Interpret Market Trends And Developments Assignment

INTERPRET MARKET TRENDS AND DEVELOPMENTS

ASSESSMENT 1

The Coca-Cola Company is truly global, and its main product is recognised and consumed worldwide. The Company organises and structures itself in a way that reflects that fact. At the same time, the Company looks to meet the particular needs of regional markets sensitively and its structure also needs to reflect that fact.

The Coca-Cola Company is the world's largest beverage company and is the leading producer and marketer of soft drinks. The Company markets four of the world's top five soft drinks brands: Coca-Cola, Diet Coke, Fanta and Sprite.

The success of The Coca-Cola Company revolves around five main factors:

- A unique and recognised brand - Coca-Cola is among the most recognised trade marks around the globe

- Quality - consistently offering consumers products of the highest quality

- Marketing - delivering creative and innovative marketing programmes worldwide

- Global availability - Coca-Cola products are bottled and distributed worldwide

- Ongoing innovation - continually providing consumers with new product offerings e.g. Diet Coke (1982), Coca-Cola Vanilla (2002).

So while Coca-Cola is probably the only product in the world that is universally relevant in every corner of the globe, the Company feels that its responsibility is to ensure that with every single can or bottle of Coca-Cola sold and enjoyed, individual connections are made with their consumer. That can only be achieved at a local level.

The challenge facing The Coca-Cola Company today is therefore to continue to build an organisational structure that will deliver a global and local strategy.

The goal of The Coca-Cola Company is 'to be the world's leading provider of branded beverage solutions, to deliver consistent and profitable growth, and to have the highest quality products and processes.'

To achieve this goal, the Company has established six strategic priorities and has built these into every aspect of its business:

- Accelerate carbonated soft drinks growth, led by Coca-Cola

- Broaden the family of products, wherever appropriate e.g. bottled water, tea, coffee, juices, energy drinks

- Grow system profitability & capability together with the bottlers

- Creatively serve customers (e.g. retailers) to build their businesses

- Invest intelligently in market growth

- Drive efficiency & cost effectiveness by using technology and large scale production to control costs enabling our people to achieve extraordinary results everyday.

There are many ways to structure an organisation. For example, a structure may be built around:

- function: reflecting main specialisms e.g. marketing, finance, production, distribution

- product: reflecting product categories e.g. bread, pies, cakes, biscuits

- process: reflecting different processes e.g. storage, manufacturing, packing, delivery.

Organisational structures need to be designed to meet aims. They involve combining flexibility of decision making, and the sharing of best ideas across the organisation, with appropriate levels of management and control from the centre.

Modern organisations like The Coca-Cola Company, have built flexible structures which, wherever possible, encourage teamwork. For example, at Coca-Cola Great Britain any new product development (e.g. Coca-Cola Vanilla) brings together teams of employees with different specialisms.

At such team meetings, marketing specialists clarify the results of their market research and testing, food technologists describe what changes to a product are feasible, financial experts report on the cost implications of change.

Central tendency measurements: Calculation of Central Tendency on Coca Cola’s for the last 4 years net Revenues.

|

Year |

Net revenues m (x) |

Average net revenues m () |

(x-x) |

(x-x)2 |

|

2013 |

5.200 |

7500,01 |

-2300.01 |

-5290046,01 |

|

2014 |

7.600 |

7500,01 |

99,99 |

9.998,01 |

|

2015 |

8.200 |

7500,01 |

700 |

490.000 |

|

2016 |

10.300 |

7500,01 |

2.800 |

784.000 |

|

Standard deviation |

2.100 (method 1) |

1.646.000 | ||

|

254.000 |

Table: Standard Deviation Calculation

Key strategic decisions at The Coca-Cola Company are made by an Executive Committee of 12 Company Officers. This Committee helped to shape the six strategic priorities set out earlier. The Chair of the Executive Committee acts as a figurehead for the Company and chairs the board meetings. He is also the Chief Executive Officer (CEO) and as such he is the senior decision maker. Other executives are responsible either for the major regions (e.g. Africa) or have an important business specialism e.g. the Chief Financial Officer.

