BSBRSK501 Manage Risk Task Sample Assignment

Task 1: Report on Risk

Performance objective

For this task you are required to determine the risk context associated with establishing a new business outlet within the existing business structure. You will be required to review internal and external environment factors, obtain support for activities and liaise with relevant stakeholders to identify risks.

Assessment description

For the MacVille Pty Ltd simulated business scenario provided, you are required to assume the role of Brisbane store Assistant Manager, Ash, who has just been promoted to be Manager of a new store. Ash has been tasked with conducting a risk management analysis of this new venture.

There are three stages to this project: (1) review, (2) analyse and plan, and (3) monitor. This project is divided into three assessment tasks as follows:

For this assessment task, you will need to review the simulated business’s risk management processes and determine the scope and objectives, taking into account stakeholders and both internal and external environmental factors affecting the organisation. Once you have gathered this information, you are to identify risks and write a draft report to the CEO. You will meet with the CEO to discuss your report, seek support for your findings, and approval to communicate risk management processes to relevant stakeholders for their feedback and participation.

Procedure

You will assume the role of Ash, Assistant Manager of the Brisbane MacVille café, who has just been promoted to Manager of the new Toowoomba store. In preparation for the new venture, Ash has been tasked with conducting a risk management analysis of this project:

Excerpt of email from CEO Paula Kinski

From: CEO – P. Kinski

To: Assistant Manager – Queen Street store

Re: New Toowoomba store

Congratulations on your new appointment. Prior to taking up your position as Manager of our new Toowoomba store, located in Ruthven Street, the Board of Directors has asked that the risks in this project be appropriately managed.

I want you to undertake this task as it will give you significant insight into the store’s operations, it will ensure a smooth transition for Hurley’s Café staff into the MacVille family and will encourage you to give ongoing support for our risk management initiatives.

I would like you to approach this task in three stages and meet with me at the end of each phase to review your work and discuss your plans for the subsequent phases. The three stages in this risk management task will include:

- Review.

- Analyse and plan.

- Monitor…..

Once I have received your risk review report, we will need to discuss the steps that you will take in the risk management process.

Regards

P.Kinski

CEO MacVille Cafés (Qld)

1. Review the provided MacVille simulated business scenario information and documentation provided in the Appendices of this task.

Assistant Manager of the Brisbane MacVille café, is located in Ruthvan st (the new Toowoomba store). In preparation for the new venture, Ash want to talk about a risk management analysis of this project. There are 3 stages to approach and meet with him at the end of each phase to review discuss plans for the subsequent phases.

2. Write a report for the CEO (your assessor) that addresses the following:

- The effectiveness of the MacVille Risk Management Framework in supporting the principles and processes of risk management, set out in the risk management standard AS/NZS ISO 31000:2009. Outline the purpose and key elements of the standard in your discussion.

The definition of risk has changed from ‘the chance of something happening that will have an impact on objectives’ to ‘the effect of uncertainty on objectives’.

While risk managers will continue to consider the possibility of risks occurring, they should now apply risk treatment options to ensure that the uncertainty of their agency meeting its objectives will be avoided, reduced, removed or modified and/or retained. For example:

- Create and protect value

- Be an integral part of organisational processes

- Be part of decision making

- Base on the best available information

The purpose of this standard is follow the policies.

- Identify and describe the scope of risk management required in your role.

Scope of business’s risk:

- Financial management

- Occupational Health and Safety (OHS)

- Governance

- Branch of business

- The external environment

- The internal environment

- Identify and describe the critical success factors, goals or objectives for areas included in the scope.

Critical success factor (CSF) is a management term for an element that is necessary for an organization or project to achieve its mission. It is a critical factor or activity required for ensuring the success of a company or an organization.

Goals provide a greater degree of detail than success factors. They start to impact exactly what must be done. Without specific and achievable goals, the risk management team and the individuals in it will have no direction - nothing to aim for.

Goals provide a focus and purpose for action.

Objectives enable team members to clarify the actions they must take. It defines and clarifies the goals and there are often multiple objectives for each goal.

Objectives break down goals into small achievable steps, define the timeframes and deadlines for completion of various objectives.

- Identify relevant internal and external stakeholders, their role in the risk management process, and any issues or concerns they have raised. Complete the Table of Stakeholders Template (provided in Appendix 3 of this task) and attach to your report.

- Complete a PEST analysis and a SWOT analysis to identify risks associated with the scenario. Outline the relevant legislation, regulations and standards (including those at a local level, i.e. Toowoomba Council).

- A SWOT analysis is a tool that helps organisations to focus on strengths, minimise weaknesses, take advantage of opportunities and reduce the threats that face their business: Privacy Act 1988, Privacy Regulation 2013, Fair Work Regulations 2009, Digital Transition Policy, AS ISO 15489 Records Management.

- SWOT analysis:

- Strength: variety of beverage, high technology machine, good position, new furniture.

- Weakness: not enough staffs, less customers then other old shops.

- Opportunities: improve competitiveness, working more professional, expand more choices in the menu.

- Threats: new opening, new branch, many competitiveness shops.

PEST analysis tool will give you a better understanding of the environment in which your industry operates, and the external factors (now and in the future) that may impact on the production of your goods or services. Importantly, you can carry out a PEST analysis on the buyer - this will give you insights into their needs and requirements.

The basic PEST analysis includes four factors:

- Politicalfactors are basically how the government intervenes in the economy. Specifically, political factors have areas including tax policy, labour law, environmental law, trade restrictions, tariffs, and political stability. Political factors may also include goods and services which the government aims to provide or be provided (merit goods) and those that the government does not want to be provided (demerit goods or merit bads). Furthermore, governments have a high impact on the health, education, and infrastructure of a nation.

- Economicfactors include economic growth, interest rates, exchange rates, the inflation rate. These factors greatly affect how businesses operate and make decisions. For example, interest rates affect a firm's cost of capital and therefore to what extent a business grows and expands. Exchange rates can affect the costs of exporting goods and the supply and price of imported goods in an economy.

- Socialfactors include the cultural aspects and health consciousness, population growth rate, age distribution, career attitudes and emphasis on safety. High trends in social factors affect the demand for a company's products and how that company operates. For example, the ageing population may imply a smaller and less-willing workforce (thus increasing the cost of labour). Furthermore, companies may change various management strategies to adapt to social trends caused from this (such as recruiting older workers).

- Technologicalfactors include technological aspects like R&D activity, automation, technology incentives and the rate of technological change. These can determine barriers to entry, minimum efficient production level and influence the outsourcing Furthermore, technological shifts would affect costs, quality, and lead to innovation.

