Industry Analysis for Effective Decision Making Sample Assignment

Introduction/Definitions

For any organization to be successful, effective decision making must be incorporated in the corporate strategy as well as the organizational culture. Decision making refers to the process whereby the management is faced with a situation involving a trade-off after two or more alternatives are analyzed and one is chosen (Navarro, 2006). A trade-off refers to weighing or considering the rewards and sacrifices of making a decision. The rewards of a decision are the benefits derived from deciding while the sacrifices otherwise known as the opportunity cost are the benefits foregone from not choosing the alternative option(s). The study of the relationship between the sacrifices and the rewards is known as cost/benefit analysis (Robinson & Hammitt, 2011). Industry analysis refers to the process of conducting a study or research on the industry in which the business is operating to determine the external forces acting on the firm. It is an essential practice because it enables the internal decision makers-internal stakeholders within an organization responsible for making economic decisions-to make informed and effective decisions. These decisions ultimately lead to performance improvement and avoidance of ineffective decisions that lead to low performance or loss incurrence.

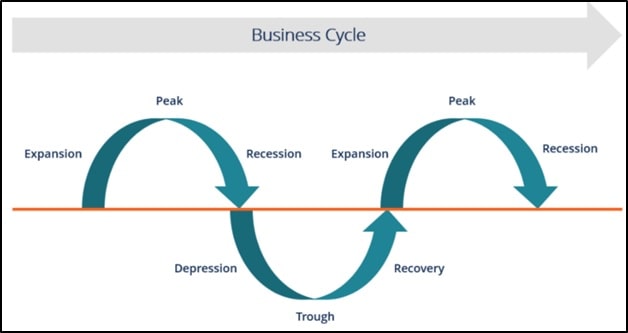

It is crucial to examine the business cycle in which the organization’s industry is operating at the time that corporate decisions need to be made. A business cycle refers to the fall and rise in economic activity or growth that takes place naturally and comprises four phases namely expansion, peak, contraction and trough (Jiang, Habib & Gong, 2015). The expansion stage refers to the economic period when the economy is growing as indicated by the Gross Domestic Product (GDP). The peak phase is the stage of the business cycle that the expansion phase changes to the contraction phase which marks the end of the trough phase and the start of the peak phase. The contraction phase marks the decline of the GDP growth rate to below 2% and is often referred to as recession. The trough phase marks the period when the economy hits rock bottom. GDP is an economic parameter used to measure the output of an economy to determine whether it is healthy or unhealthy (Fraumeni, 2017). The GDP growth rate is said to be healthy if it ranges between 2% to 3%. It is at this GDP growth rate that the rate of unemployment is also healthy at a range between 4.5% and 5% and the rate of inflation is at a desirable level of 2%. The rate of inflation refers to the decline in money value due to an increase in prices over a specified time (Eo & Lie, 2019). It is mostly measured using the Consumer Price Index (CPI) which is a measure of the price change in a basket of services or goods consumed by households expressed as a percentage (Church, 2016). The rate of unemployment refers to the proportion of total labor force/workers that are unemployed expressed as a fraction.

Figure 1: Business Cycle

Determination of the U.S. in the business cycle

To provide an informed recommendation to Allan, the position of the United States in the business cycle can be determined by analyzing the following economic indicators.

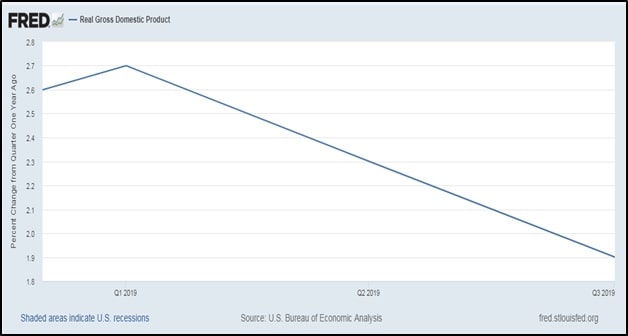

Source: U.S. Bureau of Economic Analysis

Figure 2: United States’ GDP for the last 12 months

From the graph in figure 2, the United States is in the contraction phase as reflected by the decline in the GDP growth rate from 2.7% to 1.9%.