As a company whose success rests on its ability to connect with local consumers, it makes sense for The Coca-Cola Company to be organised into a regional structure which combines centralisation and localisation. The Company operates six geographic operating segments - also called Strategic Business Units (SBUs) - as well as the corporate (Head Office) segment.

Each of these regional SBUs is sub-divided into divisions. Take the European union, SBU, for example. The UK fits into the Northwest Europe division. This geographical structure recognises that:

- markets are geographically separated

- tastes and lifestyles vary from area to area. As do incomes and consumption patterns

- markets are at different stages of development.

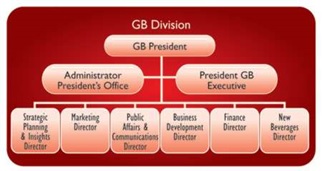

At a more local level the management of The Coca-Cola Company involves a number of functional specialisms. The management structure for Great Britain illustrates this.

The structure of Coca-Cola Great Britain combines elements of centralisation and decentralisation. Divisions and regions operate as business unit teams, with each Director reporting to the General Manager, i.e. Division President.

However, there is a matrix structure for each function e.g. the Finance Director in the GB Division reports to the GB President, but also to (dotted line) the Finance Director of North West Europe Division. In addition, functions within the Company operate across geographical boundaries to share best practice.

To take another example of local decision making at a regional (local) level the various SBUs are responsible for region-specific market research, and for developing local advertising, e.g. using the languages of the countries in which The Coca-Cola Company operates. A major region like Great Britain has its own marketing structure

Correlation Analysis:

|

Year |

Net revenues (million dollars) |

Good (million dollars) |

|

2013 |

5.200 |

6.500 |

|

2014 |

7.600 |

6.800 |

|

2015 |

8.200 |

9.100 |

|

2016 |

10.300 |

11.200 |

|

0,4184 |

Tab: correlation Analysis

Measurements of Correlation between two variables (revenues and goodwill) has been measured and found the correlation is just 41% which is non-significant. So we may assume the goodwill increase depends largely on some other variables rather than only on net Revenues.

Product support

The way The Coca-Cola Company works reflects the many countries and cultures in which it does business. It owns or licences nearly 400 brands in non-alcoholic beverages serving consumers in over 200 countries. An essential part of the organisation's structure therefore focuses on ensuring that individual products are given the best possible support in regional markets.

Within the Company, different teams concentrate on particular products and use their specialist knowledge of the brands and consumer needs to support the sales and promotional effort. In some cases a product is developed solely for local consumption and an example of this is the product Lilt, which is only available in Great Britain and Ireland.

Examples of other products available in Great Britain include:

- Carbonated soft drinks- Coca-Cola, Fanta, Sprite

- Juice & juice drinks- Schweppes' Tomato Juice Cocktail, Oasis, Five Alive

- Waters- Malvern

- Energy drinks-Burn

- Sports drinks- Powerade

- Squashes/cordials- Kia-Ora, Rose's Lime Cordial.

Structuring an organisation is not only about organising internal relationships, it also involves external ones. The Coca-Cola Company has built well-structured relationships with a range of external groups including bottling partners.

Competition and Coca-Cola company:

The nonalcoholic beverage segment of the commercial beverage industry is highly competitive, consisting of numerous companies ranging from small or emerging to very large and well established. These include companies that, like our Company, compete in multiple geographic areas, as well as businesses that are primarily regional or local in operation. Competitive products include numerous nonalcoholic sparkling beverages; various water products, including packaged, flavored and enhanced waters; juices and nectars; fruit drinks and dilutables (including syrups and powdered drinks); coffees and teas; energy and sports and other performance-enhancing drinks; dairy-based drinks; functional beverages, including vitamin-based products and relaxation beverages; and various other nonalcoholic beverages. These competitive beverages are sold to consumers in both ready-to-drink and other than ready-to-drink form. In many of the countries in which we do business, including the United States, PepsiCo, Inc., is one of our primary competitors. Other significant competitors include, but are not limited to, Nestlé, DPSG, Groupe Danone, Mondelez International, Inc. ("Mondelez"), Kraft Foods Group, Inc. ("Kraft"), and the Unilever Group ("Unilever"). In certain markets, our competition includes beer companies. We also compete against numerous regional and local companies and, in some markets, against retailers that have developed their own store or private label beverage brands.