- Describe the methods of research that you used to complete your PEST and SWOT analysis. For example, how you approached the simulated business information; legislation, regulations, etc.; and any other information or research on risk that applies to the scope of your report.

The most popular methods which I used are search on the business’s website and look for in the library’s document from school’s computer.

- Complete the analysis of risk for the scenario by summarising the scenario and identifying a list of risks to the project.

The MacVille Board has reviewed the previous report you developed, and has requested further information for four of the identified risks, including options for reducing the risk levels. These risks are as follows:

- Banking risk – theft of cash left on premises.

- Manager’s travel risk –physical injury.

- By-law compliance risk –reputation/brand loss and fines

- Loss of brand recognition risk – brand non-compliance of staff not wearing the MacVille uniform, or altering MacVille processes and service expectations.

Timelines to consider are based on risk priority levels and include the following:

- Pre-settlement – date of legal transfer of the business.

- Within six months – after the opening week.

Responsibilities for actions include the following.

- Financial, insurance and banking issues – Financial Controller.

- Legal issues – Goldsmith Partners.

- New policy – CEO with MacVille Board of Directors.

- External audits – CEO with MacVille Board of Directors.

Note: Ensure your report is written in a style appropriate to your stakeholder audience, for example, using appropriate language and including appropriate illustrative material (such as checklists, diagrams or flowcharts) and attachments to support your summary.

3. Submit your report as per the specifications on the next page. Be sure to keep a copy for your records.

4. After you have developed your report, write an email that is intended for relevant stakeholders (identified in Step 2). Your email should clearly ask stakeholders for input, include a list of risks you have identified and invite them to assist in identifying any additional risks.

From: Kim

To: Andrew

Dear Andrew,

I’d like to make an appointment on next Monday to talk about the risks and discuss solutions for this.

To set up a new business, there are many risky could be happened. Therefore, every managers have to take part in the meetings at 9am.

Regard,

Kim

5. Send the email to the CEO (your assessor) for review and request a meeting to discuss identified risks and further risk management processes.

From: Kim

To: Andy

Dear Andy,

I write this email to you to review about profit of this month. We have lost around $40.000 dollars for the first 3 months. In my opinion, the problem comes from paying too much money for advertising on website, over workers at the moment, and the manage projects are stacked. If this is still being continue, there are more and more trouble to us. Therefore, this Monday I’d like all managers come and discuss solutions.

Regard,

Kim

6. Meet with the CEO to:

- discuss your findings, particularly your understanding of the critical success factors and goals

- Success factors are the key ways in which an organisation knows whether it has achieved what it wanted to. Goals provide a greater degree of detail than success factors. They start to impact exactly what must be done. They can be, for example, profit oriented, service oriented, described in terms of improvements, percentages, market share, number of units produced or expressed as units of time.

- explain the MacVille risk management process

Because MacVille cafes is new so I think there are many problem at the first running. We should have a clearer plan for organise the shop. +How many staffs, +How much for advertise, +how much losses predict, +when capital return

Solution:

- Raising awareness

- Creating a clear and compelling business case

- Effectively communicating the requirement

- Managing resistance.

- discuss how you can communicate with stakeholders about the risk management processes in this scenario and invite them to participate in discussions to further identify risks associated with the scenario

I think the best ways to discuss about risky is by meetings. Besides can be by emails, phone, or message too. I will make a plan to solute the risks then write an email +phone to stakeholders to invite to come meetings to discuss about risk management.

- obtain the CEO’s support for ongoing risk management activities

This is a good news to obtain CEO’s support. Risk management projects can work more effectively. I need a specific plan to resolve and prevent the risks.

- ask the CEO for input on additional risks.

If there are more risk happen, ask for CEO for add 1/ 2 more persons to do together.

7. In dot-point form, summarise your discussion with the CEO. This should include any recommendations they made to you.

- The location of the store on the corner of the two main streets of the city makes for easy access for local customers and high visibility for tourists.

- The long drive from Toowoomba to Brisbane would make attending the weekly managers meeting difficult considering many meetings did not finish until into the evening after refreshments. There are also manager training sessions that need to be completed over the next six months in with a few other assistant managers. Navigating the steep narrow climb up the range with trucks blocking the way is quite difficult even in daylight hours. Being a competent driver you feel that it would be unlikely that you would be involved in an accident, but it still concerns you considerably.

- The two-hour delivery time would make fresh pastry deliveries from the company’s central bakery plant impractical. The pastries would arrive after the morning rush. These are a key part of the MacVille product assortment.

- There is also a concern about getting the company-branded supplies through as quickly as a CBD Brisbane store could.

- Hurley’s Café was a family-run store and some family members were employed on the staff. James was engaged by the family to supervise the operations of the store and Mr Hurley as manager would authorise wages but anyone can authorise deliveries.

- When asked about written policy and procedures manual, James said that Mr Hurley set the policy and procedures verbally and on the few days each week he was in the store he would show the staff how to do things the way he wanted them done.

- Water use – Water wastage present; the dishwasher is often run when only half full; fruit and vegetables are washedunder a fast-running tap; toilets all use the single flush system; James explained that Mr Hurley instructed the staff to keep the non-native flowering plants in the courtyard fully watered.

- James spoke about the café attracting a large percentage of retirees because of the easy access to buses and the store’s central location.

- The same staff member that completed the cash register balancing also completed the bank deposit form and did the banking as well. The banking was not done every day and often $4,000 was kept on the premises overnight in the cash register. There was no safe. There is a bank two shops away but the Hurley family bank is a couple of blocks away and there was not always time to do the banking.

- Not all takings from the cash register by family staff members were recorded.

- The fit-out looked old and unattractive in parts, with some chairs unstable and broken and some parts of the worn carpet were simply taped over with gaffer tape.

- One of the staff was a qualified chef who had developed an innovative and popular range of rice wraps that were tasty, gourmet and healthy. None of the other cafés in the area offered these.

- No established process for dealing with injuries that happened at work.

- James gave a brochure about an innovative frozen par-bake cooking system that was under the limit set by council for an exhaust system, yet it cooked fresh bakery items in 30 minutes from frozen par-baked pastries.

- The computer with all the store’s employee details, and financial records was not password protected and anyone could access the information.

- James’s response to your question about the lack of sales promotion techniques was that he could not get the staff interested in the activity so he stopped trying to make it happen.

- The employee detail form requested information about the employee’s entire past health issues.

