Techniques Of Evaluating A Project Assignment Help

5.3 Techniques of Evaluating a Project

5.3.1 Payback Period

This is the expected number of years needed to recover the cost of investment in a project based on net after-tax cash flows from the project.

The main drawback of payback period is that it does not take into account any cash flows after the payback period and thus also ignores the salvage value of any asset purchased as a part of the project. Thus payback as a measure is profitability is not very much popular. Payback period also does not consider the time value of money, that it gives equal weight to all cash flows before the payback period and does not discount them.

Payback as a technique of evaluation is good if we want to gauge the liquidity of the project. This technique gives us a better idea as to when the project is going to generate the amount initially invested in it. Thus it is more useful to firms who are faced with liquidity problems and face shortage of capital.

In order to use the payback rule effectively, a firm has to decide on an appropriate cut off date. If it uses the same cut off regardless of project life, it will tend to accept many poor short-lived projects and reject many good long-lived ones.

Example:

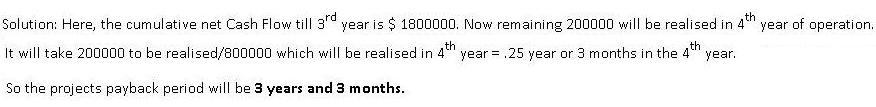

The cost of a project is $ 2000000 and the following cash flows are anticipated:

Year Net Cash Flow

1) 300000

2) 700000

3) 800000

4) 800000

5) 350000

Techniques Of Evaluating A Project Assignment Help By Online Tutoring and Guided Sessions from AssignmentHelp.Net

5.3.2 Discounted payback period

This is a similar concept to the payback period but it is based on the time taken to recover the investment based on discounted cash flows, so the cash flows need to be discounted to their present value. The discount rate used is the project’s cost of capital.

Example:

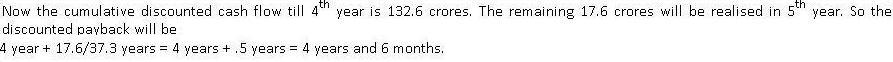

The cost of a project is $ 150 crores and the following cash flows are anticipated. The cost of capital is 10%.

Year Net Cash Flow Discounted Cash Flow

1) 25 22.7

2) 50 41.3

3) 55 41.3

4) 40 27.3

5) 60 37.3

5.3.3 Average Accounting rate of return

The average accounting rate of return is defined as the ratio of project's average net income to its average book value.

Average Accounting rate of return = Average Net Income

Average Book Value

The main advantage of AAR is that it is very easy to calculate and understand. However it also suffers from some disadvantages like- it does not discount the cash flows so it’s not a good measure of profitability and further it takes in to account book profits or accounting profits not the after tax cash flows thereby breaking one of the very basic principles of capital budgeting evaluation techniques.

Because of the above mentioned limitations AAR is not very much popular among companies as a measure of evaluating Capital Budgeting decisions.

Email Based Assignment Help in Techniques Of Evaluating A Project

Following are some of the topics in Capital Budgeting in which we provide help:

Corporate Finance Homework Help | Finance Assignment Help | Finance Assignment Help | Finance Homework Help | Finance Online Help | Finance Problems Help | Finance Tutor | Help With Finance Homework | Online Tutoring