Difference between Futures and Options Contracts

Options and Futures both are part of derivatives. However there are a lot of differences between a futures contract and an options contract.

A futures contract is a firm legal agreement between a buyer and a seller in which the buyer agrees to take delivery of the underlying at a specified futures price at the end of a designated settlement date or delivery date, while the seller agrees to make the delivery of that underlying at a specified futures price at the end of a designated settlement date or delivery date.

When an investor takes a position in the futures market by buying a futures contract (or agrees to buy at the settlement date), the investor is said to be in long-position or to be long futures. When the investor’s opening position is the contractual obligation to sell the underlying at the settlement date, the investor is said to be in a short position or to be short futures.

In an option contract, there are two parties, the buyer and the writer (also called the seller). In an option contract, the writer of the option grants the buyer of the option the right, but not the obligations, to purchase from or sell to the writer the underlying at a specified strike price within a specified expiration date. The writer grants this right to the buyer in exchange for a certain sum of money, which is called the option price or optional premium. When the option grants the buyer the right to purchase the underlying from the writer (seller), it is referred to as a call option, or simply a call. When the option buyer has the right to sell the underlying to the writer, the option is called a put option, or simply, a put.

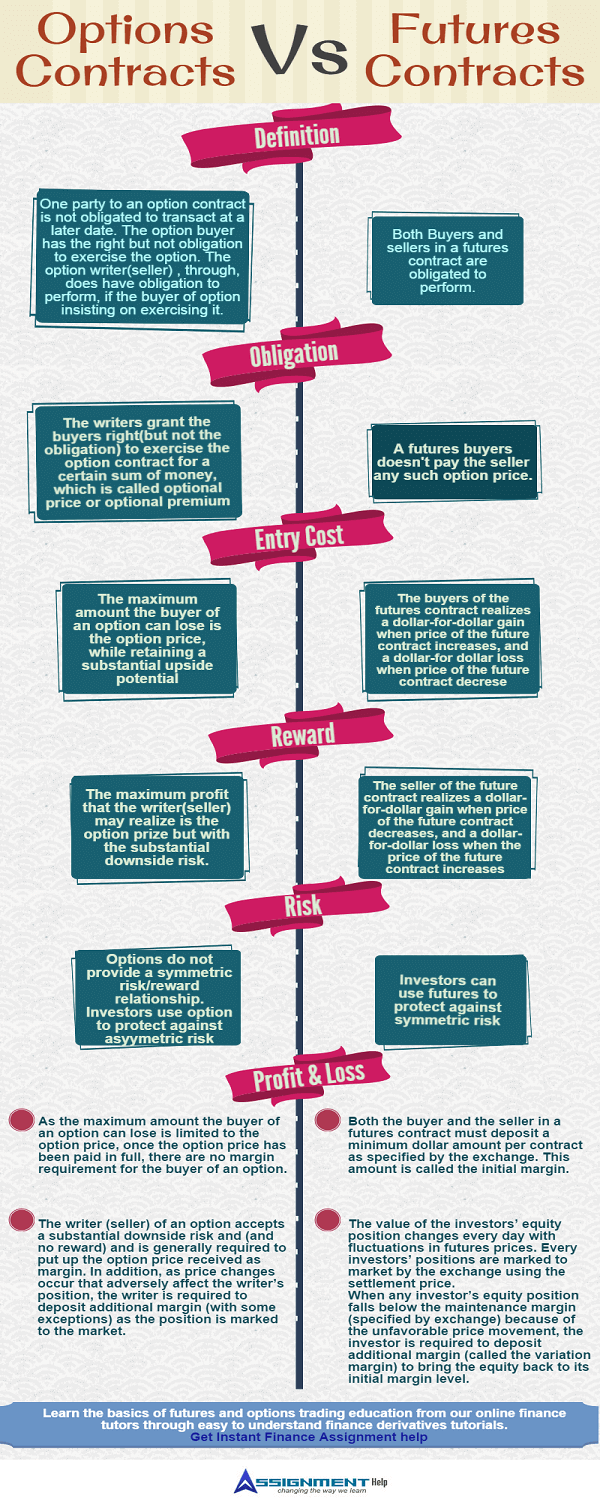

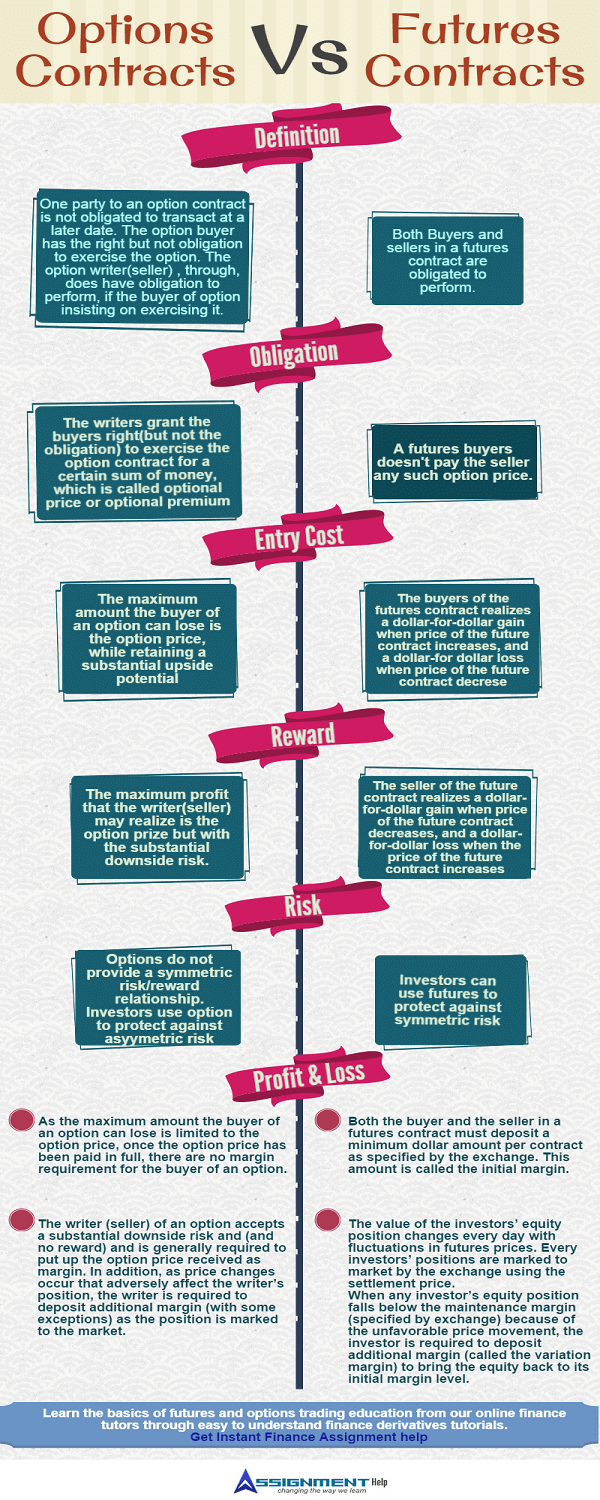

DIFFERENCE BETWEEN OPTIONS AND FUTURES CONTRACTS

| Options Contracts | Futures Contracts |

|---|---|

| One party to an option contract is not obligated to transact at a later date. The option buyer has the right but not the obligation to exercise the option. The option writer (seller), though, does have the obligations to perform, if the buyer of the option insists on exercising it. | Both buyer and seller in a futures contract are obligated to perform. |