- The wage and superannuation records seemed to be incomplete, with many calculations being worked out by the number of hours worked multiplied by a set ‘in the hand’ amount.

- James also provided a brochure about a company that could come and set up WiFi in the café so that customers could use their computer notebooks and connect to the internet while they were dining in the café.

8. Submit the required documents for assessment as per the specifications below. Be sure to keep a copy for your records.

Specifications

You must provide:

- a risk review report, including a completed table of stakeholders

- email communication to stakeholders

- summary notes from your meeting with the CEO.

Your assessor will be looking for evidence of:

- reading skills to gather, review, interpret and analyse text-based business information from a range of sources

- written and oral communication skills to organise and deliver information to effectively communicate risk management processes to a range of stakeholders

- numeracy skills to interpret mathematical data when reviewing and analysing scenario business information

- ability to work independently as well as collaboratively to make decisions about risk management

- ability to interact with others using appropriate conventions when communicating to, and consulting with, stakeholders

- ability to sequence and schedule activities and manage communication

- ability to analyse relevant information to identify scope, goals and objectives and to evaluate options

- ability to use familiar digital technology to access information, document findings and communicate them to stakeholders.

Appendix 1: MacVille Pty Ltd simulated business

Background

As part of their overall strategy in the Australian beverage market, MacVille Pty Ltd have developed a chain of cafés in the Central Business District (CBD) of Brisbane, Queensland and the CBD of Sydney, NSW. The Board of Directors has made the decision to expand their operations in Queensland with the purchase and re-branding of the existing Hurley’s Café in Toowoomba, 130km west of Brisbane.

Ash is currently the Assistant Manager of MacVille’s flagship café in Queen Street, Brisbane, and has been given the

opportunity to manage the new store in Toowoomba. Ash is also a member of the Finance, Audit and Risk Management (FARM) Committee described in the MacVille Risk Management Policy.

The CEO for MacVille’s cafés in Queensland, Paula Kinski, has assigned Ash the task of managing the risks involved with the operational aspects of this takeover. A copy of her email is provided below.

Email from CEO Paula Kinski

From: CEO – P. Kinski

To: Assistant Manager – Queen Street

Re: New Toowoomba store

Congratulations on your new appointment. Prior to taking up your position as Manager of our new Toowoomba store, located in Ruthven Street, the Board of Directors has asked that the risks in this project be appropriately managed.

I want you to undertake this task as it will give you significant insight into the store’s operations, it will ensure a smooth transition for Hurley’s Café staff into the MacVille family and will encourage you to give ongoing support for our risk management initiatives.

I would like you to approach this task in three stages. After the first stage, we will meet to review your work and discuss your plans for the subsequent phases. The three stages in this risk management task will include:

- Review

- Analyse and plan.

- Monitor

Your primary risk management focus is directed to the ongoing operations of the Toowoomba café. The strategic and investment risks of this project are being managed by the Board. To this end, you are to consider any risks that could impact on human resources management, financial operations, WHS, our supply chain and the local governance and overall compliance issues.

MacVille has agreed to employ all existing staff at Hurley’s Café on three months’ probation. The current supervisor of Hurley’s, James Mansfield, has been offered the position of 2nd In Charge and he has accepted.

While settlement on the purchase of the business is not for another few weeks, the seller has agreed to grant us full access to the store’s operational processes and store information. You should liaise weekly with the Finance, Audit and Risk Management (FARM) Committee here at head office concerning the marketing, finance and store management functions that you are investigating. I will set up a regular meeting for you.

Head office has a report on a similar expansion conducted by the NSW team that may help you in your research. You may need to review other statistical information and engage specialists to help you with your investigation. The legal firm Goldsmith Partners are advising MacVille on the Hurley’sCafé acquisition and would be available to help you with legal or any compliance issues.

The landlord of the shop in Toowoomba, Ron Langford, is also a local councillor and has offered his assistance in getting established in Toowoomba. He has offered his availability for email address for correspondence.

When you have finished your report, please name it according to our document naming conventions and send it through. Once I have received and discussed your risk review report, we can move onto the next stage of the risk management process.

Regards

P.Kinski

CEO MacVille Cafés (Qld)

MacVille document naming convention

Files should be saved using the document name, the date and the document version. For example, a meeting agenda for a meeting on 1 March 2014 would be saved as ‘Meeting Agenda 01032014 v1’.

Site visit –New Toowoomba store (the existing Hurley’s Café)

You received permission from Paula to travel to the Toowoomba store to start your research. Paula had cleared it with James Mansfield, the current senior supervisor, who will spend most of the day with you helping answer your queries. She also arranged for you to spend time with Ron Langford, the store’s landlord.

Meeting with James Mansfield

You arrived at the café and noted the two hours of drive time that it took to get there from the CBD of Brisbane. You met with James, who took you through a complete overview of the store and the surrounding area. He was OK with the idea that you needed to take notes in preparation for a report.

After lunch, you went over your notes to revise and edit key concerns and significant events that you had written down earlier:

Notes from meeting with James Mansfield

- The location of the store on the corner of the two main streets of the city makes for easy access for local customers and high visibility for tourists.

- The long drive from Toowoomba to Brisbane would make attending the weekly managers meeting difficult considering many meetings did not finish until into the evening after refreshments. There are also manager training sessions that need to be completed over the next six months in with a few other assistant managers. Navigating the steep narrow climb up the range with trucks blocking the way is quite difficult even in daylight hours. Being a competent driver you feel that it would be unlikely that you would be involved in an accident, but it still concerns you considerably.

- The two-hour delivery time would make fresh pastry deliveries from the company’s central bakery plant impractical. The pastries would arrive after the morning rush. These are a key part of the MacVille product assortment.

- There is also a concern about getting the company-branded supplies through as quickly as a CBD Brisbane store could.

- Hurley’s Café was a family-run store and some family members were employed on the staff. James was engaged by the family to supervise the operations of the store and Mr Hurley as manager would authorise wages but anyone can authorise deliveries.

- When asked about written policy and procedures manual, James said that Mr Hurley set the policy and procedures verbally and on the few days each week he was in the store he would show the staff how to do things the way he wanted them done.

- Water use – Water wastage present; the dishwasher is often run when only half full; fruit and vegetables are washedunder a fast-running tap; toilets all use the single flush system; James explained that Mr Hurley instructed the staff to keep the non-native flowering plants in the courtyard fully watered.

- The dishwasher was always set to the full wash setting and has a Water Efficiency Labelling and Standards Scheme (WELS) rating of 3. The more water efficient 5–6 star dishwashers cost about $6,000 and above.

