About the data falls within standard deviation the mean

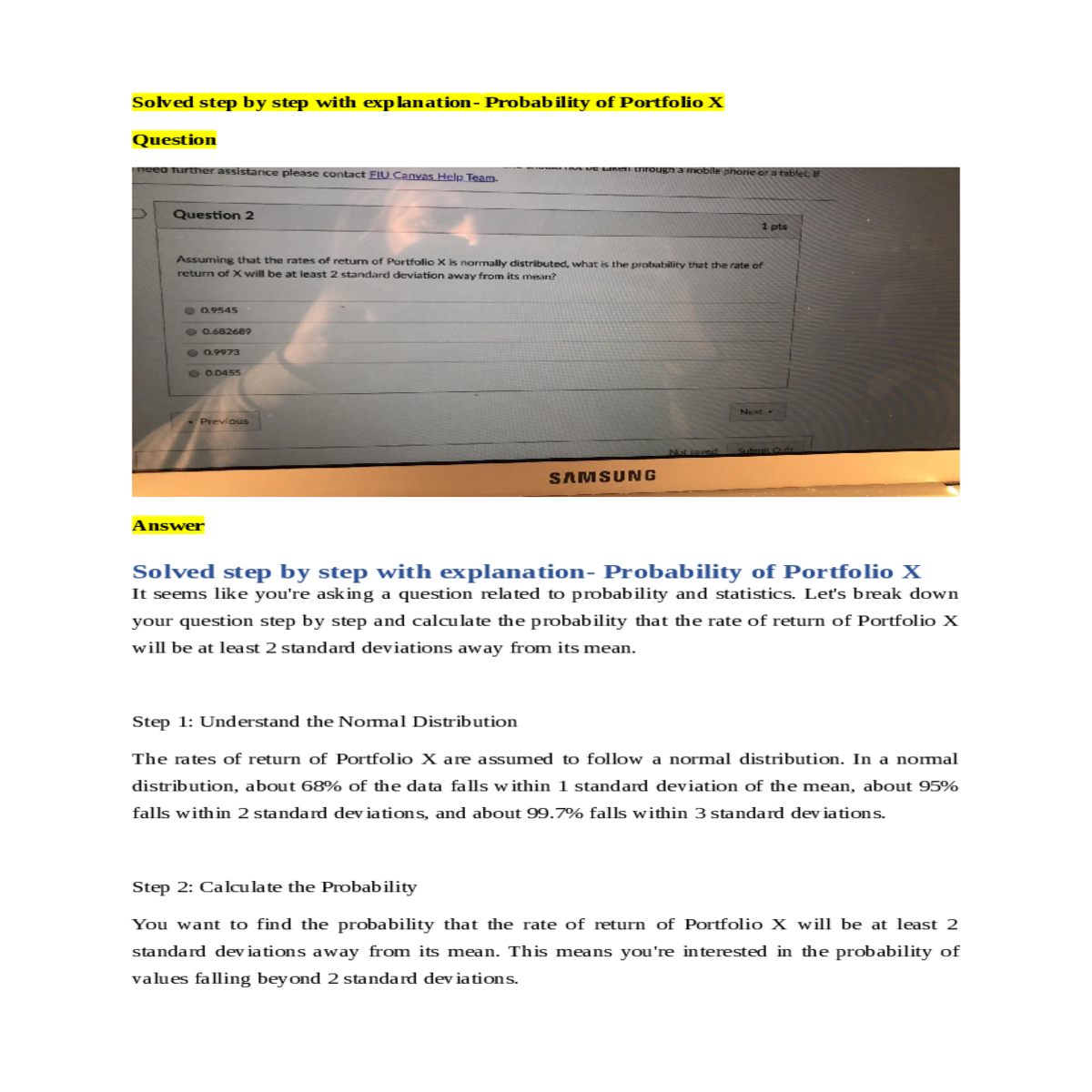

Solved step by step with explanation- Probability of Portfolio X

Question

Solved step by step with explanation- Probability of Portfolio X

The rates of return of Portfolio X are assumed to follow a normal distribution. In a normal distribution, about 68% of the data falls within 1 standard deviation of the mean, about 95% falls within 2 standard deviations, and about 99.7% falls within 3 standard deviations.

Step 2: Calculate the Probability

- \(\mu\) is the mean of the distribution

- \(\sigma\) is the standard deviation of the distribution

Step 5: Calculate the Complementary Probability

However, you're interested in the probability of values being at least 2 standard deviations away, which includes both the values greater than 2 standard deviations away and the values smaller than -2 standard deviations away. Since the normal distribution is symmetric, you can calculate the complementary probability and then subtract it from 1.

So, the probability that the rate of return of Portfolio X will be at least 2 standard deviations away from its mean is approximately 0.9772 or 97.72%. Therefore, the closest option to this probability is 0.9973.

Please note that while the options you provided are close to the calculated probability, none of them matches exactly. The closest option is 0.9973, which is the probability you're looking for.