Competitive factors impacting our business include, but are not limited to, pricing, advertising, sales promotion programs, product innovation, increased efficiency in production techniques, the introduction of new packaging, new vending and dispensing equipment, and brand and trademark development and protection.

Our competitive strengths include leading brands with high levels of consumer acceptance; a worldwide network of bottlers and distributors of Company products; sophisticated marketing capabilities; and a talented group of dedicated associates. Our competitive challenges include strong competition in all geographic regions and, in many countries, a concentrated retail sector with powerful buyers able to freely choose among Company products, products of competitive beverage suppliers and individual retailers' own store or private label beverage brands.

ASSESSMENT 2

Coca Cola and its marketing activities toward success:

Advertising and marketing campaigns have considerably increased The Coca-Cola Company’s (KO) brand power over the years. In 2013, Coca-Cola spent $3.37 billion, or 7.0% of it’s 2013 revenues, on advertising—including in-store activations, loyalty points programs, and point-of-sale marketing.

Coca-Cola was one of the official sponsors of the 2014 winter Olympics held in Sochi, Russia. The company’s Olympic game activations, including the longest-ever Olympic torch relay, helped generate 11% growth in Russian unit case volume in 2013.

Coca-Cola was able to connect with millions of fans through the 92,000-mile Coca‑Cola FIFA World Cup trophy tour in 2014. Coca-Cola also achieved major success through the “Share a Coke” campaign, which allowed fans to put their names or those of their family and friends right on the front of Coca-Cola bottles or cans, effectively personalizing the product.

To support its brands further, Coca-Cola planned additional media spending of $400 million in 2014 as part of an incremental $1 billion investment by 2016.

Power Brand:

Coca-Cola enjoys huge popularity across the world. The company ranked third in Interbrand’s 2014 world’s most valuable brands list, with an estimated brand value of $81.6 billion. Coca-Cola places sixth in Fortune magazine’s annual ranking of the world’s 50 most admired companies. The company’s aggressive marketing strategies, innovation, and extensive global reach are the reasons for its reputable name.

Coca-Cola has strong brands across its sparkling and still beverages. Six brands of the company’s sparkling beverages portfolio generated more than $1 billion in revenue each in 2013, led by the company’s leading brand, Coca-Cola. The company’s still beverages portfolio includes 11 brands that generated more than $1 billion in revenue each in 2013. The company has 20 other brands, each generating revenues between $500 million and $1 billion, with more than half of them in the still category.

Innovation:

Despite being a 129-year-old mega corporation with more than 500 brands, Coca-Cola is always looking for ways to innovate and do things differently. For instance, Coca-Cola has eco-friendly beverage containers made of ice that simply melt away after use and smart vending machines that mix and match flavors.

These ideas don't come from within Coca-Cola; the odds of unearthing an innovative idea or technology solely in-house are virtually impossible. Innovation requires generating lots of ideas in order to come up with a winner. Case-in-point: A venture capital firm looks at 3,000 deals every year, whittled down to 100 serious considerations with actual investments in four or five. In a portfolio of, say, 10 investments, half will lose money, a couple might break even, a couple might be somewhat profitable, and one will, hopefully, be a home run. In order for a large company like Coca-Cola to innovate, the CIO has to deliver this kind of scale of ideas. That's why Boehme decided to create a program aimed at startups in exchange for exclusive access to the innovative technology, whereby Coca-Cola competitors can't use the technology while the startup is in Boehme's seven-month program. Unlike venture capitalists, Coca-Cola isn't in this for the money and doesn't take equity.