- Dual-flush system would cost about $7,500 to upgrade.

The store currently uses 41,500litres a week.

- James spoke about the café attracting a large percentage of retirees because of the easy access to buses and the store’s central location.

- The same staff member that completed the cash register balancing also completed the bank deposit form and did the banking as well. The banking was not done every day and often $4,000 was kept on the premises overnight in the cash register. There was no safe. There is a bank two shops away but the Hurley family bank is a couple of blocks away and there was not always time to do the banking.

- James replied to your question about the possibility of break-ins, saying that there was a 50% chance of it happening in a year and the consequence was moderate.

- Not all takings from the cash register by family staff members were recorded.

- The fit-out looked old and unattractive in parts, with some chairs unstable and broken and some parts of the worn carpet were simply taped over with gaffer tape.

- One of the staff was a qualified chef who had developed an innovative and popular range of rice wraps that were tasty, gourmet and healthy. None of the other cafés in the area offered these.

- No established process for dealing with injuries that happened at work.

- James gave a brochure about an innovative frozen par-bake cooking system that was under the limit set by council for an exhaust system, yet it cooked fresh bakery items in 30 minutes from frozen par-baked pastries.

- The computer with all the store’s employee details, and financial records was not password protected and anyone could access the information.

- James’s response to your question about the lack of sales promotion techniques was that he could not get the staff interested in the activity so he stopped trying to make it happen.

- The employee detail form requested information about the employee’s entire past health issues.

- The wage and superannuation records seemed to be incomplete, with many calculations being worked out by the number of hours worked multiplied by a set ‘in the hand’ amount.

- James also provided a brochure about a company that could come and set up WiFi in the café so that customers could use their computer notebooks and connect to the internet while they were dining in the café.

Meeting with Ron Langford

You met with Ron Langford in his office to discuss the café, council by-laws and aspects concerning the surrounding district. You took notes that included the following significant information.

Notes from meeting with Ron Langford

- Ron explained that there were opportunities for opening more cafés in the surrounding shopping centres like Wilsonton, Clifford Gardens and K-Mart Plaza.

- Ron handed you an extract from a government report, ‘Economic Brief’.

- Ron explained that the federal government was now introducing legislation that backs up the local by-law concerning efficient water usage, particularly by industries. The current by-law has fines of up to $50,000 for excessive water breaches. Ron did explain that the council was allowing some time to ‘make good’ under certain circumstances on a case-by-case basis. Ron also agreed with the idea of installing a water tank in the courtyard for the café to use and would help get it built.

- Ron explained that Toowoomba was obviously a place for retirees and the population was growing.

- Ron spoke about the federal government’s National Broadband Network being rolled out in

Toowoomba,which would allow efficient and effective video streaming and teleconferencing.

- Ron spoke about a current by-law that is due for implementation on the first of next month, which will allow cafés to expand their footpath dining and so put more tables and chairs outside their premises.

- Ron also spoke of the fact that representatives of a large international chain of coffee shops had been making enquiries around town about opening a store in the Toowoomba CBD.

Meetings with Senior Management Team and Finance, Audit and Risk Management (FARM) Committee

Soon after you returned from your research trip to the Toowoomba store, you attended two teleconferences.

First teleconference

First, you met with the senior management team. At this teleconference, you discussed issues raised by James Mansfield and Ron Langford and there port on previous NSW expansion, which head office had given you: Report into the acquisition and re-branding of the NSW expansion store. Paula said that there may be some things to learn from the NSW experience.

Key problems identified in the report were as follows:

- Lack of internal controls, particularly over cash handling, monitoring and recording.

- Failure to meet compliance standards in WHS, privacy and industrial relations law.

- Lack of written policy and procedures to guide staff in carrying out their duties.

- Lack of a professional business culture in the family run business.

- Failure of the business to monitor the external environment and find opportunities and threats to the business.

The team agreed that similar issues would pose a risk to the Toowoomba expansion.

Second teleconference

You then held a teleconference with the FARM Committee. At the teleconference, you relayed the concerns of the senior management team. The FARM Committee decided to allow you time to complete your review and then would include discussion of your review in the monthly Board of Directors meeting.

Appendix 2: MacVille Pty Ltd – Business plan (excerpt)

MacVille Pty Ltd

Business Plan

Mission

MacVilleCafés serve competitively priced, high quality coffee and gourmet food in a safe and comfortable café-style environment. Our friendly, well-trained staff provide superior customer service.

Vision

MacVille aims to deliver our valued customers the very best café-going experience. In three years, the business will have established a presence across the Queensland and NSW, with the opening of additional cafés.

Values

- customer-focus

- safety

- teamwork

- performance excellence.

Strategic directions

The strategic context in which MacVille will achieve its mission and vision is through:

- engaging with customers and customer research

- developing and improving products and quality

- expansion of operations across Queensland and NSW

- creating a high-performing organisation.

MacVille Pty Ltd: Risk management policy

Introduction

MacVille recognises that risk management is an essential component of good management practice and is committed to ensuring the implementation of risk management processes that focus on the proactive management of risks across the organisation.

This risk management policy forms part of MacVille’s internal controls and corporate governance arrangements. The risk management policy is designed to:

- identify, evaluate, control and manage risks

- ensure potential threats and opportunities are identified and managed

- inform directors, senior management and staff members about their roles, responsibilities and reporting procedures with regards to risk management

- ensure risk management is an integral part of planning at all levels of the organisation.

Policy

MacVille is committed to achieving its vision, business objectives and quality objectives by the proactive management of risk at all levels of the organisation.

MacVille will identify, evaluate, control and manage risk throughout the organisation in accordance with the ‘MacVille Risk Management Framework’. See risk management strategy for framework details.

Responsibility and Authority

Directors, management and employees of MacVille have responsibility for implementing aspects of this policy.

Role of the Directors

The Directors have a governance responsibility in the management of risk. This includes:

- determining which types of risk are acceptable and which are not

- setting the standards and expectations of staff with respect to conduct

- approving major decisions affecting MacVille’s risk profile or exposure

- monitoring the management of significant risks to reduce the likelihood of potential organisational risks and threats or failure

- being satisfied that risks are being actively managed, with the appropriate controls in place and working effectively

- annual review of MacVille’s approach to risk management and approval of changes or improvements to key elements of its processes and procedures.

