Progressive tax regressive tax

Progressive Taxes

A progressive tax is a tax which takes a larger percentage from high-income earners than it does from low-income individuals; this means a person who is earning more will have a higher average tax rate. It is based on the concept of ability to pay. A progressive tax is one of many systems used by governments raise revenue.

The main idea of a progressive taxis controversial. Supporters of a progressive tax argue that people with higher incomes can more easily afford a higher tax burden and opponents tend to believe that it punishes high earners for their success and eliminates monetary incentives for workers who want to increase their income level. Progressive generally refers to the way in which tax rate moves from low to high. They reduce the burden of incidence of taxes that have a lower ability to pay and people bear the burden of taxation having higher ability o pay. This type of taxation also overcomes societal issues and deals with income inequality.

Tax rate increases with increase in income. Thus, high income and high net worth individuals are being taxed a larger amount overall. These higher taxes are in the form of other taxes such as a luxury tax or an estate tax.

Advantages of Progressive Taxes

- INCOME EQUALITY: A progressive tax system acts as a mechanism for redistribution of wealth from the higher-income to lower and middle-income households. This, in turn, lessens the gap between the wealthy and poor.

- SOCIAL JUSTICE: Some people believe that people with higher incomes should pay more taxes, and those who earn less should receive assistance from the government. In this type of society, progressive taxes help. A progressive tax system creates a government that provides assistance to those who need it which gives everyone a chance to pursue their dreams to the best of their abilities.

- INCREASE IN GOVERNMENT REVENUE: A progressive tax system enables the government for a collection of larger overall tax revenue from high-income earners and this higher amount of government revenue is to be used for more public services that will benefit the community as a whole.

Disadvantages of Progressive Taxes

- DISCRIMINATORY: If higher income earners are taxed and their funds get redistributed to the lower income individuals, this removes the incentive for lower-skilled workers to improve themselves in work and become more valuable workers. It also removes the incentive for high-income workers to be productive and creative because they might feel like being punished for their hard work with higher taxes. This makes the economy less productive overall.

- TAX EVASION: High-income earners may not reveal their overall income transparently and hiding of assets is also one factor which can be seen in the case of progressive taxation.

Regressive Taxes

A regressive tax is a tax which takes a larger percentage of income from low-income earners than from high-income earners. It is the opposite of a progressive tax. A regressive tax is generally a tax that applies uniformly to all situations, regardless of the payer. This means as income increases, the proportion of the income paid in tax decreases.

Regressive taxes affect the people with low incomes more severely than people with high incomes. Mostly, income tax systems employ a progressive tax system, while other types of taxes are uniformly applied. Examples of regressive taxes are sales taxes, user fees, excise duty etc.

Here, relatively a heavier burden (sacrifice involved) tends to fall upon the poor than on the rich. A regressive tax takes away a greater percentage of lower incomes as compared to higher incomes.

Advantages of Regressive Taxes

- EFFICIENT: These taxes are non-distortionary and they do not affect the economic behavior of the individuals.

- BALANCE: Parts of the tax system are highly progressive like income tax. Therefore, some regressive taxes will not cause extreme inequality because they will counter-balance the progressive taxes.

- CURB CONSUMPTION: Taxes on cigarettes and alcohol are meant to have an impact on behavior, and these taxes, together with the sales tax, try to curb consumption of these goods and services. Also, regressive taxes can be used to urge people to avoid dangerous behaviors but encourage savings.

Disadvantages of Regressive Taxes

- STRATIFICATION: Regressive taxes often encourage the stratification of society, which weakens the middle class.

- UNFAIR: The economic hardship falls upon the lower and middle class and they bear the burden of taxation. Regressive taxes hinge on the importance to maintain a strong middle class.

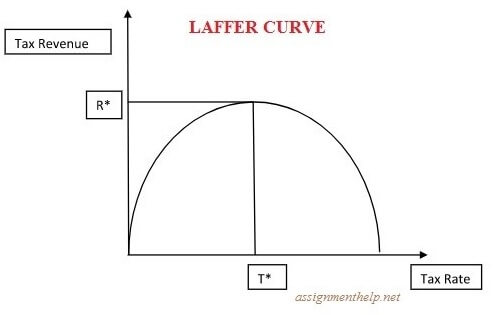

LAFFER CURVE

This curve is a graphical representation of the relationship between tax rates and tax revenues. This curve suggests that the revenues will decline after a certain tax rate.