Digital Marketing:

One of Coca-Cola’s most recent digital marketing initiatives, The Ahh Effect, involves a series of online games aimed at teenagers. The idea was to create fun, ‘snackable’ digital games that cater primarily to mobile users. It is apparently Coca-Cola’s first all-digital campaign and envisaged to be an on-going initiative over several years. The games are all quite basic and several of them involve the company’s products, such as one where you have to pin a tail on a can of Coke.Coca-Cola promoted the games by marketing them through sites such as Buzzfeed, Vevo and Twitter, and also challenged people to create their own mini-games to be included on the Ahh Effect domain.There will ultimately be 61 different games in the campaign, each designed to cater to the short attention span associated with teenagers.

Emerging market and needs:

The importance of Emerging Markets to global businesses such as ours is well known. People tend to think of the BRICS countries (Brasil, Russia, India, China and South Africa), and to a lesser extent countries like South Korea and Turkey.

But even as countries like China and India struggle to maintain the rapid growth of the last decade, the less talked about countries like Ethiopia, Vietnam or Pakistan, become ever more indispensable to our global growth. Indeed, our long-term commitment to countries such as these is a strong cornerstone to our success as a company today – and tomorrow.

Take Pakistan for instance, a great place to do business if you are willing to look beyond the often negative media headlines. With a population of 180 million, rising inflation, energy shortages and security issues, it is also not a business destination for the faint of heart.

Coke first entered Pakistan in 1953. Today, our business in Pakistan is strong because of 3 main reasons. We are committed to the country for the long haul, we have built very strong local roots, and we have learned to be more effective with fewer resources – adapting quickly to its sometimes rapidly fluctuating economy.

Years ago, when we were a distant number 2 in the country, we found ourselves facing great difficulty convincing all our business partners to buy into a growth plan. We spent months talking to them about our holistic, long-term plan for growth – committing to disciplined execution of our plans, in good times and in bad times. As a result, today our volumes are up, our bottling partners are engaged and investing and business is good.

Unlike mature markets, in emerging markets, winning plans, disciplined execution, and building belief and commitment across many stakeholders can bring positive results in a relative short time period. For long-term, sustainable growth, you need to look beyond the operations and seek out ways to add value to the local community as well.

In January 2010, we made a commitment to invest $300 million in Pakistan over 3 years. These investments go beyond bottling lines, delivery trucks or new hires. For example, we contributed over $6 million to community projects, provided millions of Iftar meals and are working to bring generations of Pakistanis together through a common passion: music. Our local music program, Coke Studio Pakistan, continues to be a source of national pride and inspiration by pairing new and traditional artists. With over 60 million hits on YouTube and around 1.5 million Facebook fans, people around the world have come to appreciate what Pakistan can offer.

ASSESSMENT 3

The global soft drink market is led by carbonated soft drinks (or CSDs), which had a market size of $337.8 billion in 2013. In the same year, CSDs were followed by bottled water, with a market size of $189.1 billion, and juice, with a market size of $146.2 billion. In a later part of this series, we’ll discuss why CSDs have been losing popularity, and why sales of other beverages, including juices and ready-to-drink tea, are increasing.

The non-alcoholic beverage market is a highly competitive industry that includes two behemoths —The Coca-Cola Company (KO) and PepsiCo, Inc. (PEP). Collectively, these companies hold about 70% of the US CSD market. Dr Pepper Snapple Group, Inc. (DPS), Monster Beverage Corporation (MNST), and Cott Corporation (COT) are some other key players in the CSD market.

Many international markets are also dominated by Coca-Cola and PepsiCo, but include other companies such as Groupe Danone, Nestle SA, and Suntory Holdings Limited.

Non-alcoholic beverage manufacturers, like Coca-Cola and PepsiCo, are part of the consumer staple sector. You can invest in these companies through the Consumer Staples Select Sector SPDR ETF (XLP).

Companies in the soft drink industry reach the end market in two ways. One way is by selling finished products, made at company-owned bottling facilities, to distributors and retailers.

Another, is by selling beverage concentrates and syrups to authorized bottling partners, who then make the final product by combining the concentrates with still or carbonated water, sweeteners, and other ingredients. The bottlers then package the product in containers and sell these beverages to distributors or directly to retailers.

Also, both bottling partners and companies manufacture fountain syrups and sell them to fountain retailers. Fountain retailers include restaurants and convenience stores, which produce beverages for immediate consumption.

