Practice assignment financial accounting

Practice Assignment #1

Section III

FINANCIAL ACCOUNTING

Please read the directions preceding each section carefully before answering the questions.

III – Free Response Questions –Show your work for partial credit.

- Four transactions are given below that were completed during 2011 by Russell Company. You are to provide the adjusting entries required for Russell Company on December 31, 2011. No adjusting entries were made during the year. (8 points)

- On December 31, 2011, Russell Company owed employees $3,750 for wages that were earned by them during December and were not recorded.

- During 2011, Russell Company purchased office supplies that cost $1,000 which were placed in the supplies room for use as needed. The purchase was recorded as follows:

At January 1, 2011, the inventory of unused office supplies was $300. At December 31, 2011, a physical count showed unused office supplies in the supply room amounting to $100. - On December 1, 2011, Russell Company rented some office space to another party. Russell Company collected $900 rent for the period December 1, 2011, to March 1, 2012. The December 1 transaction was recorded as follows:

- On July 1, 2011, Russell Company borrowed $2,000 cash on a one-year, 8% interest-bearing, note payable. The interest is payable on the due date, June 30, 2012. The borrowing was recorded as follows on July 1, 2011:

- Perform transaction analysis for Blake Company regarding the following transactions for the month of March. Indicate the account affected by the transaction as well as the increase (+) or decrease (-) to the components of the accounting equation and the amount. (10 points)

|

Transaction |

Assets |

Liabilities |

Stockholders' Equity | ||||

|

Account |

Amount |

Account |

Amount |

Account |

Amount | ||

|

Ex. |

Paid wages for two weeks in March. The total cash paid was $500 |

Cash |

-$500 |

Wage expense |

-$500 | ||

|

A. |

Collected $2,000 on accounts receivable. | ||||||

|

B. |

Services were completed for customers. A total of $1,500 was billed but none of it was received in March. | ||||||

|

C. |

Paid $3,000 for rent for April, May, and June. | ||||||

|

D. |

Received and paid the March utilities bill for $150. | ||||||

|

E. |

Sold land for $50,000 that had cost $35,000. | ||||||

|

F. |

Paid the February utilities bill for $100. It was recorded as an expense in February. | ||||||

- The Booker Corporation reported the following balance sheet data for 2013 and 2012. (12 points)

|

2013 |

2012 | |

|

Current Assets | ||

|

Cash |

$ 77,375 |

$ (22,955) |

|

Accounts receivable, net |

80,000 |

68,250 |

|

Inventory |

165,000 |

145,000 |

|

Prepaid insurance |

1,500 |

2,000 |

|

Long-term Assets | ||

|

Investment securities |

$ 15,500 |

$ 85,000 |

|

Land, buildings, equipment |

1,250,000 |

1,125,000 |

|

Accumulated depreciation |

(610,000) |

(572,000) |

|

Total Assets |

$ 979,375 |

$ 830,295 |

|

Current Liabilities | ||

|

Accounts payable |

$ 76,340 |

$ 102,760 |

|

Salaries payable |

20,000 |

24,500 |

|

Notes payable (current) |

25,000 |

75,000 |

|

Long-term Liabilities | ||

|

Bonds payable |

$ 200,000 |

$ 0 |

|

Equity | ||

|

Common stock |

$ 300,000 |

$ 300,000 |

|

Retained earnings |

358,035 |

328,035 |

|

Total Liabilities and Equity |

$ 979,375 |

$ 830,295 |

Additional information for 2013:

(1.) Sold investment securities costing $69,500 for $74,000 in cash.

(2.) Equipment costing $20,000 with a book value of $5,000 was sold for $6,000 cash.

(3.) Issued bonds payable to raise cash of $200,000 (a long-term liability).

(4.) Purchased new equipment for $145,000 in cash.

(5.) Net income was $50,000.

(6.) Current notes payable is related to inventories. It should be considered an operating liability.

Required: Prepare a statement of cash flows for 2013 in good form (using the space provided in the next page) using the indirect method. You may use scratch paper for any calculations necessary, although you will be graded only on the Statement of Cash Flows you prepare on the next page (page 11).

|

Booker Company |

|

Statement of Cash Flows |

|

For the year ended December 31, 2013 |

Practice Assignment #1

Section IV

FINANCIAL ACCOUNTING

Please read the directions preceding each section carefully before answering the questions. Selected Financial Statements for Section IV can be found at the back of the exam.

IV – Case Analysis– Instructions: Use Apple’s 2012 annual report to answer the following questions. Its fiscal year ends September 29, 2012, and FY2012 refers to the fiscal year ended September 29, 2012. Treat each item below independently. Watch the dates on the statements. All numbers on the financial statements and in the problems are in millions (except per share data).