Role of the Senior Management Team and Store Managers

Key roles of the senior management team are to:

- implement policies on risk management and internal control where this is deemed appropriate

- identify and evaluate areas of significant risks potentially faced by MacVille for consideration by the Directors

- identify areas where risk management is not adequately addressed and advise the Directors accordingly

- review and update the Risk Management Strategy

- undertake an annual review of the effectiveness of systems of internal control and provide an annual report to the Directors, including a summary review and respective recommendations.

Role of Café Employees

Key roles of employees are to:

- familiarise themselves with the content of the Risk Management Policy and clarify any aspects necessary with a senior team member

- consider any risks they feel could impact on them meeting their objectives and either manage the risk if it is in their control to do so, or inform a management team member of their concerns

- advise senior management, in the first instance, or the Board of Directors, if concerned about any fraud or unethical behaviour.

MacVille Risk Management Framework

This framework encompasses a number of elements that together facilitate an effective and efficient operation, enabling

MacVille to respond to a variety of operational, financial, commercial and strategic risks. These elements include:

- policies and procedures

- monthly reporting

- business planning and budgeting

- risk management review

- external audit.

Policies and procedures

A series of policies underpin the internal control process. These policies are endorsed by the directors and are implemented and communicated by the senior management team to all staff. These policies include:

- Human Resources Policies:

- Staff Travel Policy

- Harassment Policy

- WHS Policy

- Return to Work Policy

- Work–Life Balance Policy

- Equity/Discrimination/Diversity Policy

- Parental Leave Policy

- Organisational Culture Policy

- Financial Policies:

- Bad Debt Policy

- Cash Reserving Policy

- Revenue/Expenditure Recognition Policy

- Finance, Audit and Risk Management (FARM) Committee Terms of Reference, including delegations

- Corporate Governance Policies:

- Board Protocol

- Sitting Fees Policy

- Directors Remuneration Policy.

Monthly reporting

Decisions to rectify problems are made at regular meetings of the senior management team. Comprehensive reporting at Board and Sub-committee meetings is designed to monitor key risks and their controls.

Business planning and budgeting

The business planning and budgeting process is used to set objectives, agree on action plans, and allocate resources. Progress towards meeting business plan objectives is monitored regularly by the senior management team and by Directors at Board meetings.

Risk management review

The Finance, Audit and Risk Management (FARM) Committee is required to report at Board meetings on internal controls. The FARM Committee pays particular attention to risk management. It is the CEO’s responsibility to brief the Directors periodically and as appropriate on the development of policies and procedures to ensure effective and efficient operations, risk management strategies and implementation. In addition, the FARM Committee oversees internal audit, external audit and management as required in its review of internal controls. The committee is therefore well placed to provide advice to the Board on the effectiveness of the internal control system, including MacVille’s strategy for the management of risk.

External audit

The final audit of financial statements is controlled by an external chartered accountant who provides feedback to the Board through the FARM Committee.

Procedure: Development of a Risk Management Profile

The following outlines the process for developing a risk management profile.

1. Establish the context:

- Define and identify the environment, characteristics and stakeholders, their goals and objectives, and the scope of the specific risk management process.

- Develop criteria against which risks are evaluated and identify the structure for risk management.

2. Identify and describe risks:

- Risks are best identified through a collaborative approach involving a cross-section of stakeholders.

- All conceivable risks must be considered. Ensure any certainties are identified as problems and addressed in the risk management profile.

3. Conduct current risk analysis:

- An analysis of the risks is conducted to determine their causes, and estimate their probability and consequences.

- This analysis provides the basis for working on the ‘right’ risks.

4. Conduct risk evaluation:

- Risks are considered and prioritised according to their potential impact, and each risk is assessed to determine its level of acceptability.

5. Develop and implement proposed risk treatments:

- Risk treatments are developed to cost-effectively reduce, contain and control risk.

- Formal risk management reporting mechanisms are defined and documented.

- Categorise the risk likelihood.

6. Monitor, report, update and manage risks:

- As risks change constantly, the risk profile is continuously monitored, reviewed and updated by management. New risks may be identified as more information becomes available and existing risks may be eliminated through the effectiveness of the risk treatments/actions.

- Identified risks, and monitoring and management activities should be recorded and stored as follows:

- risks identified through regular audit should be recorded on the Risk Audit Log

- risk management activities should be recorded on the Risk Management Register.

MacVille’s Risk Areas

The following are four broad areas where potential for risk to MacVille has been identified. Under each area, examples of possible risks are detailed.

Operational/organisational:

- legal and regulatory compliance

- technology

- insurance

- resources: human, physical

- logistics

- marketing

- product quality

- communications

- infrastructure, plant and equipment

- customer interaction

- market needs.

Financial:

- accountability

- fraud or theft

- capital investment

- interest rates

- loss of income, funding/finance.

Governance:

- conduct of Board of Directors

- conflict of interest.

Project management:

- procedures and tools for project management

- stakeholders – strength of relationships/conflict of interest

- human resources

- financial resources.

MacVille Pty Ltd: Risk management strategy

Introduction

MacVille recognises that risk management is an essential component of good management practice and is committed to the proactive management of risks across the organisation. The strategy is designed to:

- identify, evaluate, control and manage risks

- ensure potential threats and opportunities are identified and managed

- inform directors, senior management and staff members about their roles, responsibilities and reporting procedures with regards to risk management

- ensure risk management is an integral part of planning at all levels of the organisation.

Guiding Principles

- MacVille is committed to achieving its vision, business objectives and quality objectives by the proactive management of risk at all levels of the organisation, acknowledging that embracing innovative ideas and practices carries with it risks, but that these are identifiable and measurable and therefore capable of being subject to realistic risk mitigation processes.

Responsibility and Authority

- The Board of Directors have responsibility for ensuring that risk management is in place.

- The Finance, Audit and Risk Management (FARM) Committee has the responsibility of reviewing the Risk Management Action Plan on a six-monthly basis.

- The CEO and the senior management team have responsibility for managing risk and advising the Board on appropriate controls.

- The CEO and the senior management team support and implement policies approved by the directors.

- Key risk indicators will be identified, closely monitored and action taken where necessary, by the staff and directors.

MacVille Risk Management Framework

This framework encompasses a number of elements that together facilitate an effective and efficient operation, enabling

MacVille to respond to a variety of operational, financial, commercial and strategic risks. These elements include:

- Policies and procedures: A series of policies underpin the internal control process.

- Reporting: Decisions to rectify problems are made at regular meetings of the senior management team.