The extensive reach of The Coca-Cola Company (KO) and PepsiCo, Inc. (PEP) allows them to produce or distribute third-party brands. For instance, Coca-Cola is licensed to produce and distribute certain brands of Dr Pepper Snapple Group, Inc. (DPS) and Monster Beverage Corporation (MNST). PepsiCo sells Lipton and Starbucks brands under partnerships with Unilever and Starbucks, respectively.

Coca-Cola and PepsiCo’s wide distribution network gives them significant pricing power. Carbonated soft drinks have similar prices due to the intense competition in the industry. Often, soft drink companies extend lower prices under promotional offers. In recent times, such promotional offers have been used to boost volumes of the carbonated soft drinks. That’s because they’re under pressure due to rising health concerns and competition from healthy substitutes such as tea, energy drinks, and water.

The non-alcoholic beverage industry is part of the consumer staples sector. You can invest in this sector through the Consumer Staples Select Sector SPDR ETF (XLP), which has notable holdings in Coca-Cola and PepsiCo.

|

Year |

Net revenues m (x) |

Average net revenues m () |

(x-x) |

(x-x)2 |

|

2013 |

5.200 |

7500,01 |

-2300.01 |

-5290046,01 |

|

2014 |

7.600 |

7500,01 |

99,99 |

9.998,01 |

|

2015 |

8.200 |

7500,01 |

700 |

490.000 |

|

2016 |

10.300 |

7500,01 |

2.800 |

784.000 |

|

Standard deviation |

2.100 (method 1) |

1.646.000 | ||

|

254.000 |

Various aspects of law and Coca Cola

Health and Safety

We believe that a safe and healthy workplace is a fundamental right of every person and also a business imperative. Our Workplace Rights Policy requires that we take responsibility for maintaining a productive workplace in every part of our Company by doing what we can to minimize the risk of accidents, injury and exposure to health hazards for all of our associates and contractors. In addition, we’re working with our bottling partners to help to ensure health and safety risks are minimized for their employees and contract workers.

Enviroment Policy

Coca‑Cola Hellenic is committed to conducting all its business activities responsibly with due regard to environmental impact and sustainable performance. The Company believes that theenvironment is everybody's responsibility and all employees are accountable for environmental performance.

Product safety Policy

In recent years, some consumers have expressed concern about bisphenol A, or BPA, which is used in making the lining of our aluminum cans. BPA is a chemical used worldwide in making the packages of thousands of products, including the coating inside virtually all metal food and beverage cans. This coating guards against contamination and extends the shelf life of foods and beverages. It also is used to manufacture shatter-resistant bottles, medical devices, sports safety equipment and compact disc covers. BPA has been used for more than 50 years. Currently, the only commercially viable lining systems for the mass production of aluminum cans contains BPA.

While we are very aware of the highly publicized concerns and viewpoints that have been expressed about BPA, our point of view is that the scientific consensus on this issue is most accurately reflected in the opinions expressed by those regulatory agencies whose missions and responsibilities are to protect the public’s health. The consensus repeatedly stated among regulatory agencies in Australia, Canada, Europe, Germany, Japan, New Zealand and the United States is that current levels of exposure to BPA through food and beverage packaging do not pose a health risk to the general population.

We will continue to take our guidance on this issue from national and international regulatory authorities, and we will take whatever steps are necessary, based on sound scientific principles, to ensure that any package technology is safe for our consumers.

Meanwhile, we are working closely with several suppliers who are seeking alternatives to can liners containing bisphenol A. Any new material, assuming it has all necessary regulatory approvals, also would have to meet our safety, quality and functional requirements.

|

Year |

Net revenues (million dollars) |

Good (million dollars) |

|

2013 |

5.200 |

6.500 |

|

2014 |

7.600 |

6.800 |

|

2015 |

8.200 |

9.100 |

|

2016 |

10.300 |

11.200 |

|

0,4184 |

|

Year |

Period |

Net revenue (m) |

|

2013 |

1 |

5.200 |

|

2014 |

2 |

7.600 |

|

2015 |

3 |

8.200 |

|

2016 |

4 |

10.300 |