- In March 2012, Apple initiated a dividend policy, in which it plans to pay quarterly dividends to shareholders. What was the total amount of dividends declared by Apple in 2012? (5 points)

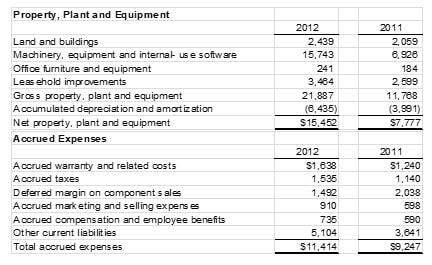

- Assume that Apple sold Property, Plant and Equipment for $1,000 during the year and that non-cash purchases of PP&E were $3,000. What were each of the following amounts? HINT: Don’t forget to use information available in Note 3. (6 points)

- Accumulated depreciation of “PP&E” disposed of during the year __

- The historical cost of “PP&E” disposed of during the year ___

- Gain or loss recognized on the sale of disposed PP&E assets __.

Be sure to clearly indicate whether there was a gain or loss.

- Assume that on July 1, 2012, Apple recorded a receipt of a $300 payment on account from a major customer with the following incorrect journal entry:

Cash 300

Sales Revenue 300

Please complete the following: (9 points)

- Compute the amount that should have been reported as “Total Current Assets” at year-end 2012.

- Compute the amount that should have been reported as “Operating Income” at year-end 2012.

- Compute the amount that should have been reported as “Cash Flow from Operating Activities” for 2012.

- Apple records liabilities related to customer warranties in the “Accrued Warranty and Related Costs” account and reduces this liability when customers submit warranty claims. During the fiscal year 2012, Apple recognized warranty expense of $2,184. What was the cost of warranty claims submitted by customers in 2012? (4 points)

- On December 1, 2012, Apple paid $10 cash for its December rent payment for its office building. To record this event, Apple made the following entry:

Rent Payable 10

Rent Receivable 10

No additional entries were made.

What would be the effect of the error on the following amounts? Circle U/S for understate, O/S for overstate, or NE for no effect. Ignore income tax effects. (8 points)

- Total Liabilities at year-end 2012 U/S O/S NE

- Cash Flow from Operations for the year 2012 U/S O/S NE

- Total Assets at year-end 2012 U/S O/S NE

- Stockholders’ Equity at year-end 2012 U/S O/S NE

- Assume that Apple had made the following mistake in preparation of its 2012 statements, and no adjustments were made:

On September 1, 2012, Apple purchased $120 of prepaid insurance for the six months beginning September 1 and made the following journal entry:

Insurance Expense $120

Cash $120

What would be the effect of the error on the following amounts? Circle U/S for understate, O/S for overstate, or NE for no effect. Ignore income tax effects. (8 points)

- Total Liabilities at year-end 2012 U/S O/S NE

- Income before tax at year-end 2012 U/S O/S NE

- Total Assets at year-end 2012 U/S O/S NE

- Cash Flow from Operating Activities at year-end 2012 U/S O/S NE

These are the excerpts from Apple’s 2012 annual report.

There are 5 pages including the cover.

