AQA AS Economics Questions With Answers

MARKETS: DO THEY BENEFIT ALL?

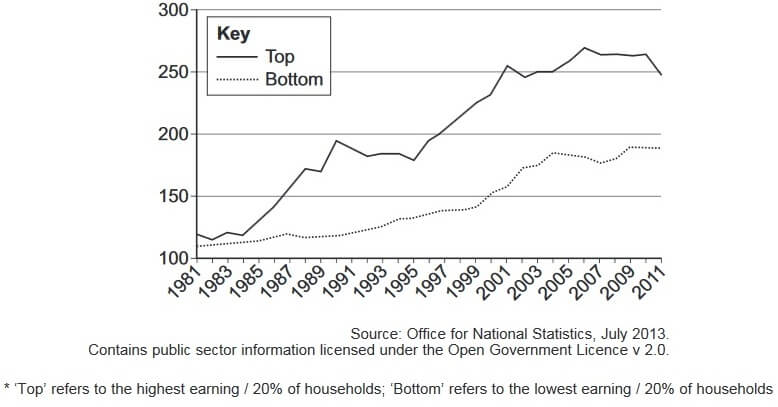

Extract A: Index of real household disposable income of two income groups*, 1981 to 2011, 1977 = 100

Extract B: Markets at work

Adam Smith, the eighteenth century economist, wrote of the ‘invisible hand of the market’. He believed that, left to its own devices, a market would ensure that resources are allocated to their best uses for the benefit of all. Changes in prices would coordinate the decisions between consumers and producers. Indeed, it is largely as a result of the market mechanism that 63 million people in the UK are fed and clothed every day. How could a government hope to plan for such an undertaking? For instance, consumers can buy fresh food or processed food; they may eat in, eat out or on the go; they can dress in designer wear, sportswear or work wear. The list is endless.

However, buying decisions can be influenced by powerful producers. Indeed, the power of brand names such as iPad and Coca-Cola can be a significant barrier to entry. It can 10 reduce competition in markets and lead to some firms possessing monopoly power. Consequently, consumers may face reduced choice and may have to pay higher prices to obtain what they perceive to be the best product. Moreover, in reality, advertising also plays a key role in the allocation of resources. Its influence, in some markets, has been criticised, and there have been calls for greater regulation. Advertising can encourage increased consumption of goods and other activities which give rise to negative externalities, such as gambling. In some cases, this has led to financial ruin, family breakdown and health problems; yet the total number of gambling advertisement slots on UK television increased from 152 000 in 2006 to 1.39 million in 2012. Statistics show that those in the lowest income group spend, on average, more per week on gambling than they do on taking part in sports activities.

Extract C: Do markets work ethically?

Can consumers always buy what they really need? One of the main determinants of a consumer’s demand is income. Whilst income inequality has reduced slightly over the past few years, in 2011/12 the highest earning fifth of UK households had an average income of £78 300, compared with £5400 for the lowest earning fifth – a ratio of 14.5 to 1. Those with higher incomes have more spending power, which inevitably leads to higher prices in certain markets, excluding those who earn less. In 2011, for example, 9% of the population felt that they were unable to afford their mortgage or rent payments, whilst 30% felt that they were unable to afford a week’s annual holiday.

One problem with markets is that there is no consideration of ethical issues. Resources are allocated on the basis of demand backed by willingness and ability to pay, and not necessarily with the general well-being of society in mind. For those people who earn very low incomes, and for those who are unemployed, life can be a struggle. As the political economist, Will Hutton, wrote recently: ‘At the bottom, a world of food banks, payday lending and quiet desperation. And at the top, an extravagantly-paid elite.’ So do markets work well, as Adam Smith suggested, or do they lead to market failures such as those arising from income inequalities, monopolies and negative externalities? Source: News reports 2014

Q. 1. Define the term ‘income inequality’ (Extract C)

Answer: Income refers to the flow of cash or cash equivalents received in the form of wage or salary, rent, interest or profit.

Income inequality refers to the extent to which the earnings or money is unevenly distributed among the various participants of an economy. The income inequality arises when the benefits of economic growth in the form of higher income is not shared fairly.

The rising gap between the rich and the poor leads to immobility of income as well as a lack of opportunities available, reflecting continuous disadvantage for a particular section of the society (the poor). Widening inequality can severely affect the growth and macroeconomic stability of a country and lead to concentration of powers in few hands.

Q. 2. Using Extract A, identify two significant points of comparison between the changes in real household disposable income for the two income groups over the period shown.

