The ratio the stock price the option price

lOMoARcPSD|2813415

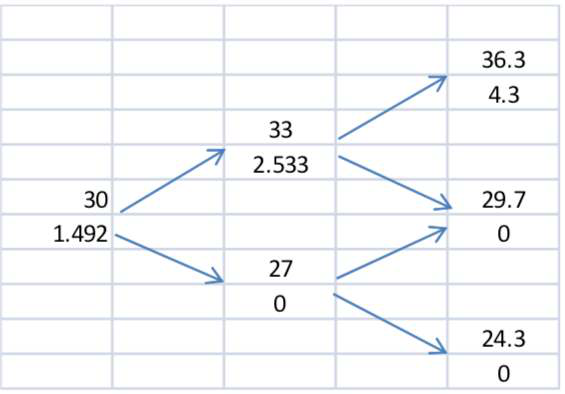

1. The current price of a non-dividend-paying stock is $30. Over the next six months it is expected to rise to $36 or fall to $26. Assume the risk-free rate is zero. An investor sells call options with a strike price of $32. Which of the following hedges the position?

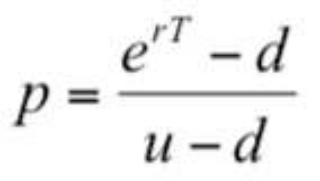

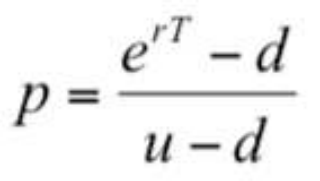

The formula for the risk-neutral probability of an up movement is

In this case u = 36/30 or 1.2 and d = 26/30 = 0.8667. Also r = 0 and T = 0.5. The formula gives

p = (1-0.8667/(1.2-0.8667) = 0.4.5. The current price of a non-dividend-paying stock is $40. Over the next year it is expected to rise to $42 or fall to $37. An investor buys put options with a strike price of $41. What is the value of each option? The risk-free interest rate is 2% per annum with continuous compounding.

A. $3.93

B. $2.93

C. $1.93

D. $0.93

A. Check whether early exercise is optimal at all nodes where the option is in-the-money B. Check whether early exercise is optimal at the final nodes

C. Check whether early exercise is optimal at the penultimate nodes and the final nodes

D. None of the aboveFor an American option we must check whether exercising is better than not exercising at each node when the option is in the money.

The expected return on the option on the tree is the risk-free rate. This is an application of risk-neutral valuation. The expected return on all assets in a risk-neutral world is the risk- free rate.

9. A stock is expected to return 10% when the risk-free rate is 4%. What is the correct discount rate to use for the expected payoff on an option in the real world?

11. Which of the following are NOT true

A. Risk-neutral valuation and no-arbitrage arguments give the same option prices

B. Risk-neutral valuation involves assuming that the expected return is the risk-free rate

and then discounting expected payoffs at the risk-free rate

C. A hedge set up to value an option does not need to be changed

D. All of the aboveThe hedge set up to value an option needs to be changed as time passes. A and B are true.

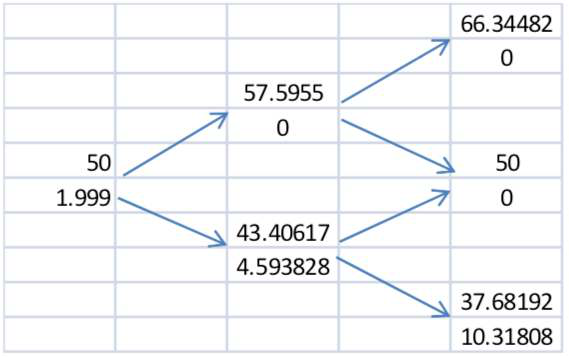

13. The current price of a non-dividend paying stock is $30. Use a two-step tree to value a European put option on the stock with a strike price of $32 that expires in 6 months with u = 1.1 and d = 0.9. Each step is 3 months, the risk free rate is 8%.

14. Which of the following is NOT true in a risk-neutral world?

A. The expected return on a call option is independent of its strike price

B. Investors expect higher returns to compensate for higher risk

C. The expected return on a stock is the risk-free rate

D. The discount rate used for the expected payoff on an option is the risk-free rate

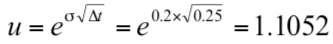

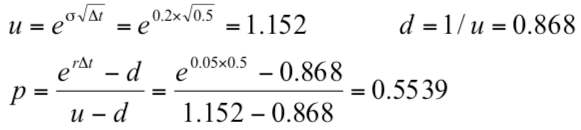

16. If the volatility of a non-dividend-paying stock is 20% per annum and a risk-free rate is 5% per annum, which of the following is closest to the Cox, Ross, Rubinstein parameter p for a tree with a three-month time step?

A. The risk-free rate is replaced by the excess of the domestic risk-free rate over the foreign risk-free rate in all calculations

B. The formula for u changes

C. The risk-free rate is replaced by the excess of the domestic risk-free rate over the

foreign risk-free rate for discounting

D. The risk-free rate is replaced by the excess of the domestic risk-free rate over the foreign risk-free rate when p is calculatedThe formula for u does not change. The discount rate does not change. The formula for p becomes

The formula for u is the same in the two cases so that the values of the index on its tree are the same as the values of the stock on its tree. However, in the formula for p, r is replaced by r−q.