The horizontal axis shows the tax rate and the vertical axis shows the revenue collected from taxes which go to the government. This curve shows the trade-off which government needs to decide between tax rate and tax revenue. The Laffer curve depicts two types of relationship. First, arithmetic i.e. when the tax rate increases, more revenue will be collected but this happens only till the peak tax rate which maximizes the revenue (T*). Second, economic i.e. tax rates increasing after a certain point (T*) would cause people not to work as hard or not at all because of no incentive is left to work thereby reducing tax revenue. Eventually, if tax rates reached 100%, shown to the far right on this curve, all people would choose not to work because everything they earn will go to the government and nothing will be left with them. Thus, 0% tax rate and 100% generates no revenue at all. The economic effects recognize the positive impact of lower tax rates on work, output, and employment because it provides incentives to increase these activities. However, higher tax rates penalize people for engaging in these activities.

Thus, Laffer curve does not say whether a tax cut will raise or lower revenues, nor it says that any and all tax rate reductions would necessarily bring in total revenues but it tells us that tax rate reductions will always result in a smaller loss in revenues. This means that the higher the starting tax rate, the more effect it will have on the supply-side stimulus. It can be concluded that tax rate cuts will generate growth, jobs, and income for all which is desirable for the economy.

Therefore, the government needs to know that optimal tax rate (T*) which will maximize the revenue and also people will continue to work hard.

Automatic Stabilizers in Economies

Automatic stabilizers describe the way in which fiscal instruments influence the rate of growth and help counter the fluctuations in any economic cycles. These are economic policies and programs which are designed to offset swings in a country’s economic activity without governmental intervention or policymakers on an individual basis because they govern and affect the economic behavior of the country. Some of the automatic stabilizers are corporate and personal taxes, and transfer systems like unemployment insurance and welfare.

Automatic stabilizers are popularly known as this because they stabilize the economic cycles and automatically triggers without explicit government action. An automatic stabilizer represents the tax and transfer systems which temper when there is overheating in an economy i.e. booms or recessions and provides economic solutions and decision-making process when the economy slumps without any direct intervention by policymakers.

Through an increase in transfer payments and reduced taxes, automatic stabilizers provide significant economic stimulus during and in the aftermath of any recession, which thus helps to strengthen other economic activity.

How do Automatic Stabilizers Work in an Economy?

If a country takes an economic downturn and the number of people unemployed increases then more people file for unemployment benefits and other welfare measures, which thus increases government spending and aggregate demand. Also, the government revenue is falling because those who are unemployed are paying less tax as they are not earning any wage. Due to all this, the budget deficit increases. The deficit spending is used as a measure to boost economic activity so that the economy recovers and the government is able to recuperate the funds through increased employment and higher productivity.

Similarly, the budget deficit decreases during booms, thus making a fall in the aggregate demand. This happens because people are earning more wages during booms which enable the government to collect more taxes. Also, fewer individuals demand social services support during a boom. The decrease in spending lead to a decrease in the aggregate demand too. Therefore, automatic stabilizers try to manage and reduce the size of the fluctuations of the GDP of a country.

Examples of Automatic Stabilizers

- PROGRESSIVE TAXES: This tax increases as the income of a person increases which eventually helps to control spending because as people’s income grows, their spending will be limited due to their increased tax rate. With higher growth, the government receives more tax revenues because people are earning more and thus paying more income tax.

- TRANSFER PAYMENT: This payment is received by a person whose funds come from the by taxes that other people pay. A person’s eligibility to receive these payments depends on his income and thus helps in maintaining stability in the business cycle and prevents extreme fluctuations from occurring.

- UNEMPLOYMENT BENEFITS: This is the money that unemployed people receives a certain amount of time when they keep looking for another job. As unemployment rises, more people have access to this and it helps in preventing a lot of people from going into poverty. This increase in benefit spending and lower tax helps to limit the fall in aggregate demand and the economy goes into a recession. However, automatic stabilizers help to limit the fall in growth.