APPLE INC. | |||||

CONSOLIDATED STATEMENT OF OPERATIONS | |||||

(in millions, except per share data) | |||||

|

Years Ended | |||||

September 29, 2012 | September 24, 2011 | September 25, 2010 | |||

Net sales | $156,508 | $108,249 | $65,225 | ||

|

Cost of sales |

87,846 |

64,431 |

39,541 | ||

|

Gross profit |

68,662 |

43,818 |

25,684 | ||

|

Operating expenses: | |||||

|

Research and development |

3,381 |

2,429 |

1,782 | ||

|

Selling, general and administrative |

10,040 |

7,599 |

5,517 | ||

|

Total operating expenses |

13,421 |

10,028 |

7,299 | ||

|

Operating income |

55,241 |

33,790 |

18,385 | ||

|

Other income/(expense), net |

522 |

415 |

155 | ||

|

Income before income taxes |

55,763 |

34,205 |

18,540 | ||

|

Provision for income taxes |

14,030 |

8,283 |

4,527 | ||

|

Net income |

$41,733 |

$25,922 |

$14,013 | ||

|

Earnings per share: | |||||

|

Basic |

$44.64 |

$28.05 |

$15.41 | ||

|

Diluted |

$44.15 |

$27.68 |

$15.15 | ||

|

Shares used in computing earnings per share: | |||||

|

Basic |

934 |

924 |

909 | ||

|

Diluted |

945 |

936 |

924 | ||

|

APPLE INC. | |||

|

CONSOLIDATED BALANCE SHEET | |||

|

(in millions, except per share data) | |||

September 29, 2012 | September 24, 2011 | ||

|

Current assets: | |||

|

Cash and cash equivalents |

$10,746 |

$9,815 | |

|

Short-term marketable securities |

18,383 |

16,137 | |

|

Accounts receivable, less allowances of $98 and $53, respectively |

10,930 |

5,369 | |

|

Inventories |

791 |

776 | |

|

Deferred tax assets |

2,583 |

2,014 | |

|

Vendor non-trade receivables |

7,762 |

6,348 | |

|

Other current assets |

6,458 |

4,529 | |

|

Total current assets |

57,653 |

44,988 | |

|

Long-term marketable securities |

92,122 |

55,618 | |

|

Property, plant and equipment, net |

15,452 |

7,777 | |

|

Goodwill |

1,135 |

896 | |

|

Acquired intangible assets, net |

4,224 |

3,536 | |

|

Other assets |

5,478 |

3,556 | |

|

Total assets |

$176,064 |

$116,371 | |

|

Current liabilities: | |||

|

Accounts payable |

21,175 |

14,632 | |

|

Accrued expenses |

11,414 |

9,247 | |

|

Deferred revenue |

5,953 |

4,091 | |

|

Total current liabilities |

38,542 |

27,970 | |

|

Deferred revenue - non-current |

2,648 |

1,686 | |

|

Other non-current liabilities |

16,664 |

10,100 | |

|

Total liabilities |

$57,854 |

$39,756 | |

|

Shareholders' equity: | |||

|

Common stock, no par value; 1,800,000 shares authorized; | |||

|

Outstanding shares -939 and 929 shares |

16,422 |

13,331 | |

|

Retained earnings |

101,289 |

62,841 | |

|

Accumulated other comprehensive income |

499 |

443 | |

|

Total shareholders' equity |

118,210 |

76,615 | |

|

Total liabilities and shareholders' equity |

$176,064 |

$116,371 | |

|

APPLE INC. | |||||

|

CONSOLIDATED STATEMENT OF CASH FLOWS | |||||

|

(in millions, except per share data) | |||||

|

Years Ended | |||||

|

September 29, 2012 |

September 24, 2011 |

September 25, 2010 | |||

|

Operating activities: | |||||

|

Net income |

$41,733 |

$25,922 |

$14,013 | ||

|

Adjustments to reconcile net income: | |||||

|

Depreciation and amortization |

3,277 |

1,814 |

1,027 | ||

|

Share-based compensation expense |

1,740 |

1,168 |

879 | ||

|

Deferred income tax expense |

4,405 |

2,868 |

1,440 | ||

|

Changes in operating assets and liabilities: | |||||

|

Accounts receivable, net |

(5,551) |

143 |

(2,142) | ||

|

Inventories |

(15) |

275 |

(596) | ||

|

Vendor non-trade receivables |

(1,414) |

(1,934) |

(2,718) | ||

|

Other current and non-current assets |

(3,162) |

(1,391) |

(1,610) | ||

|

Accounts payable |

4,467 |

2,515 |

6,307 | ||

|

Deferred revenue |

2,824 |

1,654 |

1,217 | ||

|

Other current and non-current liabilities |

2,552 |

4,495 |

778 | ||

|

Cash generated by operating activities |

50,856 |

37,529 |

18,595 | ||

|

Investing activities: | |||||

|

Purchases of marketable securities |

(151,232) |

(102,317) |

(57,793) | ||

|

Proceeds from maturities of marketable securities |

13,035 |

20,437 |

24,930 | ||

|

Proceeds from sales of marketable securities |

99,770 |

49,416 |

21,788 | ||

|

Payments made in connection with business acquisitions, net of cash acquired |

(350) |

(244) |

(638) | ||

|

Payments for acquisition of property, plant and equipment |

(8,295) |

(4,260) |

(2,005) | ||

|

Payments for acquisition of intangible assets |

(1,107) |

(3,192) |

(116) | ||

|

Other |

(48) |

(259) |

(20) | ||

|

Cash used in investing activities |

(48,227) |

(40,419) |

(13,854) | ||

|

Financing activities: | |||||

|

Proceeds from issuance of common stock |

665 |

831 |

912 | ||

|

Excess tax benefits from equity awards |

1,351 |

1,133 |

751 | ||

|

Dividends and dividend equivalent rights paid |

(2,488) |

0 |

0 | ||

|

Taxes paid related to net share settlement of equity awards |

(1,226) |

(520) |

(406) | ||

|

Cash (used in)/generated by financing activities |

(1,698) |

1,444 |

1,257 | ||

|

Net Increase/(decrease) in cash and cash equivalents |

931 |

(1,446) |

5,998 | ||

|

Cash and cash equivalents, beginning of the year |

9,815 |

11,261 |

5,263 | ||

|

Cash and cash equivalents, end of the year |

$10,746 |

$9,815 |

$11,261 | ||

Note 3. Consolidated Financial Statement Details

The following table show the Company’s consolidated financial statement details as of September 29, 2012 and September 24, 2011 (in millions):

Note 7. Long- Term Supply Agreements

The Company has entered into long- term agreements to secure the supply of certain inventory components. Under certain of these agreements, which expire between 2012 and 2022, the Company has made prepayments for the future purchase of inventory components and has acquired capital equipment to use in the manufacturing of such components.

As of September 29, 2012, the Company had a total of $4.2 billion of inventory component prepayments outstanding, of which $1.2 billion are classified as other current assets and $3.0 billion are classified as other assets in the Consolidated Balance Sheets. The Company had a total of $2.3billion of inventory component prepayments outstanding as of September 24, 2011. The Company's outstanding prepayments will be applied to certain inventory component purchases made during the term of each respective agreement. The Company utilized $943 million and $173 million of inventory component prepayments during 2012 and 2011, respectively.