Answer: The two significant points of comparison between the changes in the real disposable income for the two income groups (highest earners and lowest earners) over the period shown (1981-2011) are as follows:

a) There was growth in real disposable income for both the groups over the period shown (1981-2011). The highest earning group grew from an index of 115 (approx.) in 1981 to an index of 240 (approx.) in 2011. On the other hand, the real disposable income of the bottom or lowest earning group grew from an index of 110 (approx.) in 1981 to an index of 190 (approx.) in 2011.

b) The top income group enjoyed the most rapid growth in the real disposable income between the period 1981 and 2011. Their real disposable income grew by 108.69% {(240-115)/115} or by an index of 125 over the period shown. The lowest income group however recorded a real disposable income growth of 72.7% {(190-110)/110} or by 80 on index over the period shown.

Q. 3. Extract B states that: ‘Changes in prices would coordinate the decisions between consumers and producers.’ Explain how changes in prices allocate scarce resources in a market economy.

Answer: In economics, Price mechanism is the manner in which prices of goods or services affect the supply and demand of goods and services. The price mechanism has three functions:

a) Signaling: When price of a good changes, it sends signal or provides information to firms and consumers. When price rises, then this give signal to consumers to reduce the quantity they demand or withdraw from the market. Higher prices give signal to producers to enter the market and supply more quantities.

Similarly, lower prices provide signal to consumers to increase their demand or encourages potential buyers to enter the market. Lower prices, however, signal producers to leave the market.

b) Rationing: When a particular good becomes scarce, then the demand for that good exceeds its supply. This drives up the price of that good. As a result of increase in price. Some consumers who cannot afford to buy the good are rationed out of the market.

c) Incentive: Higher prices provide an incentive to existing producers to supply more as they expect higher profits. This also serves as an incentive for new producers to join the market. This leads to increase in the supply of the good in the market.

Now in the long run, as firms realize that due to rationing of some consumers, their profit is diminishing. Thus, they will no longer have any incentive to supply goods to the market and thus will leave the market to reallocate their scarce resources in other market having scope of profits.

This is how the price, through its 3 functions, facilitates efficient allocation of scarce resources.

Q. 4. Extract C states that: ‘One problem with markets is that there is no consideration of ethical issues.’ Using the data and your knowledge of economics, evaluate the view that governments should intervene to correct market failures such as those arising from income inequality, monopolies and negative externalities.

Answer: Market failure refers to a situation in which allocation of resources through price mechanism is not efficient. Market failure includes externalities, information asymmetries, factor immobility, public goods which are both non-excludable and non-rivalrous, monopoly power which results in high prices of goods etc. Income inequality refers to the extent to which the earnings or money is unevenly distributed among the various participants of an economy. The income inequality arises when the benefits of economic growth in the form of higher income is not shared fairly (equitably).

In a free market economy, government considers that the markets are the best way to allocate scarce resources and allow the market forces of demand and supply to set prices and the role of the government is limited to the protection of the property rights, maintaining the currency value and the law & order in the country. Government usually intervene in the market system when:

- a) The market fails to allocate resources efficiently.

- b) The market fails to distribute the income and wealth equitably.

- c) To introduce policies that improve the performance of the economy and bring it out of prolonged recessions.

A monopoly always leads to the creation of deadweight loss to the economy.

Higher prices charged by the monopolist causes the deadweight loss to increase as more people are unwilling to buy the good which they would have if the economy was operating under perfect competition (where, P=MC). The monopolist produces where marginal revenue is equal to marginal cost (MR=MC). The price is determined by the demand curve at this quantity. Unlike perfect competition, the monopolist charges price such that MC. Thus, there is underproduction in the economy by the monopolist (as price charged by the monopolist is higher than what is charged in perfect competition) leading to market failure.

Negative externality refers to an economic activity that negatively affects a third party which is not part of that activity. This type of externality can arise either during the production or consumption of goods and services. For example: A factory near residential area causing noise pollution is a case of negative externality (noise pollution is the negative externality).

The market is governed by price mechanism where prices decide the demand and supply. The market does not know what is meant by equitable distribution. As mentioned in the extract C, resources are allocated in a market economy on the basis of demand backed by willingness and ability to pay and not necessarily with the general well-being of the society in mind. Thus, it is said that market does not considers the ethical issues i.e. it has no cognizance of right or wrong.

Thus, as mentioned earlier, the government intervention is required and is inevitable in the cases when market fails to allocate resources equitably, and remove negative externalities.

- AQA AS Economics Unit 1 Section A

- AQA AS Economics Unit 1 Section B Part 1

- AQA AS Economics Unit 1 Section B Part 2

- AQA AS Economics Unit 2 Section A

- AQA AS Economics Unit 2 Section B part 1

- AQA AS Economics Unit 2 Section B part 2

- AQA AS Economics 2015 Unit 1 Section A

- AQA AS Economics 2015 Unit 1 Section B Part 1

- AQA AS Economics 2015 Unit 1 Section B Part 2

- AQA AS Economics 2015 GCSE solved Question Paper