- Business planning and budgeting: The business planning and budgeting process is used to set objectives, agree on action plans and allocate resources. Progress towards meeting business plan objectives is monitored regularly by the senior management team and by directors at Board meetings. Contingency planning is undertaken as required.

- Risk management review: The FARM Committee is required to report at Board meetings on internal controls.

- CEO: The CEO has responsibility to brief the Directors periodically and as appropriate on the development of policies and procedures to ensure effective and efficient operations, risk management strategies and implementation.

- External audit: The final audit of financial statements is controlled by an external chartered accountant who provides feedback to the Board through the FARM Committee.

Definitions

Risks are identified on a scale of likelihood of occurring in the next 12 months and assigning an impact or consequence to the risk as high, medium or low. High includes either a significant shortfall of around 40% in achieving budget or a significant reduction in ability to function. Medium includes either a shortfall of budget of between 10% and 20% or some reduction in function. Low indicates minor reductions in achieving budget or minimal reduction in performance.

Appendix 3: Table of stakeholders template

|

Stakeholder |

Internal/external |

Role in process |

Stake in process |

|

General manager |

Internal |

How much to pay for workers |

Salary have to pay follow the laws |

|

Officer of WHS |

Internal/External |

Check Safe at work policies |

Check possible risks for work |

|

Employee |

Internal |

Review fair work and trading |

Review health work safety |

|

Government |

Internal/ External |

Check legal workers |

Check illegal workers |

|

Customers |

External |

Review food and customer safety |

Check customer’s benefit |

Task 2: Analyse and Treat Risk

Performance objective

For this task you are to analyse the risks you identified in the simulated business scenario to assess the likelihood and consequence of risks, evaluate and prioritise risks, and determine options for treatment. You are also required to develop a risk management action plan for the treatment of risks and communicate it to relevant stakeholders.

Assessment description

For the MacVille Pty Ltd simulated business scenario provided, you are required to assume the role of Brisbane store Assistant Manager, Ash, who has just been promoted to be Manager of a new store. Ash has been tasked with conducting a risk management analysis of this new venture.

There are three stages to this project: (1) review, (2) analyse and plan, and (3) monitor. This project is divided into three assessment tasks as follows:

For this task, you are to use the information you gathered in Assessment Task 1, along with the simulated business information provided, to examine the likelihood and consequence of identified risks, prioritise the risks and determine options for treatment of each risk. Using this information you are required to develop a risk management action plan for implementing risk treatment, document the plan as required, and communicate the risk management plan to relevant parties.

Procedure

Part A

1. Review the MacVille simulated business scenario information and documentation provided in the Appendices of this task and in Assessment Task 1.

MacVille Pty Ltd have developed a chain of cafés in the Central Business District (CBD) of Brisbane, Queensland and the CBD of Sydney, NSW. The Board of Directors has made the decision to expand their operations in Queensland with the purchase and re-branding of the existing Hurley’s Café in Toowoomba, 130km west of Brisbane.

There is an email from CEO to ask for how to manage the risks in the project. The primary risk is directed to ongoing operations of Toowoomba café.

MacVille has agreed to employ all existing staff at Hurley’s Café on three months’ probation.

While settlement on the purchase of the business is not for another few weeks, the seller has agreed to grant us full access to the store’s operational processes and store information.

MacVille documents :

+ Site visit –New Toowoomba store (the existing Hurley’s Café)

+ Meeting with James Mansfield:

- There is also a concern about getting the company-branded supplies through as quickly as a CBD Brisbane store could.

- Hurley’s Café was a family-run store and some family members were employed on the staff. James manage to pay wages to staffs.

- Set up the policy and procedure

- Water use

- Need at least 1 qualified chef

- No established process for dealing with injuries that happened at work

The computer with all the store’s employee details, and financial records was not password protected and anyone could access the information.

- Employee’s health

- Set up wi-fi for customers and staffs

2. Develop a report for the CEO (your assessor) that includes the following:

- For each risk (i.e. the four identified in the scenario for this task), assess the likelihood of the risk occurring.

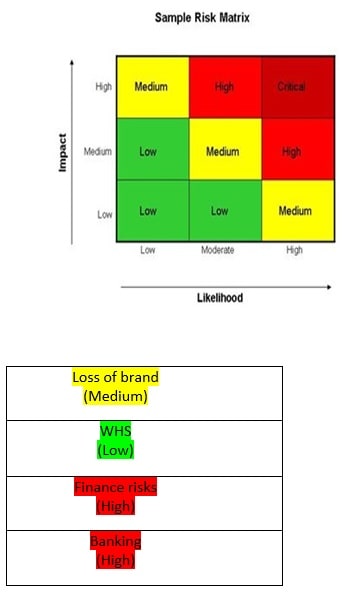

- Loss of brand: I think about 30% happening if we don’t manage operation well

- WHS: 100% very important to protect risks of machine and employees as well

- Banking: 70% could be happen if we don’t have good plans , good position, do more research to ask for customer’s favourite to attract them

- Compliance: 100% compulsory to bring the best quality

- For each risk, assess the consequence of the risk occurring.

- Suffering losses too much could lead to bankrupt then the branch will be closed.

- WHS plays an important role in decrease cash compensation for company and protect employees if there is any accident happen

- If Loss of capital happens for long time could lead to bankrupt

- No compliance, the company can run well. Arrangement is important to manage employees

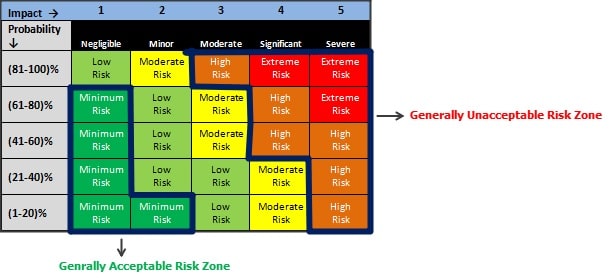

- Develop a risk matrix to assist in prioritising the treatment of the identified risks, including numerical values (e.g. risk matrix in the Student Workbook).

- Once you have prioritised the risks, for each, outline at least two suitable options for treatment.

- there is a highly effective strategy, as internal staff know the organisation in detail, have an established working relationship with stakeholder groups and often have a good idea of the risks that will be brought up.

- as an extra resource a consultant can do tasks that a client organisation knows how to do itself, but does not have the staff to accomplish, e.g. organising stakeholder meetings, drafting documents and conducting interviews with clients.

- providing a neutral perspective that can be used to manage discussion and debate without any bias or favour.