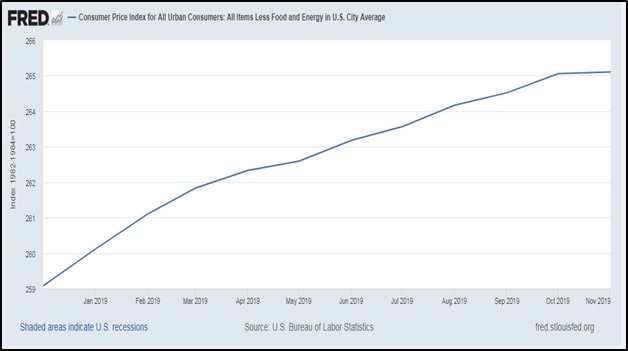

Source: U.S. Bureau of Labor Statistics

Figure 3: Consumer Price Index for the United States in the last 12 months

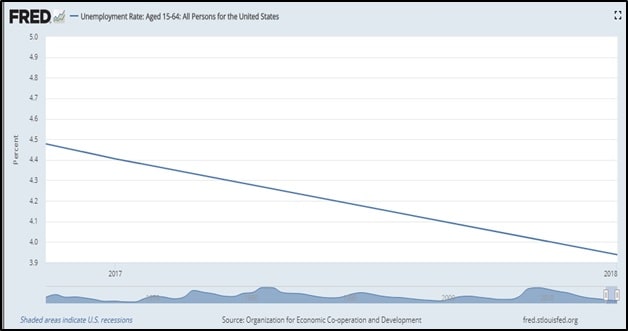

Source: Organization for Economic Co-operation and Development

Figure 4: United States' rate of unemployment for the last 12 months

The impact of national inflation on the cost of living

In simple terms, an increase in the rate of inflation means that the prices of goods and services have increased and therefore households have to pay a higher price for the same services and goods. From figure 3, the country’s CPI indicates that the inflation rate has increased for the last 12 months. This has a negative implication on the disposable income of Algration’s employees because their purchasing power has declined. The increase in the cost of living while their salaries remaining constant implies that the employees are dissatisfied with their jobs and therefore are less motivated. This translates to decreased productivity.

The impact of the labor market

Source: U.S. Bureau of Labor Statistics

Figure 5

The rate of unemployment has declined for the last 12 months in New York as illustrated in figure 5 which means that more Americans are employed. While this may be a good thing for workers, it cannot be said to be the same for employers such as Algration. For businesses, when the rate of unemployment is high, organizations are in a position to determine the level of minimum wage and thus reduce the cost of doing business thereby increasing profitability.

Recommendations to Allan

Although the rate of unemployment has decreased steadily from 4.5% to 3.9%, the growth in GDP has also declined from 2.7% to 1.9%. It implies that the country’s production output has also declined. However, since Algration has been doing well and managed to make successful acquisitions, it is crucial to maintain its performance. This is achievable by maintaining a satisfied and motivated workforce. The cost of living has increased for the last 12 months as indicated by the increase in the CPI as indicated in figure 3 from 259 to 265. This means that goods and services have become expensive for the company’s employees. Studies have shown that satisfied employees exhibit higher productivity compared to dissatisfied employees. Considering the good performance of Algration and the declining welfare of its employees, I recommend Alan to proceed and increase the salaries of the employees. My cost/benefit analysis finds that not increasing the salaries means that the company will be sacrificing its good performance at the expense of maintain current labor costs.

References

Church, J. (2016). Comparing the Consumer Price Index with the gross domestic product price index and gross domestic product implicit price deflator. Monthly Labor Review. Doi: 10.21916/mlr.2016.13

Eo, Y., & Lie, D. (2019). Changes in the Inflation Target and the Comovement between Inflation and the Nominal Interest Rate. SSRN Electronic Journal. Doi: 10.2139/ssrn.3360730

Fraumeni, B. (2017). Gross domestic product: Are other measures needed? IZA World of Labor. Doi: 10.15185/izawol.368

Jiang, H., Habib, A., & Gong, R. (2015). Business Cycle and Management Earnings Forecasts. Abacus, 51(2), 279-310. Doi: 10.1111/abac.12047

Navarro, P. (2006). The Hidden Potential of “Managerial Macroeconomics” for CEO Decision Making in MBA Programs. Academy Of Management Learning & Education, 5(2), 213-224. Doi: 10.5465/amle.2006.21253787

Organization for Economic Co-operation and Development, Unemployment Rate: Aged 15-64: All Persons for the United States [LRUN64TTUSA156N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LRUN64TTUSA156N, December 11, 2019.

Robinson, L., & Hammitt, J. (2011). Behavioral Economics and the Conduct of Benefit-Cost Analysis: Towards Principles and Standards. Journal of Benefit-Cost Analysis, 2(2), 1-51. Doi: 10.2202/2152-2812.1059

U.S. Bureau of Economic Analysis, Real Gross Domestic Product [OB000334Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/OB000334Q, December 11, 2019.

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average [CPILFENS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPILFENS, December 11, 2019.

U.S. Bureau of Labor Statistics, Unemployment Rate in New York-Newark-Jersey City, NY-NJ-PA (MSA) [NEWY636URN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NEWY636URN, December 16, 2019.