Money Supply Assignment Help

What is Money: Definition of Money

There are two approaches in literature for defining money:

1. A priori or theoretical approach: Money is first conceptualised in terms of specific functional and institutional attributes and then corresponding measures of money is obtained by aggregating relevant financial assets possessing those specified attributes.

2. Empirical Approach: It does on rely on any preconceived notion of money. Instead it directly arrives at a measure of money as an aggregate of financial assets which, when introduced, in certain functions, gives the best result in terms of specified criteria. E.g. for Monetarists such as Friedman, money is best measured as that sum of liquid financial assets which has the highest correlation with national income and a stable demand function.

The theoretical approach has a greater analytical appeal while the empirical approach is used to test adequacy of concepts.

Functions of Money

Money came into existence to overcome the problems of a barter economy. In order to facilitate a barter exchange, the double coincidence of wants must be satisfied. Barter is very expensive in terms of time and energy spent in locating the ‘right’ exchange partner. Thus barter system restricts the number of exchanges and also introduces inefficiency in allocation of resources in an economy.

One person must search for another exchange partner who has exactly what he wants such that the second person would also want what the first person has in exchange for what he has. Also he must have as much of the second thing as much the first thing is worth, keeping in mind that goods have a certain indivisibility.

Money as a medium of exchange

- Money as a medium of exchange facilitates exchange of goods and services in an economy.

- Exchange of goods and services becomes cheaper in terms of time and energy spent in searching for the correct exchange partner.

- This broadens the scope of exchange with greater efficiency in allocation of resources and production possibilities in an economy.

Money Supply Assignment Help By Online Tutoring and Guided Sessions at AssignmentHelp.Net

For any commodity to be called as money its intrinsic value is not important. All that matters is that it should be generally acceptable in exchange.

Money as a unit of Account

In a barter economy the relative price structure will have rates of exchange between an item and everything else it can be exchanged for. Thus for n commodities, there would be n(n-1)/2 different relative price ratios for which exchange can be made between two different goods.

Instead if an intermediate good such as money is introduced, prices of all goods and services can be expressed in terms of money as a unit of account. Thus for n commodities, there would only be n price tags. Thus money becomes a useful denominator for accounting by facilitating exchange.

Money as a Store of Value

In absence of money, people will have to save in hundreds of commodities which will be inefficient because of cost of storage, transportation and possible damage. Instead money can be efficiently used to transfer current income for use in future date for as long as possible.

However, it would not be entirely costless. When price level rises, purchasing power of money will be diminished. Also there can be other assets that can serve as a better store of value by earning higher interest to holders and in fact give greater returns even when price level is not changing.

Determination of Money Supply

Till 1960s Money Supply was treated as a policy variable determined by monetary authorities.

In developing countries and EMEs, there are two main approaches for money stock determination:

- the money multiplier approach

- the balance sheet or structural approach.

The money multiplier approach focuses on the relationship between the money stock and the reserve money.

The structural approach favours analysis of individual terms in the balance sheet of the consolidated monetary sector to explain variations in money stock.

Money Multiplier Approach

- In its simplest form money multiplier approach is

- M = m H

- Where M = nominal money stock

- m = money multiplier

- H = nominal reserve money

- The reserve money (H) is also called the monetary base or high powered money.

Thus money stock is simply a multiple of the reserve money. If money multiplier is a constant then variations in money supply are caused entirely by changes in reserve money.

A more general version of this approach is M = m(.) H

Where money multiplier is not a constant but a function of some other variables. Thus money stock is determined by

- Variables that affect the reserve money

- Variables that affect the money multiplier

Reserve Money

The reserve money is the total of existing assets, which either are, or potentially could be, used as reserves by the banking sector, H = C + R

Where C is the currency held by the general public

R = Bank reserves.

The reserve money is also called the monetary base or the high powered money as an increase in reserve money has potential to bring about a multiple increase in bank deposits and hence money supply.

Sources of Change in Reserve Money

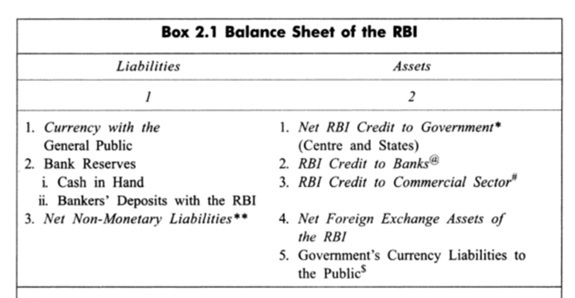

Reserve money can also be looked at as Net Monetary Liabilities of the central bank. These liabilities are created in the process of generating matching assets by the central bank. Thus central bank’s balance sheet can be examined to analyse the sources of change in reserve money.

Reserve money is the net monetary liabilities of the central bank: Currency with public and banks’ reserves.

Itemised:

- Net RBI credit to Government: Net of government Deposits. Includes RBI holding of T-bills and ad hocs, dated securities of Central Government rupee coins and advances to state governments

- RBI credit to Banks: Credit to commercial and cooperative banks by the way of accommodation against government securities, usance bills, promissory notes and through purchase and rediscounting of bills.

- RBI’s credit to commercial sector : Loans and advances in investment in shares/bonds of NBFIs such as NABARD, IDBI, and internal bills purchased and discounted

Note: RBI is the sole agency issuing rupee coins and small coins to public on behalf of government

Non-Monetary liabilities

Capital and reserves of RBI, profits of RBI temporarily held, IMF account No 1, Compulsory deposit scheme deposits, National funds maintained by RBI, banks’ borrowings from abroad etc net of other assets such as buildings.

- Reserve Money =

- Net RBI credit to Government

- + RBI Credit to banks

- + RBI credit to commercial sector

- + Net Foreign Exchange Assets of RBI

- + Government’s Currency Liabilities of RBI