- Include an explanation of the process you used to identify risks and assess likelihood, consequence and priority. Also include an explanation of why the options you have suggested for treating the risks are:

- likely to be effective: Employees are essential parts of company. If as many good employees as possible hundred percent that company run very well.

- feasible for the organisation: Do more survey to ask customers for what they like, how they are satisfied with our service, and what they are respecting.

Note: Ensure your report is written in a style appropriate to your stakeholder audience, for example, using appropriate language and including appropriate illustrative material (such as checklists, diagrams or flow charts) and attachments to support your findings and process.

3. Develop an action plan(you may use the Risk Management Action Plan template provided in Appendix 3 of this task)for implementing risk treatment and attach it to your report.

4. Communicate your analysis to the Board of Directors by submitting your risk analysis report, along with your risk management plan, to the CEO (your assessor) for internal distribution.

20/11/2017

From: Kim

To: Daniel

Subject: Risk analysis and manage plan

Dear Daniel,

I write this email to give some ideas about our risks. This is likely to be effective to minimize losses. We can focus on established working relationship with stakeholder groups and accept good ideas from supervisors. Beside we have to make an excellent project to expand our business: how to manage it, how much for investment, when it happening.

I think we should have a meetings on next Monday to talk more about this.

Regard,

Kim

Part B

1. Implement your risk management treatment of one key risk, such as decreased brand recognition, in accordance with the requirements provided to you by the CEO (your assessor). You will need to discuss and agree with your assessor how to provide evidence of your implementation.

Risk treatment is the process of identifying, assessing, controlling threats to an organization's capital and earnings and monitoring. These threats, or risks, could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors. Manage risks could do by check list, policy, communication, etc.

Besides legislation is also essential in manage risks.

+ WHS

+ Fair and Trading Act 1987

+ Fair Trading Regulation 2012

2. Submit the required documents for assessment as per the specifications below. Be sure to keep a copy for your records.

Specifications

You must:

- submit a risk analysis report, including a risk matrix

- submit a completed risk management action plan

- implement one risk treatment and submit evidence as agreed with your assessor.

Your assessor will be looking for evidence of:

- reading skills to gather, review, interpret and analyse text-based business information from a range of sources in order to evaluate risk

- written skills to organise and deliver information to effectively communicate risk management analysis and plan to a range of stakeholders

- numeracy skills to interpret mathematical data when reviewing and analysing scenario business information and evaluating risks and treatment options

- ability to work independently to evaluate risks and make decisions about treatment options

- ability to interact with others using appropriate conventions when communicating to, and consulting with, stakeholders

- ability to sequence and schedule activities and manage communication

- ability to analyse relevant information to identify and evaluate treatment options

- ability to use familiar digital technology to access information, document findings and communicate them to stakeholders.

Appendix 1 – Scenario – MacVille Pty Ltd simulated business

Background

The MacVille Board has reviewed the previous report you developed, and has requested further information for four of the identified risks, including options for reducing the risk levels. These risks are as follows:

- Banking risk – theft of cash left on premises.

- Manager’s travel risk –physical injury.

- By-law compliance risk –reputation/brand loss and fines

- Loss of brand recognition risk – brand non-compliance of staff not wearing the MacVille uniform, or altering MacVille processes and service expectations.

Timelines to consider are based on risk priority levels and include the following:

- Pre-settlement – date of legal transfer of the business.

- Opening week – first week of company operations.

- Within three months – after the opening week.

- Within six months – after the opening week.

Responsibilities for actions include the following.

- Financial, insurance and banking issues – Financial Controller.

- Legal issues – Goldsmith Partners.

- Expenditure >$5,000 – MacVille Board of Directors.

- New policy – CEO with MacVille Board of Directors.

- On-site management, training – Store Manager.

- Changes to MacVille Café Queensland operations – CEO.

- External audits – CEO with MacVille Board of Directors.

Develop a report for the Board of Directors that examines these risks and describes ways that each can be treated, and forward a copy of your report to the CEO to table at the next Board meeting.

Appendix 2: Revised notes from previous meetings

Site visit – New Toowoomba store (the existing Hurley’s Café)

Meeting with James Mansfield

You revise your notes from the meeting with James Mansfield and identify the following points.

- In the context of MacVille’s investment here, $4,000 would be considered to be of minor consequence if it were burgled from the closed premises overnight.

- One or two of the staff at Hurley’s pride themselves on being on-trend and well-dressed; they are going to struggle with being required to wear a MacVille uniform. It will be difficult to make them comply with the uniform requirement. The rest of the staff are generally very responsive to employment requirements. The consequence of initial non-compliance would be minor.

Meeting with Ron Langford

You revise your notes from the meeting with Ron Langford and identify the following points.

- He also said that the Toowoomba Council water patrols meant that it is likely that stores not complying with the by-law would be discovered.

Senior management team meeting

You go back over your notes compiled with the senior management team and note the following.

- Further feedback from Paula included that the water compliance risk was one where significant time and resources would be required and the Board would view it having moderate consequences for MacVille’s cafés in Queensland. She also indicated that while the Board views the risk of a serious accident unlikely, any potential risk that could result in the death of an employee would have a catastrophic consequence.

Brainstorming ideas

Looking at the hierarchy of control, the senior management team were able to give you some good brainstorming ideas to pursue. These include the following.

- Installing native plants to cut down water use.

- Making it a company policy to bank every day and eliminate the need to carry overnight.

- Install a teleconferencing system.

- Install a water tank and reduce dependence on council water.

- Change banks to the nearer one to avoid the long walk.

- Install dual-flush toilets.

- Insure overnight cash holdings.

- Finish management meetings at 3.00pm.

- Introduce new processes on water use and conservation.

- Change assistant manager training times to the morning.

- Write new policy and procedures for water use in Toowoomba.

- Install a water-usage graph in the staff room.

- Give the manager an excusal letter allowing them to leave any meeting at no later than 3.00pm every day.

- Replace the dishwasher with one that has a 5–6 star (WELS) rating.

Have Goldsmith Partners apply for time to ‘make good’.

Appendix 3: Risk Management Action Plan Template

|

Assess |

Action | |||||

|

risk |

priority | |||||

|

Risk |

(score) |

Controls |

Monitoring |

(1–5) |

Timelines |

Responsible |

|

Loss of brand |

30% |

By advertisement By sign more contract with other company |

Operation manager |

Medium |

30/10/2017 |

Marketing supervisor |

|

Financial risk |

30% |

Check economy’s report regularly Do research cheaper supplier |

Accountant manager |

High |

Every month |

Accounting department |

|

WHS |

100% |

Provide good working environment Buy insurance for all employees |

Human resources manager |

High |

30/12/2017 |

Accounting department |

|

Banking |

40% |

Report profit/ losses Find good suppliers |

Director manager |

Every month |

Accounting department |

Task 3: Monitor Risk and Evaluate Processes

Performance objective

For this task you are required to review the implementation of the risk management action plan you developed in Assessment Task 2 and prepare a monitoring report.

