101.79 |

Coupons are paid semi-annually. Determine the spot rate for the 1-1/2 year period, expressed as a nominal rate compounded semi-annually.

7

Solution

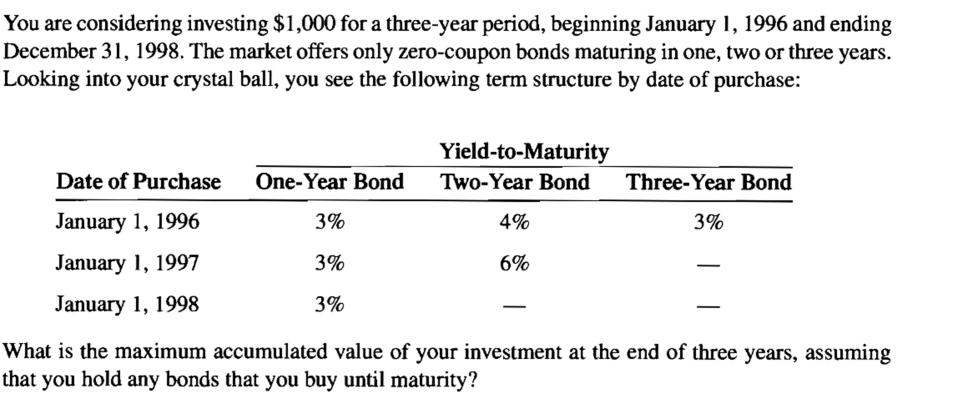

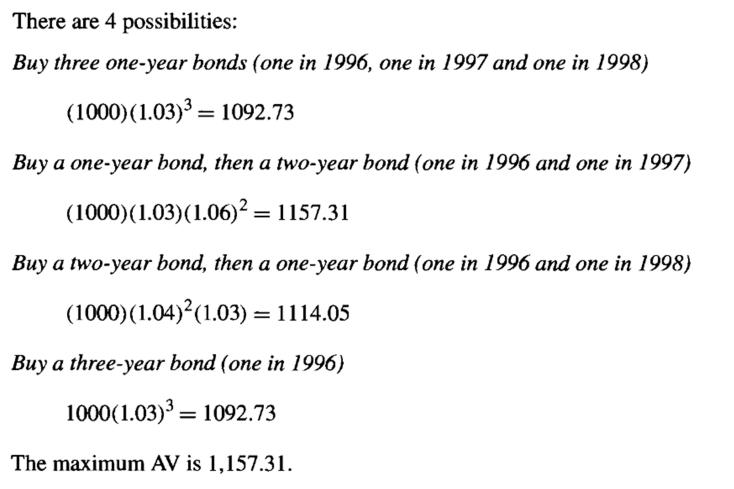

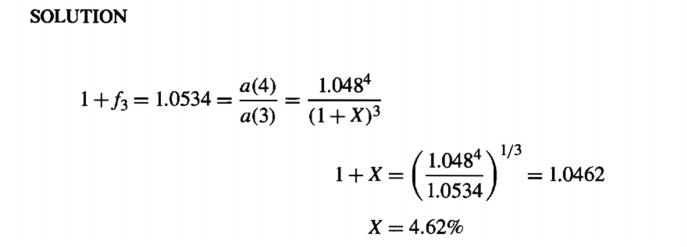

11.

Solution

8

12. | You are given the following spot rates: |

|---|

Term (years) | Spot Rate |

|---|---|

1 | 4.00% |

2 | 4.30% |

3 | X |

4 | 4.80% |

If the one-year forward rate for year 4 is 5.34%, calculate X.

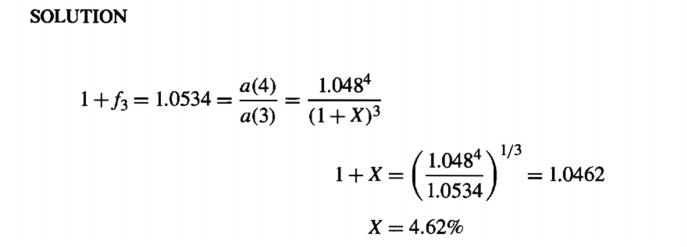

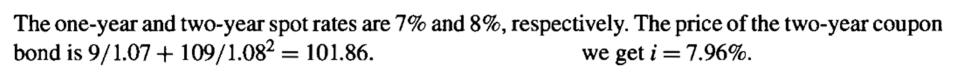

13.

Solution

9

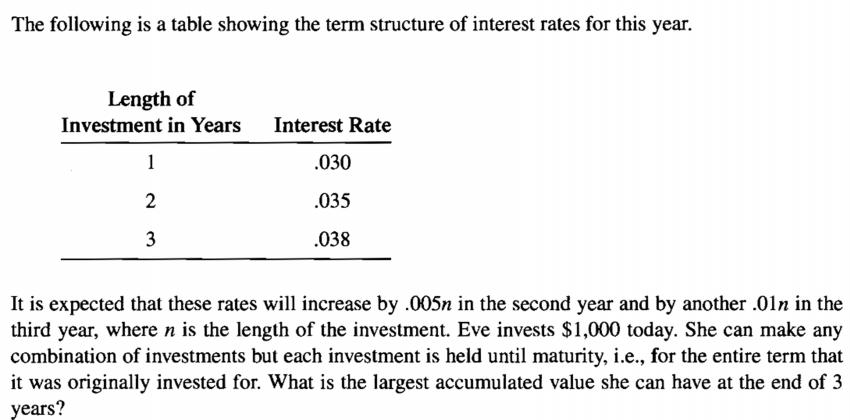

14.

Solution