| The writer grants the buyer right (but not the obligation) to exercise the options contracts for a certain sum of money, which is called the option price or optional premium. | A futures buyer does not pay the seller any such options price |

| The maximum amount the buyer of an option can lose is the option price, while retaining a substantial upside potential. | The buyer of the futures contract realizes a dollar-for-dollar gain when the price of the futures contract increases, and a dollar-for-dollar loss when the price of the futures contract drops. |

| The maximum profit that the writer (seller) may realize is the option price but with a substantial downside risk. | The seller of a futures contract realizes a dollar-for-dollar gain when the price of the futures contract decreases, and a dollar-for-dollar loss when the price of the future contract increases. |

| Options do not provide a symmetric risk/ reward relationship. Investors use options to protect against asymmetric risk. | Investors can use futures to protect against symmetric risk |

| Both the buyer and the seller in a futures contract must deposit a minimum dollar amount per contract as specified by the exchange. This amount is called the initial margin. The value of the investors’ equity position changes every day with fluctuations in futures prices. Every investors’ positions are marked to market by the exchange using the settlement price. When any investor’s equity position falls below the maintenance margin (specified by exchange) because of the unfavorable price movement, the investor is required to deposit additional margin (called the variation margin) to bring the equity back to its initial margin level. |

Embed this Infographics on your site(Copy this Code)

{`

Courtesy of: AssignmentHelpNet

`}

Learn the basics of futures and options trading education from our online finance tutors through easy to understand finance derivatives tutorials. Get instant finance Assignment Help.