Assessment description

For the MacVille Pty Ltd simulated business scenario provided, you are required to assume the role of Brisbane store Assistant Manager, Ash, who has just been promoted to be Manager of a new store. Ash has been tasked with conducting a risk management analysis of this new venture.

There are three stages to this project: (1) review, (2) analyse and plan, and (3) monitor. This project is divided into three assessment tasks as follows:

For this task, you are to review the implementation of the risk management action plan you developed in Assessment Task 2 against the simulated business information provided in this task. Then, you will need to prepare a monitoring report evaluating the outcomes of the action plan and risk management process.

Procedure

1. Review the MacVille simulated business scenario information provided in the Appendix of this task.

MacVille Pty Ltd have developed a chain of cafés in the Central Business District (CBD) of Brisbane, Queensland and the CBD of Sydney, NSW. The Board of Directors has made the decision to expand their operations in Queensland with the purchase and re-branding of the existing Hurley’s Café in Toowoomba, 130km west of Brisbane.

There is an email from CEO to ask for how to manage the risks in the project. The primary risk is directed to ongoing operations of Toowoomba café.

2. Develop a report for the CEO (your assessor), which examines the ongoing implementation of the risk management action plan.

- Ensure you include the following sections in your report:

- Plan –a clear summary of the initial risk and the plan implemented to manage it.

- Implementation– a summary of all actions taken to date in attempting to manage identified risks

Answer for I and ii:

There are 4 risks that i mention before:

+ Loss of brand

+ WHS

+ Financial risks

+ Banking

Risks can happen at any time. This happen because there are many competitors, new born brand, capital is not enough to suffer in the losses time. What we need to do at the moment that is try to look for more contracts, expand brand, improve quality of product, do more things to interesting customers.

Managing employees are also important to keep business run well. Everything has to do compliantly. Choosing experienced staffs help much for company.

- Outcomes –a clear statement identifying continued and/or reduced risks, with supporting information in tables or graphs where available.

Loss of brand

By expand more brands which is trustworthy to customers

WHS

Buy insurance for all employees

Financial risks

Hire good managers and enthusiastic employees

Banking

Pay and control well where money go

- Evaluation –a clear analysis of the effectiveness of the risk management plan, including risk assessment (e.g. risk matrix), by comparing the implementation with the outcomes.

Note: Ensure your report is written in a style appropriate to your stakeholder audience, for example, using appropriate language and including appropriate illustrative material (such as checklists, diagrams or flow charts) and attachments to support your findings and process.

3. Submit the required documents for assessment as per the specifications below. Be sure to keep a copy for your records.

Specifications

You must provide:

- a monitoring report.

Your assessor will be looking for:

- reading skills to review, interpret and analyse text-based business information from a range of sources in order to evaluate effectiveness of risk management implementation

- written skills to organise and deliver information to effectively communicate evaluation of activities to stakeholders

- numeracy skills to interpret mathematical data when reviewing and evaluating scenario business information effectiveness of activities

- ability to work independently to analyse scenario information and evaluate effectiveness of activities

- ability to interact with others using appropriate conventions when communicating to, and consulting with, stakeholders

- ability to sequence and schedule activities and manage communication

- ability to analyse relevant information to identify and evaluate effectiveness of activities

- ability to use familiar digital technology to access information, document findings and communicate them to stakeholders.

Appendix: Scenario – MacVille Pty Ltd simulated business

Implementation information

It has now been six months since you delivered your risk management action plan.

In accordance with the action plan, an external audit was completed and has been presented to the MacVille Board. The audit investigated the status of the planned actions on the risks identified.

A summary of the findings

- The financial controller had taken out $5,000 on insurance cover for cash held on the premises overnight from the launch week as planned.

- The company bank account that was planned to be opened in the first week was actually opened about four weeks after the café’s launch at the bank two doors down the street. As it is not MacVille’s regular bank, there are difficulties with getting the same level of service that MacVille stores receive in Brisbane.

- The teleconferencing system, planned for six months after launch, has not yet been installed, due in part to the delay in the rollout of the federal government’s National Broadband Network.

- The weekly management meetings are finishing close to 3.00pm as planned but sometimes the manager has to stay on at the request of the head office team. The manager has not yet been issued with an excusal letter by the CEO as agreed, and feels that they do not have the authority to just walk out at 3.00pm.

- The assistant manager training has been shifted to the mornings, allowing the manager to leave before 1.00 pm as planned.

- The Board of Directors and CEO included a new policy regarding compliance with the Toowoomba by-law on water conservation as planned, but the specific procedure has not yet been written. However, it appears that compliance is being achieved.

- The plants have been changed to natives that require minimal water as planned. The installation of dual-flush toilets were planned for completion six months after settlement, and although the dual-flush toilets have been ordered and are in stock, they cannot be installed due to the backlog of work by district plumbers. The five-star rated (WELS) dishwasher was installed by the supplier within the six-month timetableas planned.

- The application to ‘make good’ by Goldsmith Partners on behalf of MacVille was accepted by the Toowoomba City Council; however, the grace period to comply with by-law ends in 14 days and the store is still above the acceptable benchmark for water use.

- The training on daily banking appears to have been successfully completed as planned. An audit of the bank deposit book shows that there is no banking entry for the day’s sales on only two occasions in the past six months.

- There has been one internal audit arranged by the store and, as planned, there should have been a call every two months. The store manager cites the distance that auditors have to travel and their overloaded work with the Brisbane stores as the reason for this infrequency.

- Although the training on the water-saving processes, as directed by the policy, has been verbally explained and followed, the written procedure has not been completed as the assistant manager (James Mansfield) claims to be too busy.

- A water tank had been built in to the courtyard but the plumbing has not yet been connected. There is a weekly water-usage monitor in the staff room as planned but the information has not been updated for the past three weeks.

- All the original staff members are wearing the MacVille uniform. However, these original employees are now responsible for directly supervising new employees. The original staff members are not explaining the uniform requirements to new employees and are not delivering any warnings for uniform non-compliance. As a result, there has been an increase in uniform non-compliance.